Iron Condors are by far and away my favorite option strategy. The are one of the most profitable and one of the easiest to understand once you have robust rules in place that have stood the test of time.

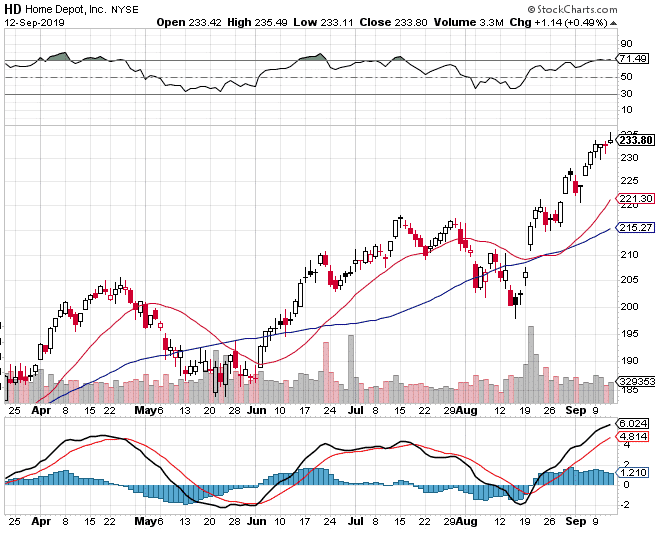

Today we’re going to look at two different iron condors examples, first up is HD.

Date: September 12th, 2019

Current Price: $233.80

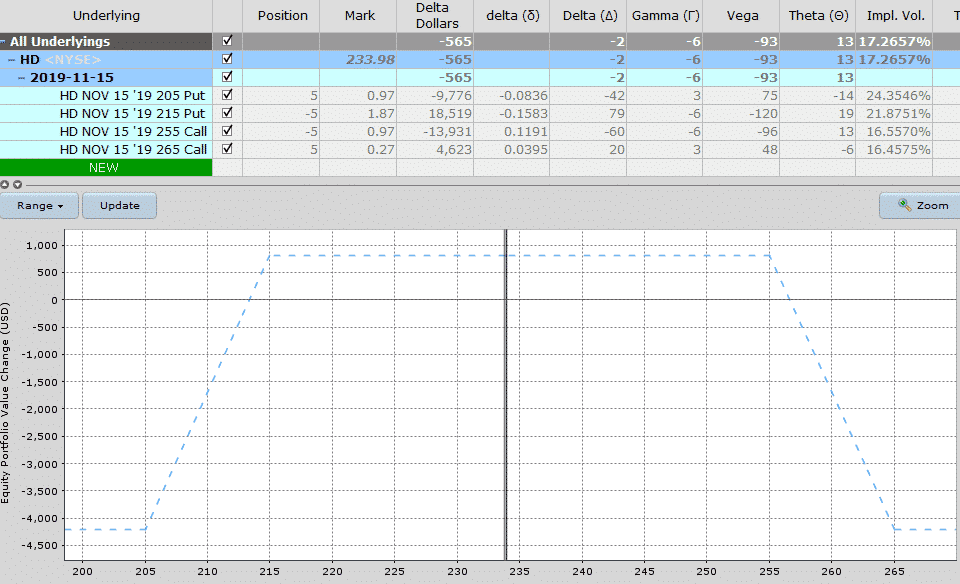

Trade Set Up:

Sell 5 HD Nov 15th, 215 puts @ $1.87

Buy 5 HD Nov 15th, 205 puts @ $0.97

Sell 5 HD Nov 15th, 255 calls @ $0.97

Buy 5 HD Nov 15th, 265 calls @ $0.27

Premium: $800 Net Credit

Maximum Risk: $4,200

Potential Return: 19.05%

Breakeven Points: 213.40 and 256.60

I typically don’t like trading iron condor on individual companies because there is so much stock specific risk, but I will make an exception here.

Earnings are set for the week of Nov 25th, so that won’t impact this trade.

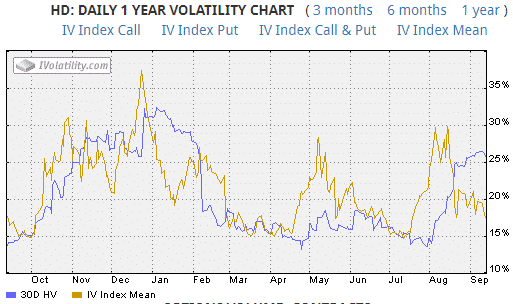

One concern is that volatility is quite low, but I still like this trade because looking at the chart, HD has been an extremely strong stock and I don’t see a huge pullback happening.

I can definitely see this one having a pause here and consolidating some of the recent gains.

I would like to be out of the trade with a $400 gain within 4 weeks or so and will set a $400 stop loss giving this a 1:1 risk reward ratio.

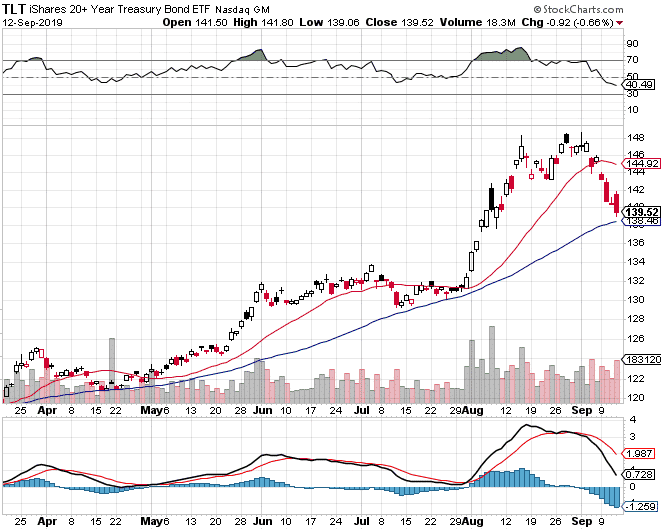

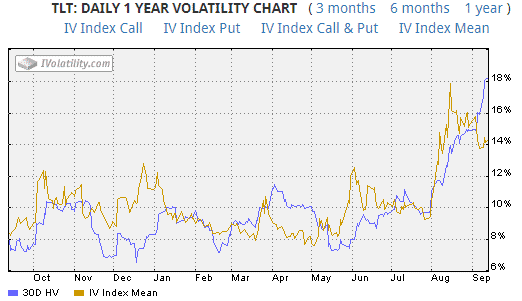

The second Iron Condor trade is on TLT. This bond ETF has seen volatility go through the roof following a strong up move then a violent drop.

While implied volatility of 14% might sound low, remember this is normally a slow-moving ETF where volatility usually hovers between 8% and 12%.

So elevated volatility means a good time to sell options if we think the ETF is going to settle down a bit and trade in a range.

TLT is a good instrument for option traders because there is no earnings risk.

Date: September 12th, 2019

Current Price: $139.55

Trade Set Up:

Buy 10 TLT Nov 15th, 127 puts @ $0.24

Sell 10 TLT Nov 15th, 132 puts @ $0.69

Sell 10 TLT Nov 15th, 147 calls @ $0.79

Buy 10 TLT Nov 15th, 152 calls @ $0.29

Premium: $950 Net Credit

Maximum Risk: $4,050

Potential Return: 23.46%

Breakeven Points: 131.05 and 147.95

After a big up move, then down move I can definitely see this one going sideways over the next few weeks.

I’ll be looking at a $475 profit and $475 stop loss which is 50% of the premium received.

P.S. Do you own due diligence before making any trading decision and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.