Read Part 1 – The Basics

Read Part 2 – How To Set Profit Targets and Stop Losses

Read Part 3 – How To Successfully Leg Into A Butterfly

Read Part 4 – Trading Rules

Read Part 5 – Using Low Risk Directional Butterflies

In today’s lesson, we’re going to be looking at the greeks of butterfly trades.

Understanding option greeks is vitally important with most option strategies and that is definitely the case with butterflies. Greeks for a neutral long call butterfly, long put butterfly and iron butterfly are all going to be very similar. I will discuss the greeks for a traditional neutral long call butterfly spread and you will know that the same can apply to the other varieties of neutral butterflies.

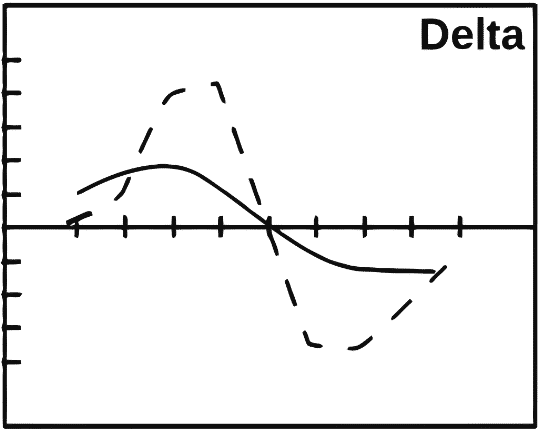

DELTA

A typical butterfly spread is set up with the short strikes placed at-the-money. It doesn’t take a genius to realize that the delta of a neutral butterfly will be zero (or very close to), but what happens when the stock prices moves away from your short strikes?

If the stock falls, your butterfly becomes positive delta. If you think about it, this makes sense. When the stock falls, your point of maximum profit is above the current stock price, therefore you want the stock to rise. Positive delta indicates that you will make money as the stock rises.

The opposite can be said if the stock rises. Your point of maximum profit is now below the current stock price, so you want the stock priced to fall. Therefore, you have negative delta.

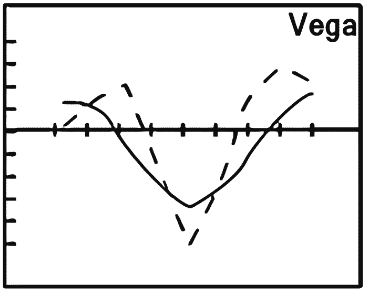

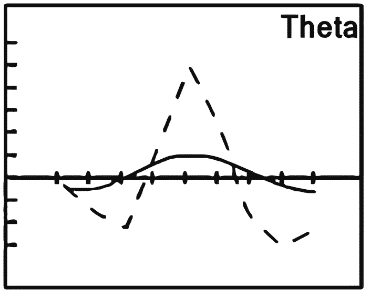

This is shown graphically in the image below. The dotted line represents a shorter dated option and the solid line represents a longer dated option. You can see that the effect is more pronounce in the shorter dated option. In other words, the delta (directional) risk is greater in shorter term butterflies.

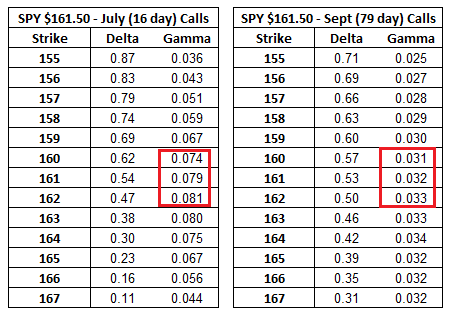

GAMMA

Gamma is a hugely important greek to understand when trading butterflies as I have previously alluded to. Important and frequently overlooked. Gamma is the reason why the delta of a butterfly changes from positive to negative. For those that are unfamiliar with gamma, a quick discussion might be in order before we look specifically at butterfly gamma.

Gamma represents the rate of change of an option’s delta. An option with a gamma of +.05 will see its delta increase by +.05 for every 1 point move in the underlying.

Delta neutral trades don’t stay neutral for long and the reason is gamma. To understand how gamma works, let’s look at an example. Assume you buy a 30 day, 50 delta straddle and a 90 day, 50 delta straddle. Both positions have the exact same delta, so how will they perform if the stock moves? The one with the highest gamma will do better, in this case the shorter dated trade.

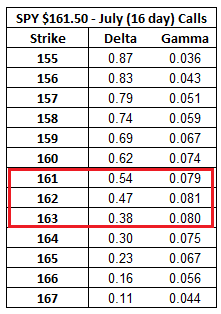

Gamma is at its highest with at-the-money options. Looking at SPY call options with 16 days to expiry, you can see the gamma is highest around $161 – $163. From this you can deduce that at-the-money butterflies have a large (negative) gamma risk.

Gamma will be higher for shorter dated options as you can see below. Gamma for the July at-the-money calls is around 0.08 whereas the September at-the-money calls are 0.03. For this reason, the last week of an options life is referred to as “gamma week”. Most professional traders do not want to be short gamma during the last week of an options life.

Net sellers of options will be short gamma and net buyers of options will be long gamma. This makes sense because most sellers of options do not want the stock to move far, while buyers of options benefit from large movements.

A larger gamma (positive or negative) leads to a larger change in delta when your stock moves.

When trading butterflies, it definitely pays to keep an eye on gamma. When the stock is outside the wings of a butterfly, the trade has positive gamma. This indicates that the trade will gain delta as the price rises and lose delta as the price falls.

When the stock is right at the middle strikes you have a large negative gamma exposure. A large negative gamma means you don’t want the stock to move far. This makes sense for a butterfly when you are right at the middle strikes.

As the stock moves up from the short strikes the butterfly will lose delta (and probably go from neutral delta to short delta as we discussed above). As the stock falls from the short strikes the butterfly will gain delta (going from neutral to positive delta).

The negative gamma exposure on a butterfly trade is a lot more than on other popular income trades like iron condors.

VEGA

Neutral butterflies are short Vega. The Vega exposure is similar to the gamma in that you have a large short Vega exposure at the short strikes and positive Vega outside the wings. So Vega works against you around the short strikes, but then when the stock starts to move away, it actually begins to work in your favor.

In the first few days of a butterfly, volatility will have the biggest impact on profits out of all the greeks. For example a RUT 45 day at-the-money butterfly has a Delta of -2, a Gamma of 0, a Vega of -31 and Theta of 4. Vega is by far the biggest exposure and will have the biggest impact.

Butterflies have a very similar payoff diagram to a calendar spread, the main difference being that butterflies are negative Vega while calendars are positive Vega.

THETA

Theta is the exact opposite of gamma. You have a large positive Theta (you make money as time passes) when the stock is right at the short strikes and you have negative delta (losing money as time passes) when the stock is out beyond the wings.

That’s it for today, in the next lesson we’ll look at Broken Wing Butterflies which I call the “One Size Fits All” Strategy.