Despite what others might try and tell you (usually when they are trying to sell you something), adjusting Iron Condors is not rocket science.

You don’t need some fancy system or training that costs hundreds of dollars, and trust me there are hundreds of websites run by slick internet marketers trying to sell these products.

There is no special sauce when it comes to adjusting iron condors, all you need is a couple of different choices and a system that you stick to.

I will outline a few of those choices for you here today (and you won’t need to pay hundreds of dollars for it!!)

At the bottom of this article, I’ll even show you a few examples of how it’s done.

Contents

- Profiting From Range Bound Stocks

- Key Features of Iron Condors

- How To Adjust Iron Condors

- Adjustment 1

- Adjustment 2

- Adjustment 3

- Adjustment 4

- Adjustment 5

- Adjustment 6

- Adjustment 7

- Adjustment 8

- Adjustment 9

- FAQ

- Summary

Profiting From Range Bound Stocks

When it comes to market neutral strategies, you can’t do much better than iron condors.

This options trading strategy profits if the underlying stock remains within a specified range.

What hurts this strategy is sharp moves in either direction after the trade is placed.

Sometimes, and it depends on the timing and how you have structured your Iron Condor, you can still ride out these big moves and be profitable.

However, at other times, these violent moves can have a negative effect on your position at which point you need to make a decision as to whether to close the trade and take your loss, or make an iron condor adjustment.

These decisions should all be part of your trading plan and you should know in advance what you are going to do should a big move occur.

What you don’t want to do, is close your eyes, cross your fingers and hope that the position comes back into profit. Hope is not a strategy.

With and Iron Condor trade, the maximum loss is more than the maximum gain, so it is VERY important that you don’t let small losses turn into very big losses.

Key Features of Iron Condors

Before we get to how to adjust an Iron Condor, it’s important to have a general understanding of the strategy. The key features of Iron Condors are:

• This strategy is set up by selling a Bear Call Spread and selling a Bull Put Spread.

• They have a limited profit potential, which is limited to the premium collected on the Bear Call Spread and the Bull Put Spread.

• Potential losses are higher than potential profits.

• This is a strategy that has a high probability of success, usually around 80%. This is offset by the risk that you can lose more than you can make. Hence adjusting your losing trades is very important

• You will not win every time with Iron Condors, that’s just a fact of life. Even with adjustments, you will still have some losing trades, as with any strategy.

• The most important consideration is not incurring big losses that give back a lot of your gains from previous trades.

