Back on December 22, 2016, I wrote an article asking if the beaten down renewable energy sector could bounce back in 2017. Well, just over half way through the year, I think we have our answer.

At the time, I posted this chart showing the sector declining from a high of 200 to a low of 50 over the course of 2 and a bit years. That was a 72% decline. Talk about an unloved sector!

To me it seemed crazy that renewables were so beaten down considering that you would assume most major economies would be looking to ramp up investment in the technology over the next 5-10 years.

I remember reading some articles on Seeking Alpha at the time calling for FSLR to go to zero. Just goes to show, you should do your own research and form your own opinions!

Register For 10x Your Options Trading

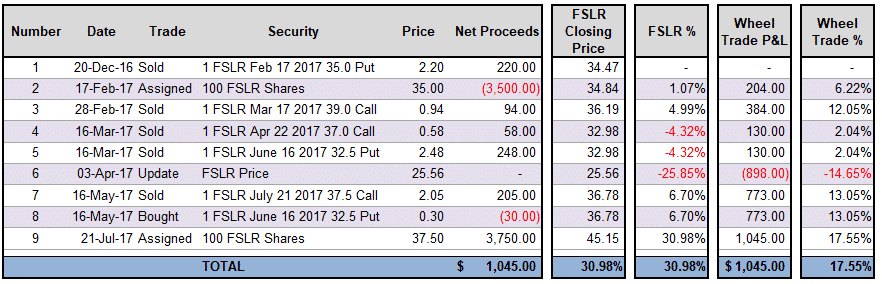

I started a Wheel trade on Dec 20th by selling a Feb $35 put for $2.20. Implied volatility was pretty high meaning a nice juicy premium.

The trade bounced around a little bit but I ended up getting assigned in Feb at $35. I was pretty quickly questioning my sanity as the stock plummeted pretty quickly from $38.50 down to $25.56.

Luckily that turned out to be the bottom and the stock quickly rallied from there.

I ended up selling some calls and another put along the way and eventually had the shares called away for $37.50 for a $250 gain on the stock and a total of $795 in option premium received for a net gain of $1,045.

You can see the full trade history below, plus an explanation of my thought process:

- With FSLR trading at 34.47, I sold a $35 put. I wanted to be assigned on the stock, hence why I sold a slightly in-the-money put. The added advantage of the in-the-money put was that I received more option premium

- On expiry day, FSLR closed just below the $35 strike so I was assigned and bought 100 shares at $35.

- I waited a few day, FSLR rallied and then I sold a 39 call. In hindsight, I should have sold a call closer to the money. I wanted to have some upside potential, but unfortunately the stock dropped pretty steadily from this point.

- In mid-March, FSLR had dropped about 15%, my March $39 call was about to expire so I sold another call, this time at $37. This was a fair bit above the stock price at the time, so I didn’t receive much premium, but I wanted to maintain some upside potential

- At the same time, I took advantage of the drop in the stock and sold another put, this time at $32.50, slightly below the stock price this time.

- FSLR’s slide continued, eventually bottoming out at $25.56. At this point, the stock was down 25.85% and my Wheel trade was down 14.65%.

- My $37 call expired on April 22, but with the stock down so much, I decided not to write another call and just hold the stock. I wanted to wait for a rebound before selling another call, otherwise I would end up selling a call below my cost basis. By May 16th, the stock had recovered well above my cost basis so I sold a slightly out-of-the-money call.

- At the same time I bought back the second sold put as there wasn’t much premium left so I decided to remove the risk and free up the margin.

- On July 21st, FSLR was above $37.50 (quite a bit above unfortunately) and my shares were called away.

Over the course of the trade, the stock went up 30.98% while my Wheel trade made 17.55%. My return assumes having capital allocated to finance the purchase if the second put was assigned. If we remove that capital from the equation, the return is 38.63%.

Ultimate Guide to the Stock Repair Strategy

Two different ways to look at it, but either way I was happy with the trade.

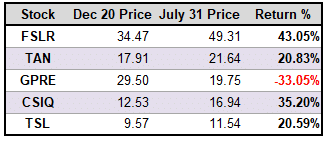

Interestingly FSLR rallied a massive 76.60% from the April 3rd low!

It since rallied to over $49 for a total rally off the lows of 91.20%!! Talk about a high performing sector!

By selling the $37.50 call, I gave up another $550 in profit potential, but I never expected the stock to rally so far.

I love using Wheel trades in the longer term portion of my portfolio. Shoot me an email if you want to learn more about this.

Most of the other stocks mentioned in the December article have also done well.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.