Mainstream financial news and media seem to be filled with both sides of the coin when it comes to assessing today’s market situation. You hear CEOs and bullish investors saying things like this is the best time to be in stocks, pointing to the strong performance of the S&P 500 lately, which has delivered a 20%+ return year-to-date; yet, you also hear alarming statements that point to several facts that could lead to the conclusion that the market is fairly overvalued.

Is a severe market correction possible? Are we headed towards one? There’s no easy answer, but in this article, you’ll learn a strategy to help you in protecting your portfolio of a potential market correction by using put options.

Is this really an expensive market to be in?

There are many ways to estimate the potential overvaluation of the stock market based on hard facts and not just guesswork. Some of these techniques are easy, but others involved a significant number of calculations, financial models, knowledge, and resources.

Warren Buffet’s Way

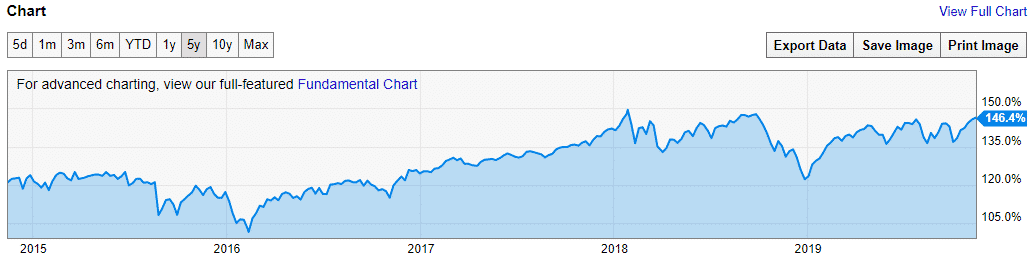

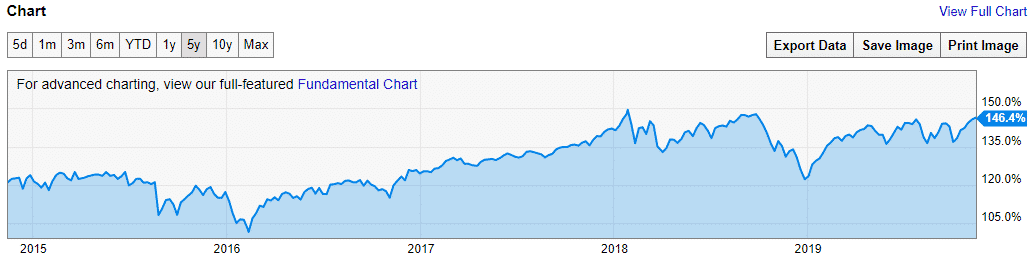

Same as with other things, the Oracle of Omaha’s approach to understanding market valuations is as simple as it gets. According to Mr. Buffett, his way to estimate the potential overvaluation of the market is to divide the total market capitalization by the U.S. Gross Domestic Product (GDP). He states that a ratio between 70% to 80% should be considered ideal for stock investors to step into the market. On the other hand, a ratio of 200% or more should indicate that a market correction is about to come.

To save you some time, the result of this simple formula right now results in a ratio of 140% – 150%. This doesn’t mean a correction is not coming, yet it may be an indication that the market is still not at its worst stage of overvaluation. On the other hand, what it does tell you is: this is an expensive market to be in.

Hedge your portfolio from a market correction using put options

A put option allows you to lock in some of your annual gains by offsetting the impact of a downfall in stock prices. The way this strategy works involves buying a certain number of put options to hedge just a portion or your entire portfolio by being able to earn money from a potential setback (if it occurs) from the increase in the value of the put option.

If the market suddenly goes south, your put options will increase in value. While your underlying assets will experience a drop, the option will gain on the correction and your net result will end up being much higher due to this hedge.

How much does this strategy cost?

This strategy should be understood as if you were buying insurance on your stock earnings. Yes, you have to pay a premium, same as any insurance policy, and if the market doesn’t react negatively from this moment up until your options mature you may face a loss, but considering the obviously expensive stock prices of today’s markets, the benefits of this “insurance policy” is not something you should underestimate.

The dividends you earn on your stocks, ETFs or mutual funds should provide enough funds to cover for the premium paid on the put options, and through this strategy you will continue to benefit from the rise of the stock market, while you’ll also protect your portfolio from potential large losses that could result from a severe market correction.

How expensive are put options right now?

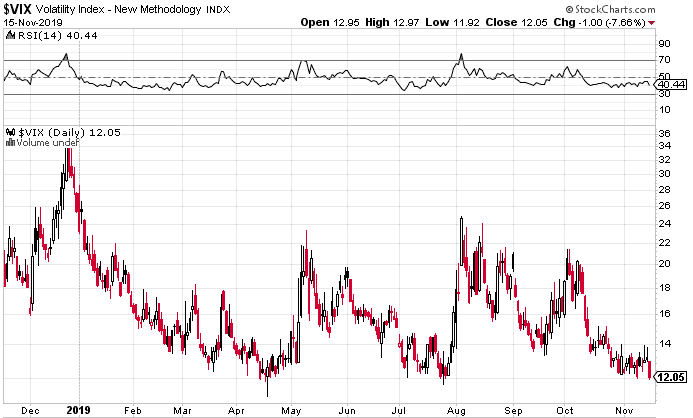

If you’ve had a good couple of months in the market and you’ve benefited from the bull run, now could be a good time to think about buying some cheap downside protection.

VIX closed at 12.05 on Friday which is about the lowest level we’ve seen in the last 12 months. That means put options are cheap compared to the recent past.

Good luck out there and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

How far out( as in time ) should one buy OTM PUTs? and how many? and on what? should then I keep them until expire, or try to roll them ?

Thank you

I go out about 6 months, and delta between 2 and 5. Usually roll them a few months from expiration to try and minimize the time decay.

So, would I do it like this: Let’s say one’s portfolio was in XYZ stock (some type of a TSM mutual fund or ETF) going at $300 per share. And one had, say, around 1000 shares of the stock totaling $300,000. Would you buy 10 puts on that ETF (so 1000 “shares worth”, since each contract is 100 shares), every 6 months? And if it cost you something like 2% of your total portfolio (for example), would that be something you did anytime you expected the market to drop MORE than 2% to each that money back?

Yes that’s not a bad way to do things. Only giving up 4% per year for some safety and being able to sleep at night.