EBAY had a tough day today, in fact it was the stocks worst day in 2 years as it dropped 10% on the day.

The reason for the drop was sluggish growth and a reduced revenue forecast for the remainder of the year. Also contributing to the decline was the “challenging near term outlook” for Ebay’s subsidiary, StubHub.

EBAY’’s earnings of 53 cents came in 2 cents above analysts expectations, but it was a $50 miss on revenue that really impacted the stock today.

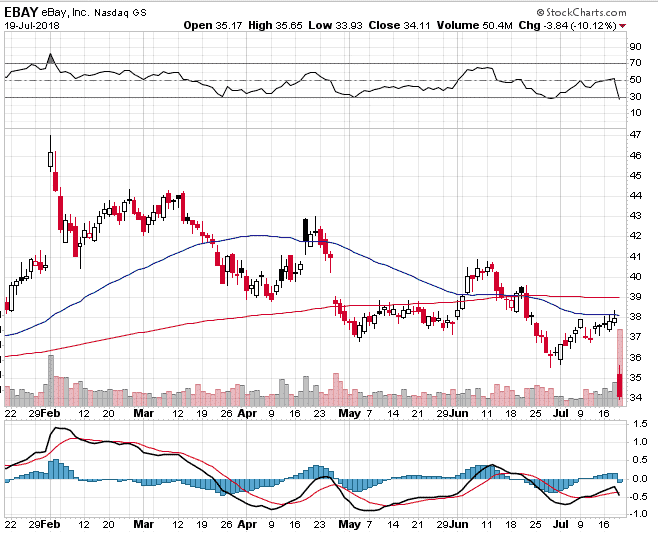

On the chart, we can see the big gap down on huge volume today. The stock has been in a clear down trend since February, putting in a series of lower highs and lower lows. In addition, the stock suffered a death cross, where the 50 day moving average crosses below the 200, back in June.

Wild moves like this provide opportunities for option traders. Here’s four trade ideas for traders who want exposure to EBAY.

Just a reminder that these are not trade recommendations and you should do your own due diligence and consult with a licensed financial advisor before making any investment decisions.

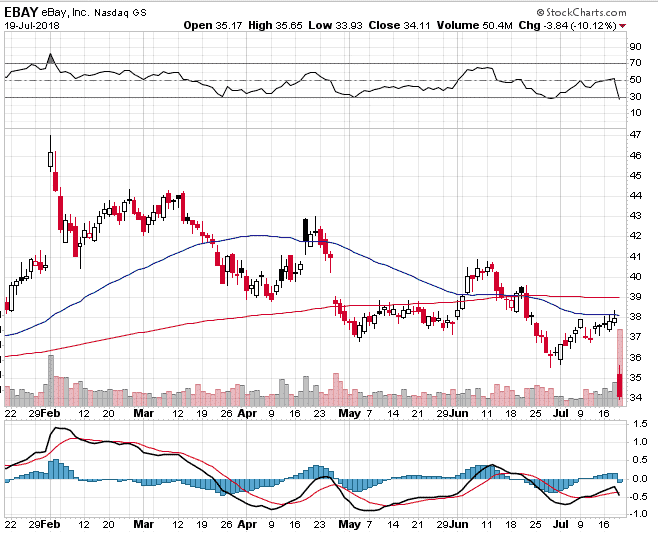

BULL PUT SPREAD

As the name suggest, this is a bullish bet that will do well if EBAY stock recovers or holds steady. The trade can also be set up with a large margin for error, by trading an out-of-the-money spread.

Going out to September and selling the $32-$30 put spread generates around $140 premium per contract on capital at risk of $860. Should the trade expire worthless, the trader would make a 16% return in just under 2 months.

There is also a 6.2% margin for error should EBAY trade lower over the next few months.

