While markets have been on a stellar run lately and it seems like there is no stopping the bulls, now might be a good time to start thinking about having some downside protection.

A sharp selloff would be particularly painful for bull put spread sellers. You would get hurt both directionally and from the spike in volatility. If you’ve made some great gains over the past 12 months, it would be a shame to see them evaporate overnight in the event of a sharp decline.

One way you can give yourself a little bit of protection while still maintaining an attractive income potential is to add a debit spread in front of your put credit spreads.

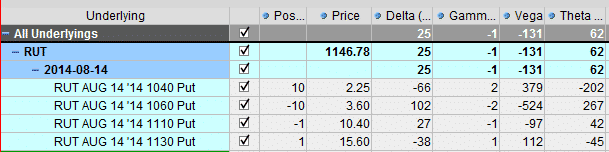

Here’s an example:

Date: July 21, 2014

Current Price: RUT 1146

Trade Set Up:

Buy 1 August 14th RUT 1130 put @ $15.60

Sell 1 August 14th RUT 1110 put @ $10.40

Sell 10 August 14th RUT 1060 puts @ $3.60

Buy 10 August 14th RUT 1040 puts @ $2.25

Premium: $830 Net Credit.

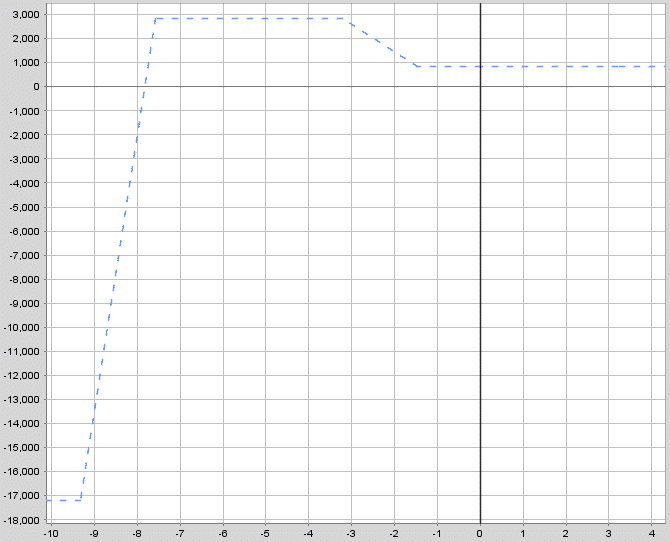

The above trade provides a 4.83% income potential, with larger gains possible if RUT finished between 1110 and 1060. There is zero risk to the upside.

I would set a stop loss at 2 times the credit received. Adjust if RUT hits 1080 or if the delta of the short strike hits 0.30.

Hi Gavin

1) How do we defend our Iron condor and butterfly when Implied Volatility spiked up or a drastic price movement against our bull PUT spread positions?

2) we have some option to our losing position:

i) Can we roll over to different strike price o

ii) better to add some call debit spread to protect our Bull put spread position

iii) Or perhaps best option is to close out and exit the position.

Please advise which are better options for different spread position and expiration duration/ timeframe.?

I found that it is quite difficult to defend our spread option position when stock trading on range bound or during consolidation.

I checked the stock position using Ichimoku indicator and TTM Squeeze indicator or trendlines.

Hi Gavin

After studied your illustration of protecting the Bull put spread through buying 10 contracts of the debit spread RUT Aug 14th, 1060/1040.

How do we calculate the right quantity of contracts for the protection? Since the spread option is a delta neutral strategy, but here you showed that your overall delta was 25. Please explain how do we determine the correct delta and theta positive for the protection.

Thanks

Hi Lawrence, I like to use either 1 or 2 debit spreads as protection per 10 credit spreads. It depends on your market outlook, how much income potential you want on the trade and what greeks you are happy with.

I was happy taking a slightly bullish bias on this trade. If I wanted to be completely delta neutral, 2 debit spreads would have got me there, but it would have also removed most of the income potential from the trade.

Hi Lawrence,

You can protect in a similar way to a regular iron condor by rolling out the strikes, or you could add to the debit spread.

This position actually has less Vega exposure than a regular credit spread or iron condor due to the positive Vega on the debit spread.

I like to think of the debit spreads as soldiers. You need more soldiers when your front line (short strikes) are under pressure.

Always keep an eye on the greeks too.

Hope that helps.

Hi, Gavin

Thanks for your feedback, It is a very complicated situation for new or inexperienced traders to defend the option spreads like iron condor, butterflies, credit or debit spreads because there are many factors to consider.

1) Implied volatility or vega of the stocks and VIX, general market conditions like SPY or SPX, DIA, RUT, gold, oil and gas sectors.

2) Which strike price or which month to roll over when the spread option is ITM or change the play to calendar or diagonal play.But we need to either pay for spread or sell more credit spread

3) The value of delta, theta and gamma for those strike price. Different timeframe we use for our trade.

4) If the market is very volatile, I may prefer to do some directional option rather than play spreads because it is more profitable but the market is choppy then we need to add more debit spreads or credit spread to offset those losses. I prefer to close out the spread earlier to buy back those spread at about 20% or less than the initial credit premium I received. Any good advice you can give here ?

Anyway, I found that you have ave a good articles write up to explain them, but it is good if you offer some webinar on this defending the spread option.

Hi Lawrence,

Thanks for your comments. You seem like you have a good grasp of this stuff. In October I’ll be doing another 1 month group mentoring course. If you’re on my email list, you get notification of the details.

Gav.