How To Adjust Iron Condors

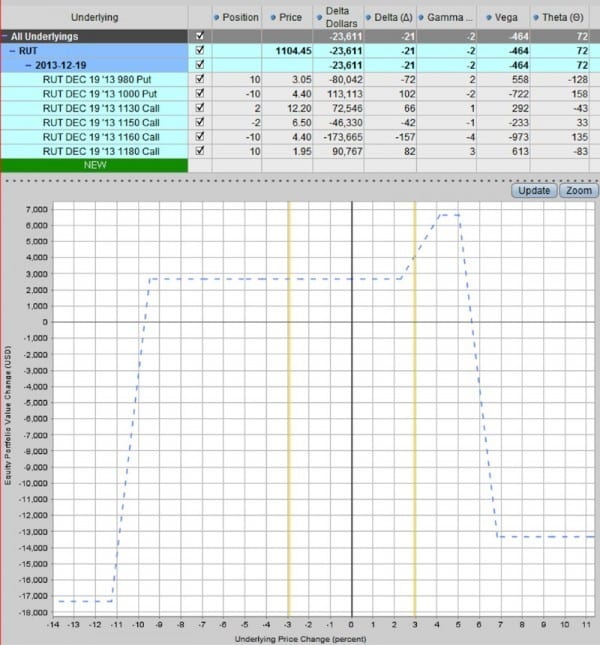

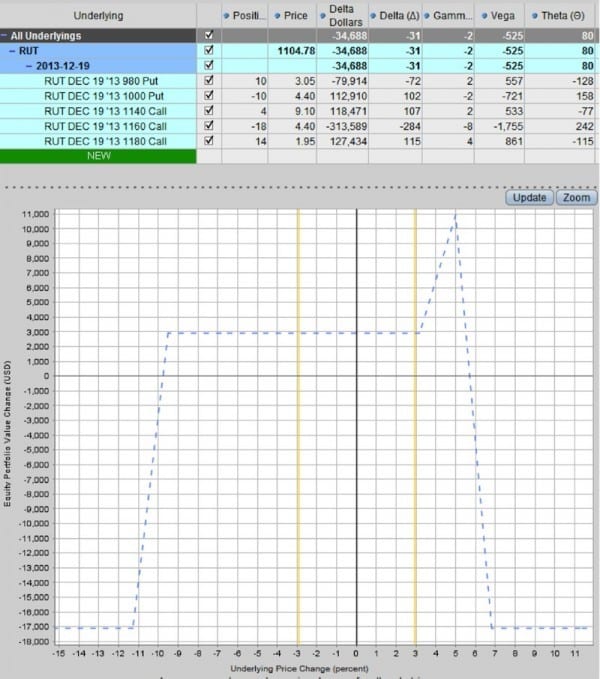

Let’s look at an example iron condor from the December 2013 expiry.

The position started as a neutral trade, but RUT then rallied and the position has become skewed with a delta of -45.

The short calls are 5.01% away from the current price whereas the short puts are 9.47% away.

We could leave the position as is if we anticipate RUT to move back down, but the conservative route would be to adjust the trade.

Let’s look at a few different techniques you could use and analyze the advantages and disadvantages of each.

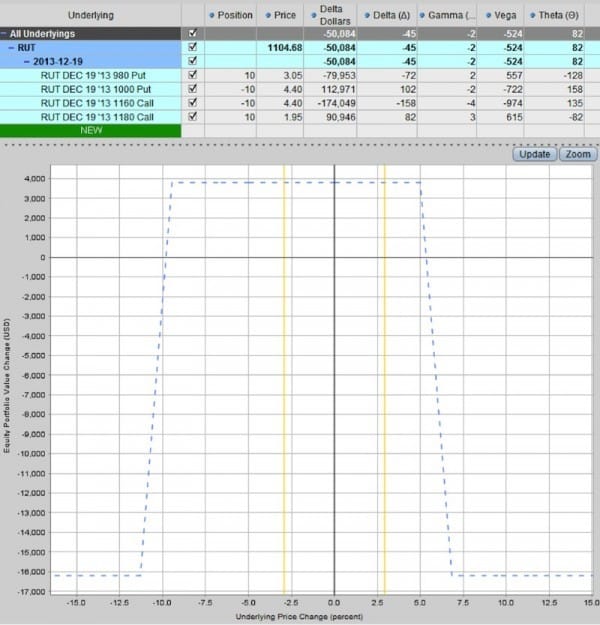

Adjustment 1

In this first example, we leave the short calls where they are.

A good rule of thumb with iron condors is to adjust the side that is under pressure when the stock gets to within 3% or if the delta of the short strike touches 25.

In this case the short calls are 5% away and the delta is only 15 so we’re happy to leave them where they are.

Instead we will roll up the puts from 980-1000 to 1010-1030.

Here is the resulting expiration profit graph and new greeks.

This adjustment is an attacking adjustment rather than a defensive adjustment.

We are bringing in more option premium and increasing our risk by bringing our short strikes closer to the index price.

With this adjustment we have reduced the overall position delta and given ourselves a more centralized expiration graph.

The short calls are still 5% away and the short puts are 6.76% away.

Our expiration graph is now more centered between the puts and the calls.

This adjustment brings in an extra $550 in option premium while keeping capital at risk roughly the same.

