The following is a guest post from the team at Investment Basecamp

I am a dividend growth investor at heart. My personal portfolio and all of the strategies I recommend for my readers, center around growing your wealth through a strong stable of dividend stocks. Yet I personally also think it’s important to have a few lotto tickets in your portfolio. For me NVDA was one of those lotto tickets.

NVDA pays a dividend but it’s a nominal one. I made a bet on NVDA, betting on the growth of the company itself and its earnings potential in the future. NVDA makes and manufactures microchips used in things that require a large amount of computing power.

NVDA has supported businesses that have been around for decades like gaming and datacenters. But the case for NVDA’s growth in the future relies on its more esoteric uses for its products: use in cryptocurrency mining, robotics and driverless cars. These hopes sent the shares from $20 in 2015 to close to $300 in 2018.

Sales and revenue growth followed the stock price. In 2017, sales were up by 38% to $6.91 billion, with revenue growth accelerating to 41% as sales hit $9.71 billion in 2018. In Q1 2019 rose by 66% to $3.21 billion. Revenues growth decelerated to a still strong 40% in Q2 2018 with revenues hitting $3.12 billion. The issues came in Q3 2018when sales slowed to (only) 21% and key growth areas like the aforementioned cryptocurrency mining started to look less promising.

So, I bought into some of this thesis. I started to amass a position over a few months and by late August 2018 my position grew to 100 shares. This position was making my portfolio veer away from the proper diversification I talk to my readers about.

It got a bit outsized, but I didn’t think it was time to sell. So, what did I do?

I started to explore options strategies to hedge. I have a background in finance so I knew the basics but I read countless options books to dive deeper into the weeds. (Gavin provides five free awesome ones here)

What types of options strategies can I use to hedge?

Below are few of the basic strategies I considered. If I could do it again I probably would have consulted an expert to figure out the best approach. But back in August I only thought about these three options:

A Collar

A collar can be created by buying a put (creating your floor) and selling a call (earning a little income). This is generally done when you own a position, though it doesn’t have to be if you want to gamble on a stock price increase while protecting your downside.

A Long Straddle

A long straddle is put in place by purchasing both a long call and long put option. This is essentially betting there is going to be a shift in the asset price but you’re not sure if it’s going to be up or down.

Simple Put

Or I could have went the simplest route and bought a put where I was comfortable with the floor on my position being.

(Charts via http://www.theoptionsguide.com)

Setting up the Hedge

At the end of August I decided to go ahead with my hedging strategy. I chose a collar.

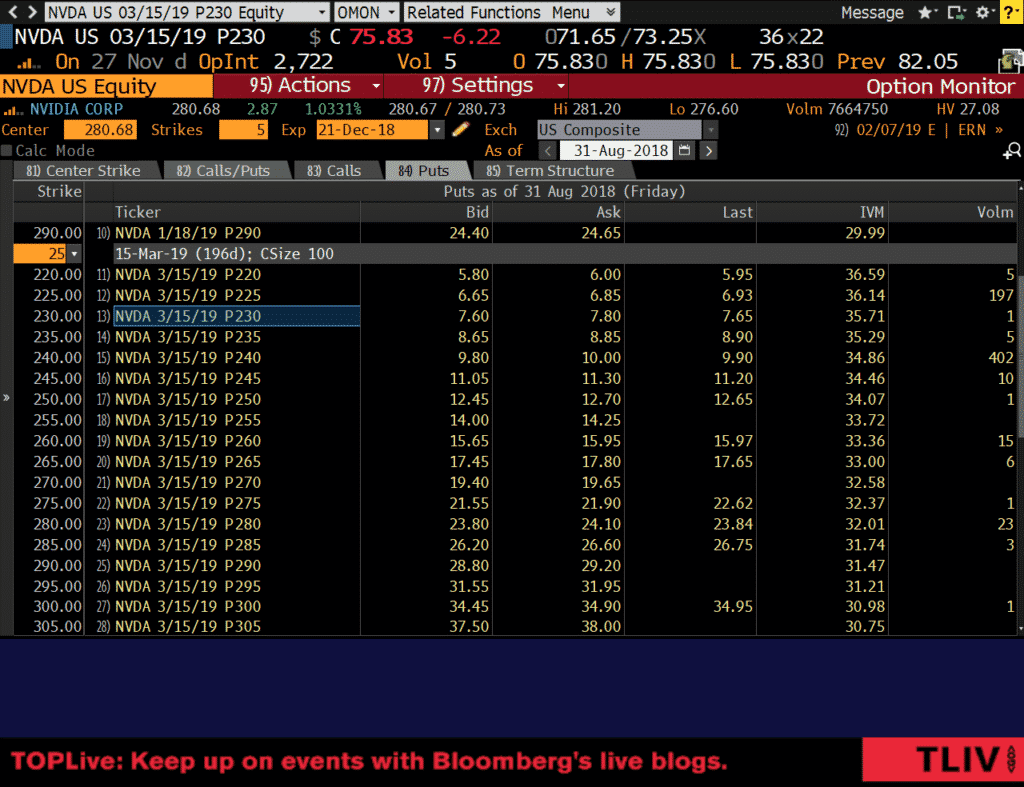

I bought one long put option at $780.

