For some investors, New Residential Investment Corp. is an attractive, high-yield mortgage real estate trust with a high dividend yield. That yield is currently sitting at nearly 12%. There is also the potential for capital gains over time.

Anytime a stock or REIT trades with a very high dividend yield, investors need to be a little wary. Is that yield sustainable? What other issues does the stock face?

With NRZ I was initially attracted to the high yield and decided to make a long-term play using options known as a Wheel Trade.

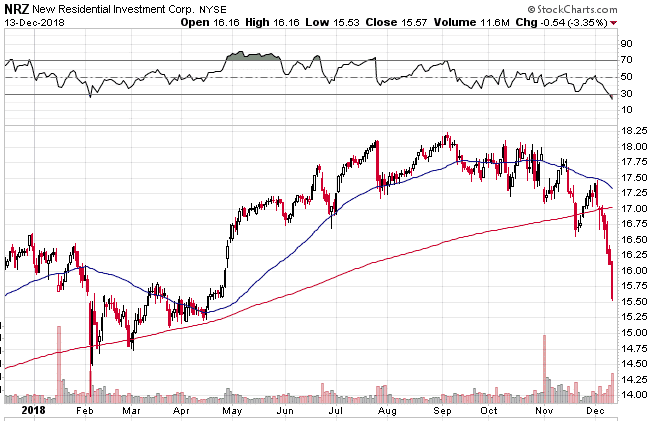

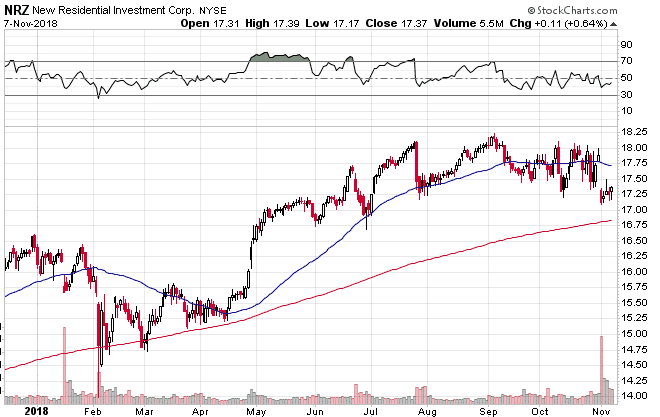

Back on November 7th, I sold two May 17th, 2019 $17 puts for $1.00.

At the time, NRZ had pulled back from the highs and it looked like the 200 day moving average would hold as support.

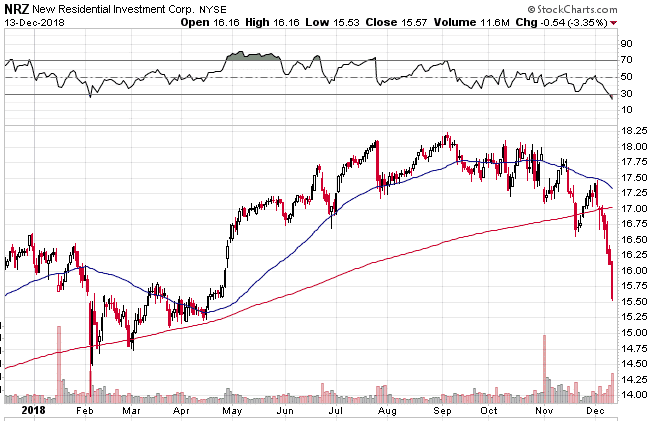

Fast forward to today and the chart is not looking nearly so good as NRZ has been crushed due to the potential inverted yield curve which will be bad for REITs.

Remember that mortgage REITs borrow short-term and lend long-term, so if short-term borrowing costs are higher than long-term mortgage rates, that’s not a good thing.

Those $17 May puts that I sold for $1 are now trading at $2.28 so I’m down $256 on the trade. Hardly disastrous, but the question remains:

What should I do now?

The way I see it, there are three options:

- Close the trade and walk away with a small loss

- Hold the trade for now and see if it recovers. If I get assigned, I collect the 12% per year dividend while I wait.

- Sell some more puts and take a bigger position in NRZ

I’m reluctant to throw good money after bad, especially with the way the yield curve is looking. If I were to do that, I would prefer to wait for signs of a bottom, although NRZ has had some sharp recoveries in the past.

Access the Top 5 Tools for Option Traders

I also don’t really want to close the position because it’s a long-term play and I’m sure it will eventually recover.

If I’m assigned at $17, my effective cost will be $16 due to the premium received. So even with NRZ trading at $15.50, I’m not really down that much and taking ownership allows me to collect the dividend and sell covered calls if NRZ recovers.

What do you think I should do. Let me know in the comments below.

I’ll be sure to keep you posted.

Also, Jeff from Option Boxer has a really cool Wheel Tracking Spreadsheet that can be accessed here.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.