The delta on the trade has dropped from -45 to -34 and vega has increased slightly. Theta remains about the same.

PROS

Delta has been reduced

More income potential in the trade

CONS

Short puts are now closer to the money which could cause losses if the index reverses

Delta is reduced, but not by a huge amount. A further rally could still hurt the position

WHEN TO USE?

Early on in the trade if most of the risk parameters on the threatened side are ok

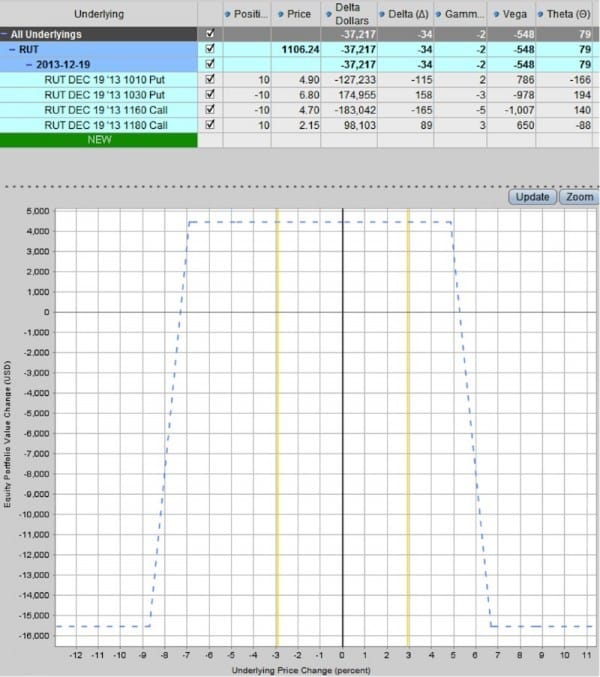

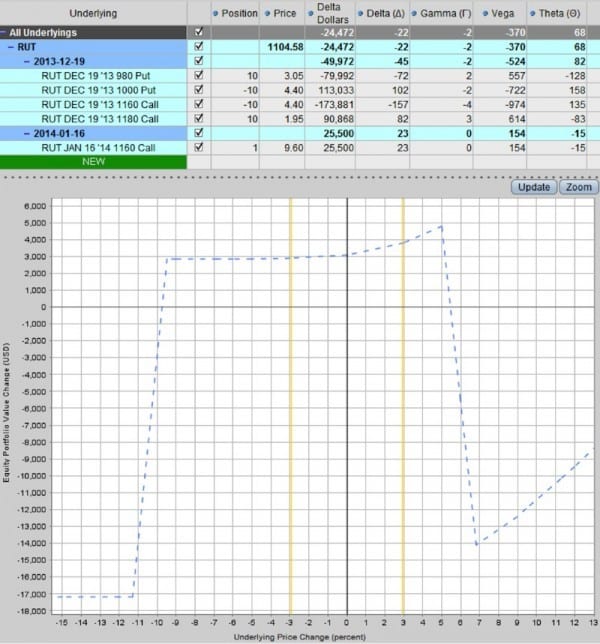

Adjustment 2

Assuming you want to leave the call spreads as they are; another adjustment you could try is adding more contracts to the non-threatened side.

With this condor, rolling the short puts up 30 points might be a bit aggressive considering that the market is overbought and starting to show weakness.

Instead, what we can do is go to our full allocation of 20 contracts in the puts and leave the calls as they are.

Here is the new profit graph based on this adjustment

This adjustment increases the capital at risk on the downside, but gets our delta back into a more neutral position.

It reduces delta by more than the previous adjustment, BUT risks are higher if there is a sharp reversal.

Vega has increased from -524 to -688 and Theta has also increased from 82 to 112.

The Vega/Theta ratio has dropped slightly from 639% to 614%.

By selling another 10 put credit spreads, we have increased the profit potential by $1,350.

When adding spreads to the non-threatened side, you wouldn’t want to sell them for less than about $1.