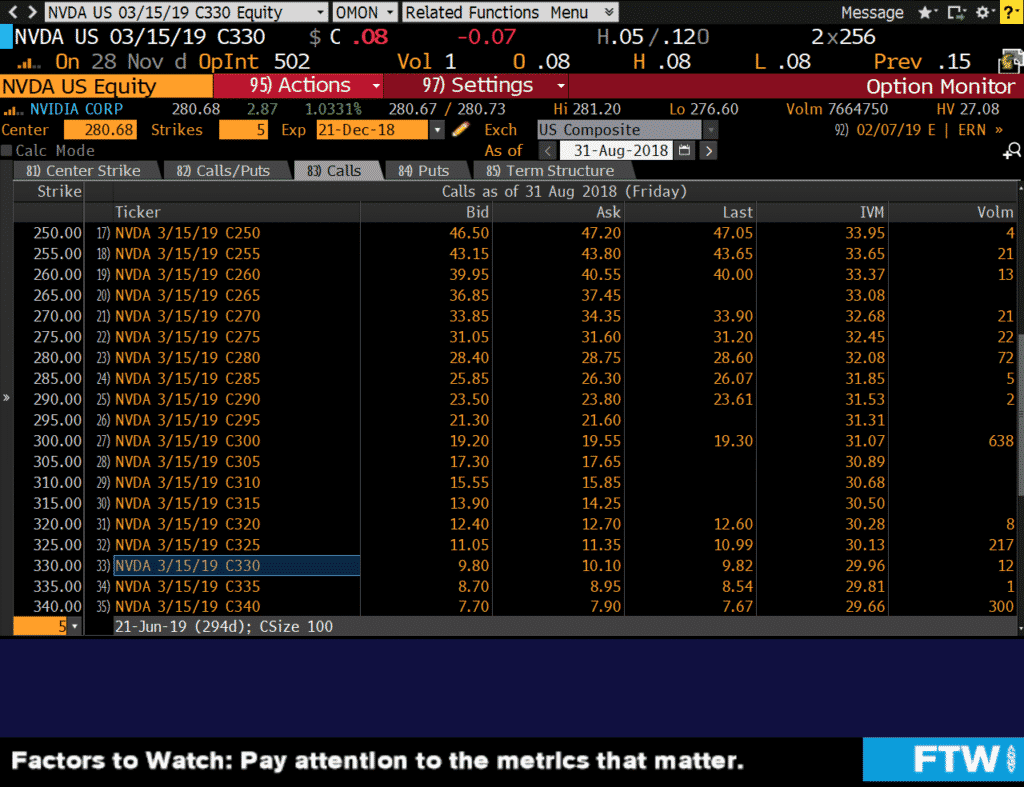

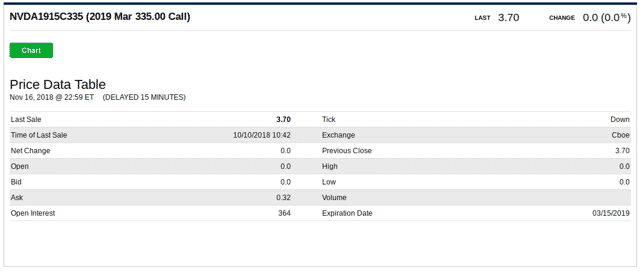

A sold one call option $980

The Result

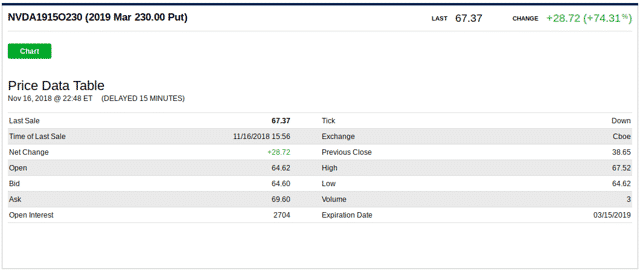

At the time I initiated the collar NVDA traded right at $280. So, with my 100 shares I had about $28,000 in NVDA stock. At expiration on November 16th closed at $164.43. Without the options that would have been a loss of over $11,000 or a 40% loss! So where were those options on November 16th?

(slightly different price but the point still holds)

Luckily, I was able to hedge the downside and come out with only a loss of 20% or so. Not the best but not horrible.

If the price went up, I could have participated and made a few thousand up until the stock price hit the $330 ceiling where I sold my call.

I like to think of this strategy as a heads you win, tails you don’t lose too much.

Wrapping Up

Putting a collar in place can help you sleep well at night, while still keeping the upside you hoped for when you initiated your position.

If thinking about implementing one of these options strategies, you want to be smarter than me. You want to know the technical indicators to look for when setting your positions and the intricacies of what you are getting yourself into.

What’s your go to options strategy to protect your downside for a position or your portfolio as a whole? Leave the answer in the comment below. If you want to learn more about building dividend growth portfolios check out the perfect five dividend stocks to build your portfolio around.

Author Biography

The author currently writes about investing, personal finance and building your retirement portfolio over at www.investmentbasecamp.com. He’s not sure why but people seem to think he makes sense when he talks about investing and personal finance. His Quora answers in finance received over 80,000 views in the month of November alone.

He currently work in the Investment Consulting industry advising pension and 401k plans, worth over a collective $5B dollars in assets.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.