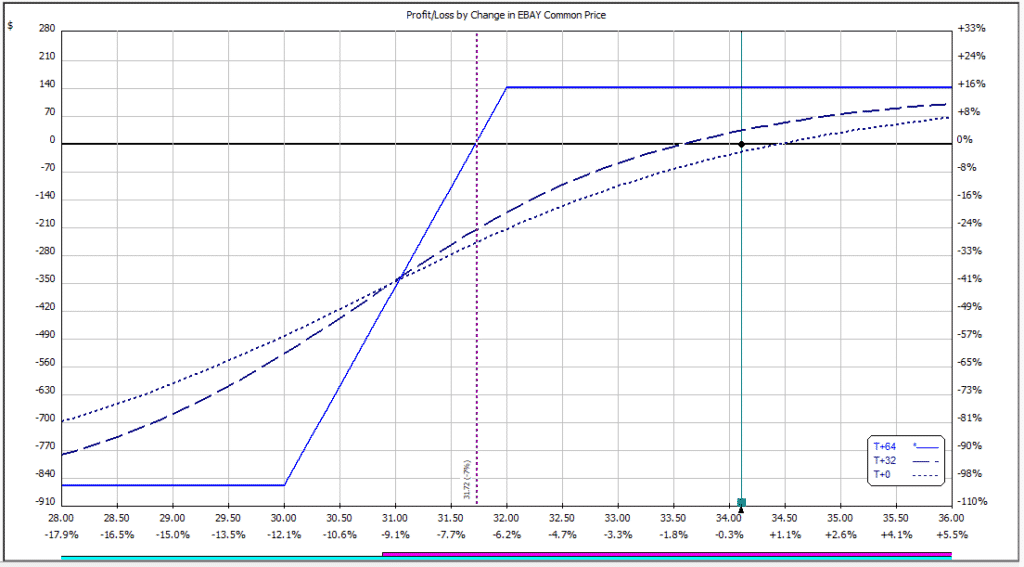

PUT RATIO SPREAD

I’ve talked about put ratio spreads here recently and I do like them in the case when a stock has suffered a precipitous decline.

Access the Top 5 Tools for Option Traders

Using September options again and buying two $33 puts and selling four $31 puts can be done for a slight debit. This means we only have a small risk on the upside and a large profit zone is created between $33 and $29.

Traders who think EBAY might continue to slowly decline and end in that area in a few months might consider this strategy.

As with the bull put spreads, the risk is that EBAY continues to fall hard in the early part of the trade.

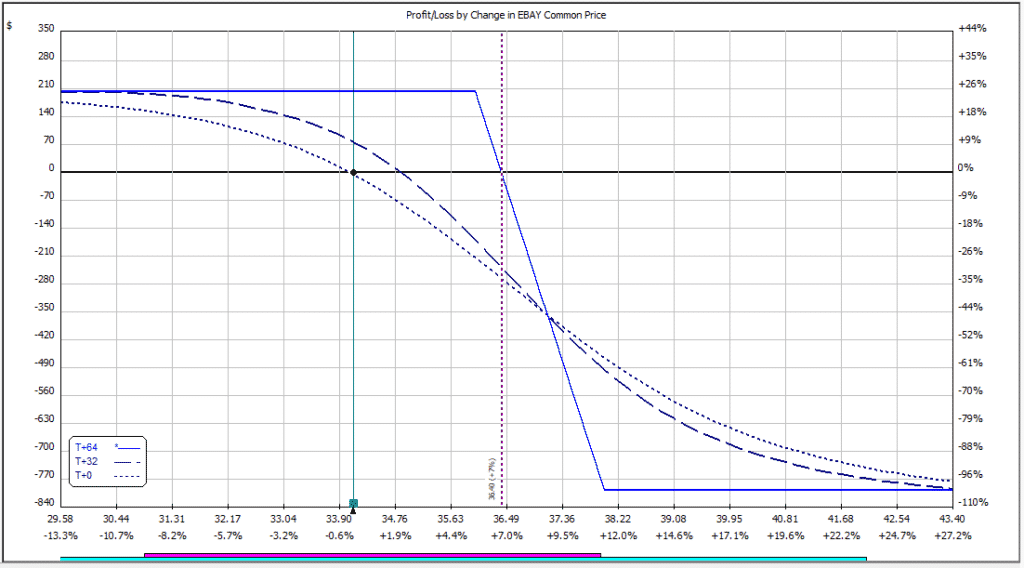

BEAR CALL SPREAD

Traders who thinks EBAY’s troubles will continue could sell a bear call spread.

As the name suggest, this is a bearish bet that will do well if EBAY stock declines or even holds steady. The trade can also be set up with a large margin for error, by trading an out-of-the-money spread.

Going out to September and selling the $36-$38 call spread generates around $200 premium per contract on capital at risk of $800. Should the trade expire worthless, the trader would make a 25% return in just under 2 months.