Otherwise you’re not getting adequately compensated for the additional risk you’re taking on.

PROS

Delta is significantly reduced

Much higher income potential in the trade

CONS

Capital at risk on the downside has doubled

Higher Vega exposure (although Vega/Theta ratio has been reduced slightly)

WHEN TO USE?

Early on in the trade as you are building up to your full allocation

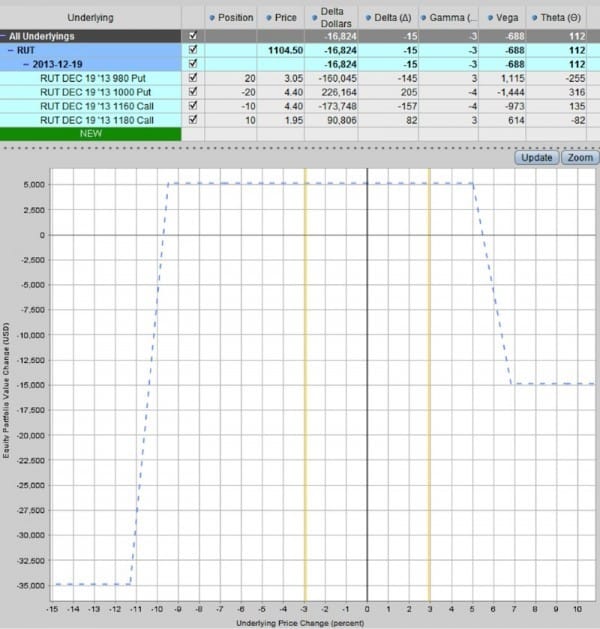

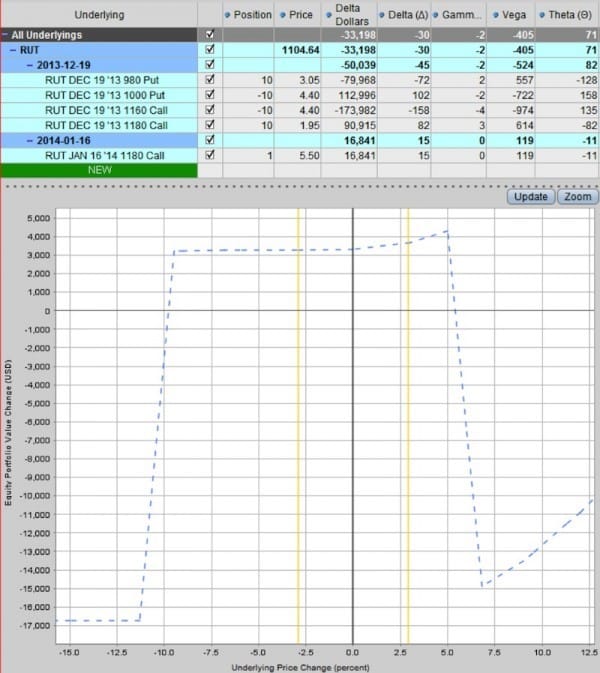

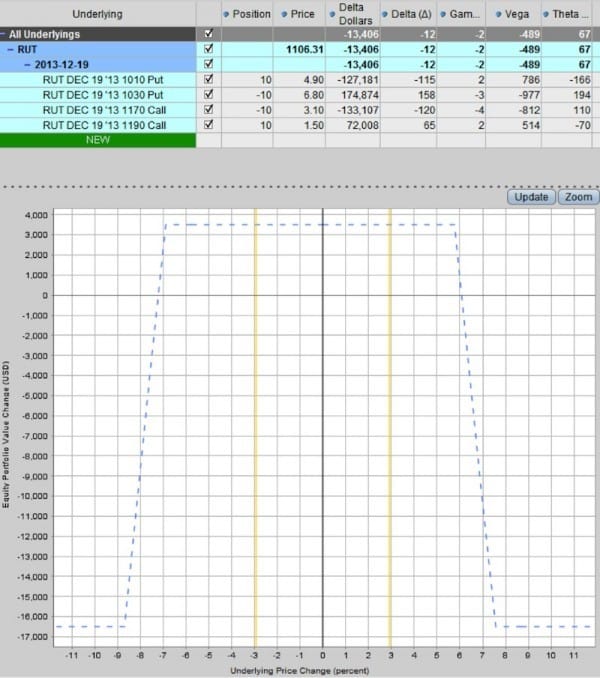

Adjustment 3

The first two examples would be considered offensive or attacking adjustments.

Both methods increased the income received.

The first method moved the short strikes closer and the second method increased capital at risk.

A more defensive adjustment would be to add a call debit spread (bull call spread) in front of the short calls.

Using the short strike of the credit spread as the short strike of the debit spread results in a profit tent that is sometimes referred to as a mouse ear or cat ear.

Unlike the first two adjustments, this method costs us money to buy the debit spread.

One advantage of this adjustment is that it reduces our capital at risk on the threatened side.

The adjustment costs $440 and results in delta dropping from -45 to -24.

Vega has been reduced from -524 to -454 but Theta has also been reduced from 82 to 71.

The Vega/Theta ratio remains the same at 639%.

PROS

Nice way to reduce delta and also reduce Vega

Reduces capital at risk on the threatened side

