Renewable energy stocks have been crushed in 2016. Absolutely crushed.

One measure of the sector is the Dow Jones US Renewable Energy Equipment Total Stock Market Index, symbol $DWCREE.

This index began 2016 at 125.66 and was around 210 in mid 2014.

As of the close of business on December 20, 2017 the index was trading at 57.95. That’s a 54% decline for the year and a 72% decline since the 2014 high.

IS RENEWABLE ENERGY DEAD?

So is renewable energy dead as a sector? It’s hard to imagine that renewable energy will not be a major part of the world’s energy consumption in the future.

I tend to be a bit of a contrarian at heart, so when I saw that this article, I immediately took notice.

The author Tom Bowley does say, “Timing bottoms can be very rewarding….or very painful. So be sure you can accept the high risk associated with trading renewable energy stocks. They typically move very quickly in both directions.”

It certainly does take some balls to go long on a sector that has been crushed, but sometimes that’s where big profits can be made.

As always, you should consult your financial advisor before making any investment decisions.

DONALD TRUMP AND CLEAN ENERGY

Trump’s victory in the election has generally been seen as a negative for clean energy.

Crude oil has been rallying strongly since the election.

Trump complained that that renewable energy “is not working so good.” and that wind power “kills all your birds.”

Certainly there is a concern that Trump’s policies will have an adverse impact on the industry.

In a recent Forbes article, author James Conca state that:

“President-Elect Donald Trump supports an all-of-the-above energy strategy with a heavy tilt towards fossil fuels, and with no regard to climate change or regulations of any kind. Trump wants to increase American energy production to add jobs and bring the country closer to energy independence.”

The Guardian recently reported that:

“No one is facing the future with more trepidation than those working on clean energy, clean transportation, climate and the environment. Hillary Clinton had promised to build on Obama’s substantial progress in this area; now they worry that it may be reversed, and then some.”

Investors looking to gain exposure to renewable energy, can look at ETFs for a broad based exposure, or go for a focuses exposure in certain stocks.

BEST ALTERNATIVE ENERGY ETFs

Some of the top Alternative Energy ETF’s are listed here:

I tend to stay away from the ETFs with low Total Assets as they can be thinly traded. If the ETF is thinly traded, then the options are also going to be thin or even non-existent.

Any of the top 5 alternative energy ETFs above could be suitable for gaining a broad based exposure to the sector, but I would need to do some more research before jumping in.

TAN would be the pick of the bunch with clearly the highest Total Assets and daily volume.

BEST RENEWABLE ENERGY STOCKS

Wikipedia also has a really good list of the top renewable energy stocks:

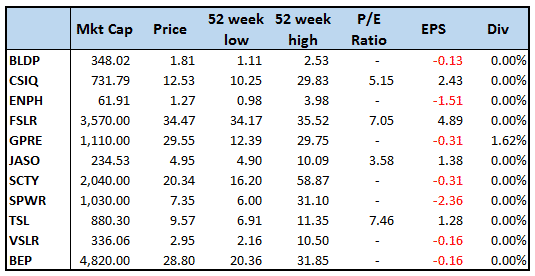

I looked through this list of stocks to see which ones might be tradeable. A lot of them were penny stocks or very thinly traded so I condensed it down to the following list.

You can see that the vast majority of them have negative earnings per share, so that is an automatic warning sign for me.

Personally I also tend to steer clear of stocks under $10 as well.

Some stocks are also close to their 52 week low, another warning sign.

Each to their own, but the only ones I would consider trading are FSLR, GPRE, CSIQ and TSL.

ALWAYS CHECK THE OPTION CHAINS

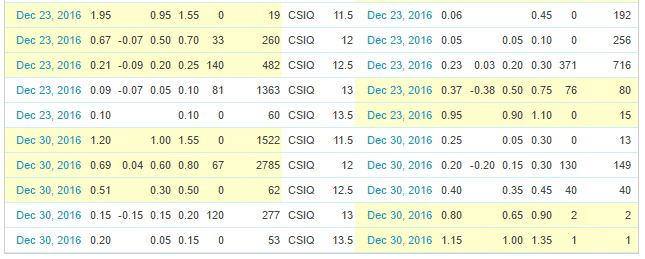

If trading options, it’s always a good idea to check the option volume.

This can be done on the Nasdaq website, see this page for the FSLR example.

FSLR has a couple of hundred contracts traded daily in the front month at-the-money strikes.

GPRE as you can see is very thinly traded.

CSIQ is somewhere in the middle.

TSL is traded pretty well, but there are only 2 option strikes available so that can be a bit limiting.

A LOOK AT THE TECHNICALS

Let’s take a look at the charts and see how these 4 stocks look.