There is also a 7% margin for error should EBAY trade higher over the next few months.

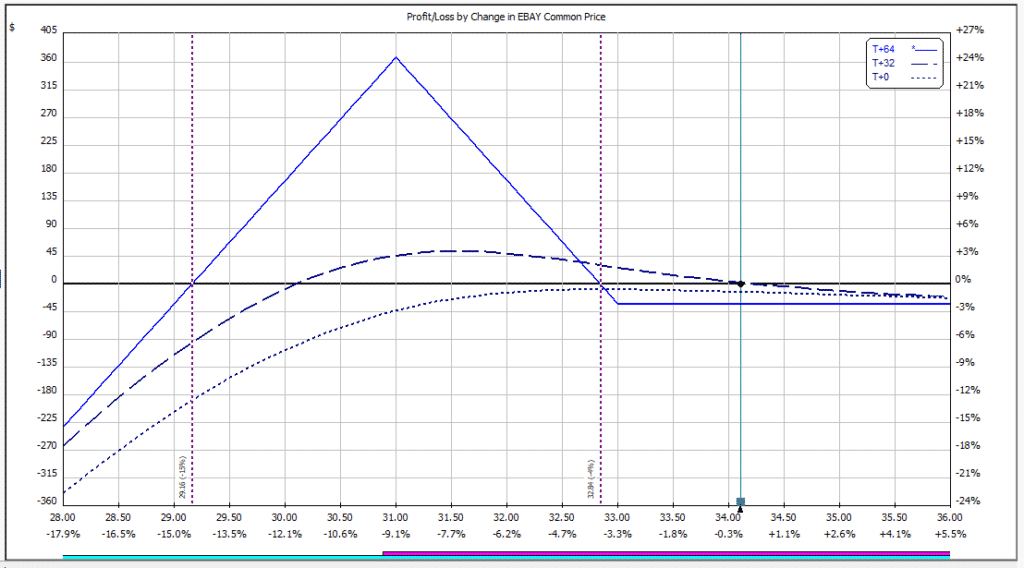

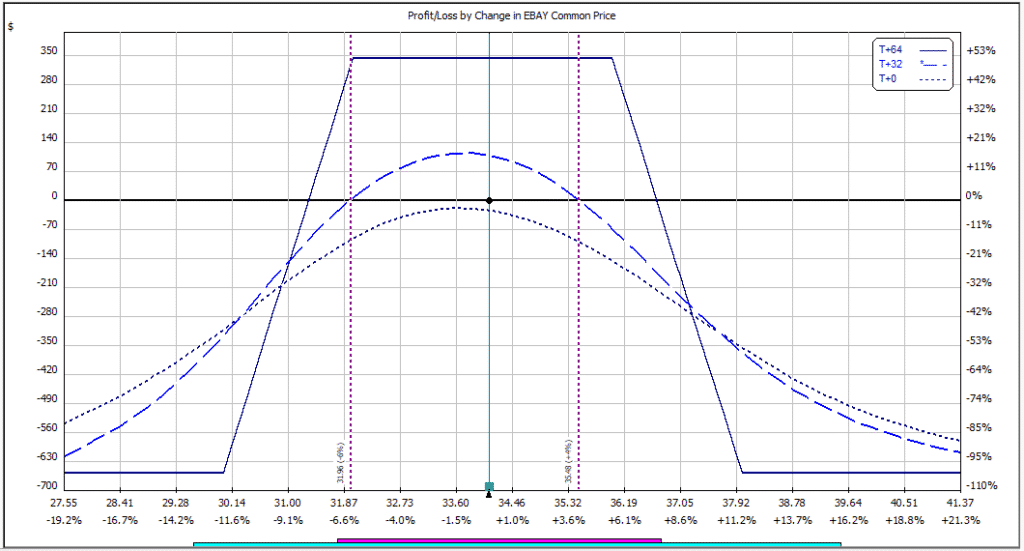

IRON CONDOR

Traders thinking sideways action is on the cards, could trade the $32-$30 and $36-$38 Iron Condor. That trade currently generates $340 per contract in premium with a maximum loss of $660.

If the trade were to expire worthless, that represents a 51.50% return on capital.

This trade would need EBAY to stay above 31.30 and below 36.70 at expiry to be profitable.

As always, do your own due diligence before making any trades, but there is definitely some opportunity to be had in EBAY right now.

Trade safe!