Allows you to stay in the position and not move your short strikes

Potential for the stock or index to close in the profit zone

CONS

The adjustment costs you money, reducing the income potential from the trade

You can get “sucked in” by the profit zone.

If RUT moves up into the ear shape with more than 2-3 days to expiry you will be sitting with losses and the potential of your short calls being breached.

WHEN TO USE?

When the market is overextended, mainly on the upside.

If the chances of a pullback are high and it doesn’t make sense to increase risk on the put side.

When volatility is low, this can be a good adjustment on the call side as the debit spread will be cheaper.

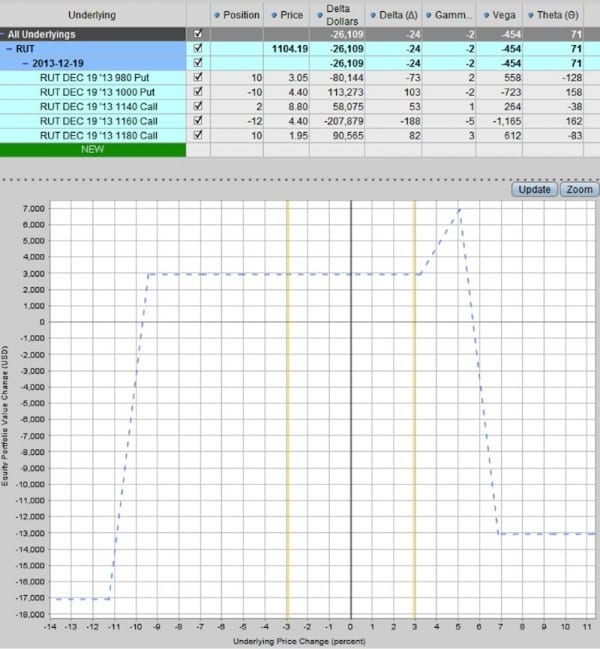

Adjustment 4

This adjustment idea is similar to the last one in that we are adding a debit spread in front of the threatened side.

In this case we are placing the debit spread further away from the short calls to create a larger profit zone.

Again, you have to be careful with this not to get sucked into thinking about the profit zone. You still have negative delta, so you do not want RUT to rally, especially in the next few days.

You only want RUT to start entering the profit zone with around 2-3 days till expiry or less.

The greeks on this adjustment are fairly similar to the previous adjustment.

This adjustment costs slightly more at $570 as opposed to $440 so your income potential is further reduced.

PROS

Nice way to reduce delta and also reduce Vega.

