Nike has been a strong performer with the stock up over 22% this year.

Bank of America Merrill Lynch recently upgrading their rating on NKE and raised their price target from $70 to $98. The new price objective assumes NKE shares trade at 28X to 29X the 2021 earnings per share estimate, a “slight premium to high-quality global consumer staples franchise names”.

During the company’s recent quarterly results revenues were up 10 percent and net income rose 25 percent.

Risks to the stock include an increased cost of production due to the US-China trade tensions and the NBA controversy having an adverse effect on growth in China.

Since breaking out to an all-time high in September, the stock reached a high of $96.87 but has since pulled back to $90.85.

Right around this area, there is a confluence of support developing that could provide a high probability trade entry.

The 50-day moving average sits just below the current price as does some previous heavy resistance which may now become support.

Counting against the stock is increased volume on the latest decline and a bearish MACD cross.

A very easy trade would be to sell a bull put spread with a stop loos just below the 50-day moving average.

Click Here For My Top 5 Technical Indicators

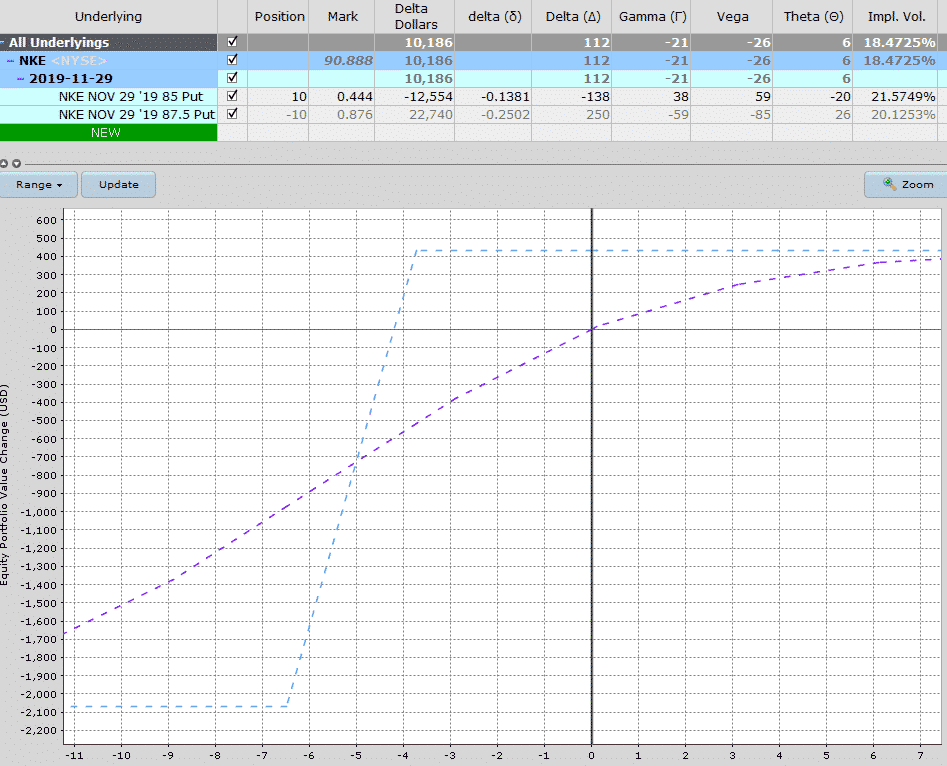

Selling 10 of the November 29th put spreads with $87.50 as the short put and $85 as the long put would generate around $430 in premium with total risk of $2,070.

If the spread expired worthless, that would be a 20.77% return on capital in one month.

It’s a risky trade but one that has a nice payoff if it works. Not sure whether I will make this trade or not.

Normally I would choose the December 20th expiry, but as earnings are scheduled for December 19th, that expiry will have exposure to the earnings announcement.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.