Not everyone has enough cash to get involved in the real estate game.

Then of course you have issues with collecting rent, broken toilets etc. etc.

Luckily, using options, there is a way to gain exposure to the real estate market without having to put up any cash (or at least very little).

No, I’m not some crazy real estate spruiker trying to sell you some shady deal.

This really is possible and today I’ll show you how.

The strategy is called a Risk Reversal, which might sound complicated but really it’s very simple.

All you do is sell a put and buy a higher call in the same expiry month. If you can use the same strikes for the put and call, then it would be called a Synthetic Long Stock Position.

I tend to prefer the Risk Reversal, but really there isn’t too much difference between the two.

I’ve talked a little bit about IYR recently, so I’ll use that as our example again because it gives a broad and diversified exposure to the real estate market.

For this example, I go out as far in duration as I can which means using the Jan 17th, 2020 options. That gives me a long time for the trade to work out in my favor.

As of June 22nd with IYR trading at 80.70, I could sell an $80 put for $6.59 and buy an $81 call for $4.51

This gives me a net credit in my account of $208 which is mine to keep no matter what.

I actually get paid to make the trade, so there must be a catch right?

Not so much a catch, but yes, there’s no such thing as a free lunch. In order to maintain this exposure, we need to put up some margin. So the trade doesn’t quite cost us nothing, but we can gain exposure for very little.

In this example, the margin requirement is likely to be around $2,500. That could vary from broker to broker and it will change as the underlying instrument moves in price.

While the trade doesn’t require much capital, it’s important to remember that the exposure is similar to owning 100 shares of IYR which would normally set you back about $8,000.

Returns will be similar, so it like taking a leveraged exposure on IYR which is another important point to consider.

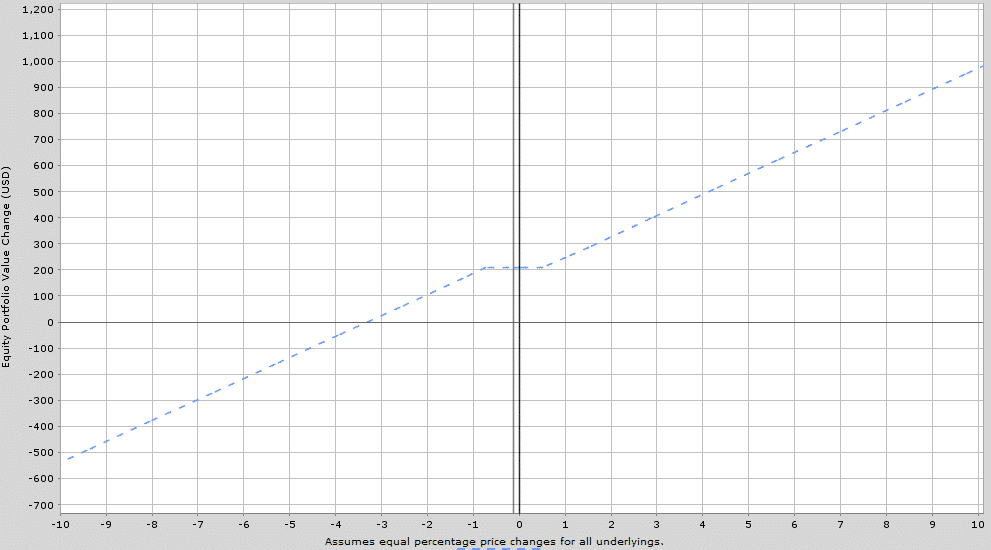

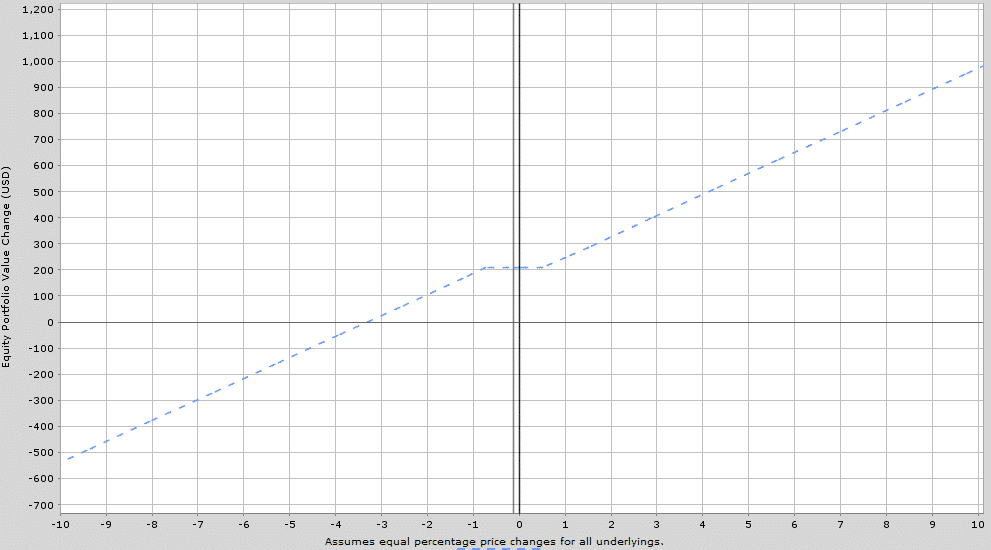

Let’s look at the payoff diagram for the strategy.

You can see that the puts are trading at a much higher price than the calls. This is because, all else being equal, IYR would be expected to decline by the amount of the dividends paid over the trade duration.

Trading options means we do not get the benefit of the dividends, so that is reflected in the option prices.

So, if IYR finished exactly where it started, then we get to keep the $208 premium and that is our total profit.

If IYR is 10% higher, we make just under $1,000 and if it is 10% lower, we lose about $500.

In percentage terms, that equates to +40% and -20% on the margin required for the trade.

So you can see the returns are magnified on the upside and downside.

What do you think of this strategy? Have you tried it before? Let me know in the comments section or send me an email.

Another option for investing in real estate with little money is Ark7, which you can read about here.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.