Reduces capital at risk on the threatened side

Allows you to stay in the position and not move your short strikes

Potential for the stock or index to close in the profit zone

CONS

The adjustment costs you money, reducing the income potential from the trade

If RUT moves up into the ear shape with more than 3-4 days to expiry you will be sitting with losses and the potential of your short calls being breached.

WHEN TO USE?

When the market is overextended, mainly on the upside.

If the chances of a correction are high and it doesn’t make sense to increase risk on the put side.

When volatility is low, this can be a good adjustment on the call side as the debit spread will be cheaper.

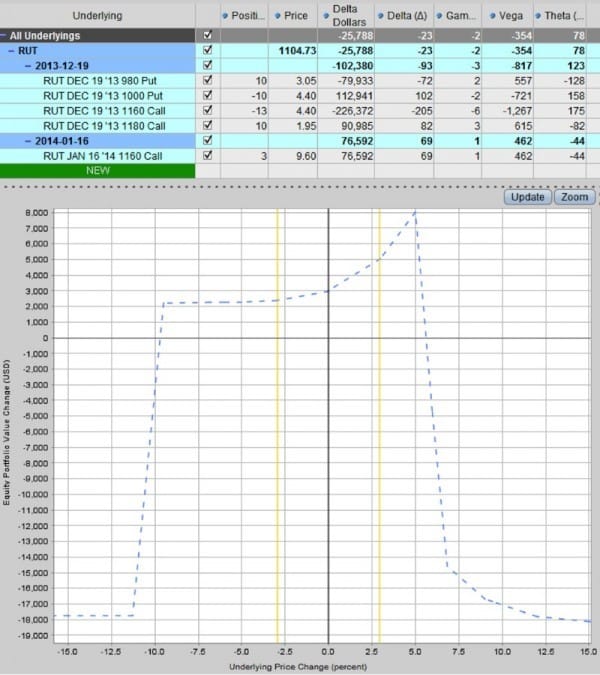

Adjustment 5

If a stock is particularly fast moving and you need a quick adjustment then adding a long call option in the next expiry can be a good idea.

Usually this will be a temporary measure but it helps stem them bleeding and gives you time to think about whether you want to remain in the position.

If the stock expires close to your short strike you can end up making some extra money from the long call if you decide to hold on to it.

In this example we’re adding the long call at the same strike as our short call.

The adjustment costs $960 and brings delta down to -22, and also brings vega down significantly.

If the market continues to move against you, the gains on the long option will help cushion the losses on the credit spread.

PROS

Gives a much greater reduction in vega, which can be good if you expect a rise in volatility.

Reduces capital at risk on the threatened side

Allows you to stay in the position and not move your short strikes

Nicely sloping profit graph if the market continues to trend

Easy adjustment to make and manage

CONS

The adjustment costs you money to make it, reducing the income potential from the trade

Can be expensive

WHEN TO USE?

When volatility is low as the long call will be cheaper

On the puts side, if markets are dropping fast

When the market is moving fast and you need to quickly cut delta

Adjustment 6

If you’re looking for a similar adjustment to the last one, but don’t want it to cost as much, you can buy a long option in the next month, but go a little bit further out of the money.

This adjustment costs $550 as opposed to $960, but the trade-off is that it doesn’t give you as much protection.

Your delta and vega exposure are not reduced by as much as the previous adjustment.

PROS

Reduces vega exposure, which can be good if you expect a rise in volatility.

Reduces capital at risk on the threatened side

Allows you to stay in the position and not move your short strikes

Nicely sloping profit graph if the market continues to trend

Easy adjustment to make and manage

Cheaper than the previous example as the long call is further out-of-the-money

CONS

The adjustment costs you money to make it, reducing the income potential from the trade

Can be expensive

Provides less protection than a closer to the money long call

WHEN TO USE?

When volatility is low as the long call will be cheaper

When the market is moving fast and you need to quickly cut delta

Adjustment 7

Adding a calendar spread centered on the short strike can be an attractive adjustment option that gives you a nice tent-shaped profit zone.