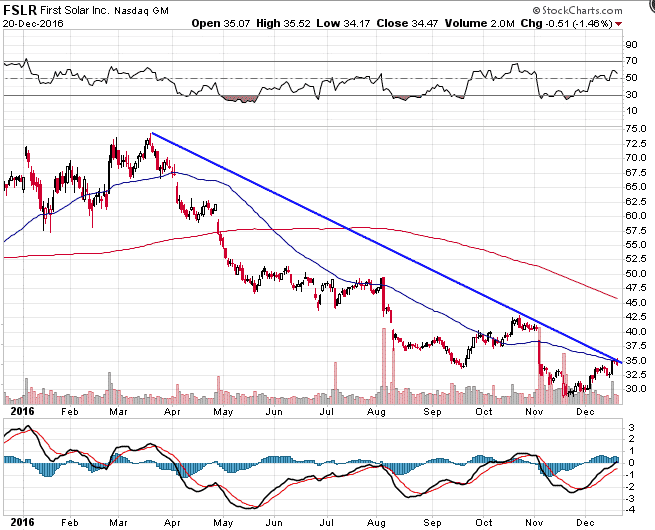

FSLR – First Solar Inc.

Been a dog of a stock this year falling over 50%.

The stock is 20% off the lows seen in November, but is now bumping up against resistance in the form of the down trend line and also the 50 day moving average. If the stock can get above those levels, could it possibly hit the 200?

It hasn’t touched that level since May.

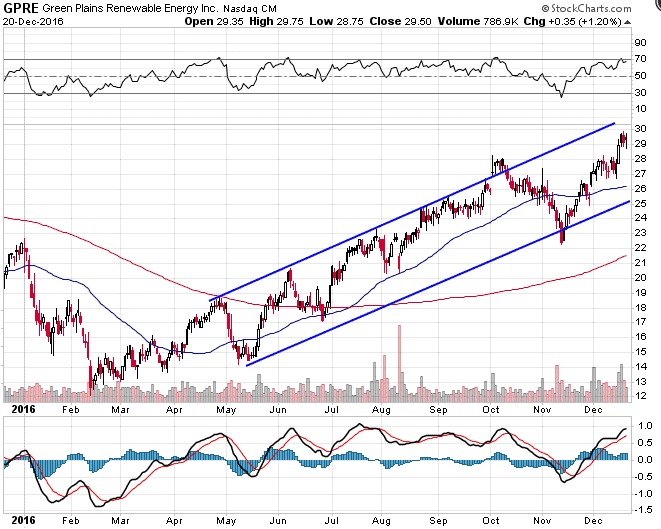

GPRE – Green Plains Reneable Energy Inc.

The strongest of the four from a technical standpoint.

GPRE has been in a strong uptrend channel since early 2016. Quite impressive considering what has been going on in the sector as a whole. Above the 50 day and 200 day moving averages.

CSIQ – Canadian Solar Inc.

Pretty strong down trend channel since early 2016.

GPRE is currently finding it difficult to break above the 50 day moving average. Hard to get excited about this stock based on the chart.

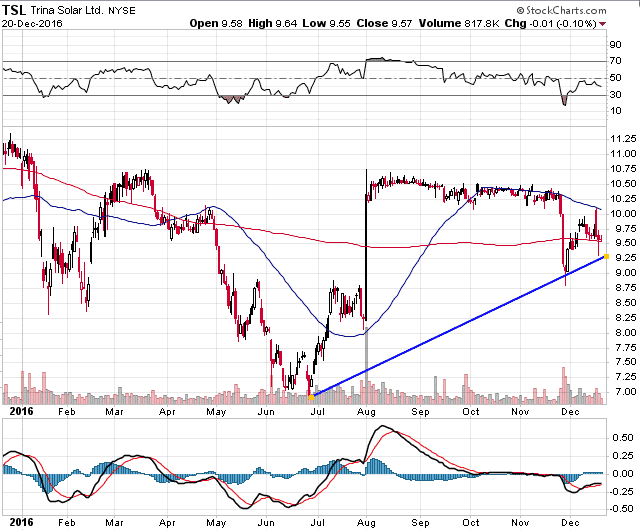

TSL – Trina Solar Ltd.

TSL has a bit of a funny looking chart really and it’s hard to get a decent read.

You could argue it is holding above a major trendline and is also above the 200 day moving average, although it is below the 50. To me the chart says stay away.

Based on the above, FSLR and GPRE are the clear standouts as the best renewable energy stocks for 2017.

GPRE looks stronger technically and also pays a small dividend which can help boost returns.

The renewable energy sector has had a tough couple of years and there’s no gaurantee it will bounce back in 2017. In this article, we have looked at some of the top renewable energy ETFs and stocks and which might be suitable for options trading.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.