The great thing about this technique is that it reduces delta and vega, and also increases theta.

A good rule of thumb is to trade 2-3 calendars for every 10 credit spreads.

The downside is that the income potential of the trade is greatly reduced if the market reverses.

PROS

Very nice profit zone if the market continues to trend

Cuts Delta and Vega exposure while also increasing Theta

CONS

Can be expensive and reduces income potential if the market reverses

WHEN TO USE?

If you think the stock or index will finish around the short strike

When volatility is low and you are expecting an increase

Adjustment 8

Rather than adding a calendar at the short strike, you can add a butterfly.

This creates a similar profit tent to the calendar, however vega is not reduced in this case.

The advantage of this technique as opposed to the calendar is that keeping all the options in the same expiry month can make things a little simpler.

You don’t have to worry about things like volatility skew.

PROS

Creates a profit zone around the short strikes

Easier to manage with all strikes in the same expiry month

Maintains short Vega exposure which may be good if volatility is high and expected to come down

CONS

Does not reduce Vega

The profit zone can create a false sense of security.

If the market continues to trend strongly and gets in to the profit zone too early, you will still have losses.

WHEN TO USE?

When volatility is high, so is more useful on the put side

Adjustment 9

The last adjustment option I’ll present here is repositioning the entire condor by rolling both the puts and the calls in the direction the market has moved.

This adjustment may cost some money to perform.

When you roll the threatened side, you will receive less income from selling the new spread.

On the non-threatened side you will bring in more income because you are moving the spread closer to the stock price.

When you make this adjustment, you can also think about adding more capital to the trade.

The advantage of this technique is that you will re-center the iron condor structure so that it is once again delta neutral.

PROS

Gets you back close to delta neutral and better aligned with the short calls and puts

Not too expensive (if the market hasn’t moved too far) as the loss on one side will be somewhat covered by the increased income on the other side.

Can be a good opportunity to add capital to the trade, further decreasing the cost

CONS

Sometimes it can be better to wait for the market to revert to the mean, rather than repositioning

WHEN TO USE?

If the stock or index has broken out of a trading range.

FAQ

What Is An Iron Condor?

An iron condor is a popular options trading strategy that involves simultaneously buying and selling two credit spreads on the same underlying asset.

The goal of an iron condor is to profit from a stable or slightly volatile market by generating income from the premiums received from the sold options, while limiting potential losses through the purchased options.

Why Would I Need To Adjust An Iron Condor?

An iron condor may need to be adjusted if the underlying asset’s price moves too far away from the center of the spread, or if there is a change in market conditions that affect the option prices.

Adjusting an iron condor can help reduce potential losses or increase potential profits, depending on the adjustments made.

What Are Some Ways To Adjust An Iron Condor?

There are several ways to adjust an iron condor, including: adding or removing legs to widen or narrow the spread, rolling the spread to a different expiration date or strike price, hedging the position with a different option or asset, or closing out the entire position for a profit or loss.

The best adjustment strategy depends on the market conditions and the trader’s goals and risk tolerance.

Can Adjusting An Iron Condor Guarantee Profits?

No, adjusting an iron condor cannot guarantee profits, as options trading always involves risks and uncertainties.

Adjusting an iron condor can help manage risk and increase the likelihood of success, but it can also result in additional costs and losses.

Traders should always have a well-defined plan and risk management strategy when trading options.

What Are Some Common Mistakes To Avoid When Adjusting An Iron Condor?

Some common mistakes to avoid when adjusting an iron condor include: making adjustments too early or too late, over-adjusting or under-adjusting the position, not considering the potential costs and risks of the adjustments, ignoring the impact of volatility changes, and not having a clear exit strategy.

Traders should also avoid adjusting an iron condor out of fear or emotion, and instead rely on a well-reasoned and disciplined approach.

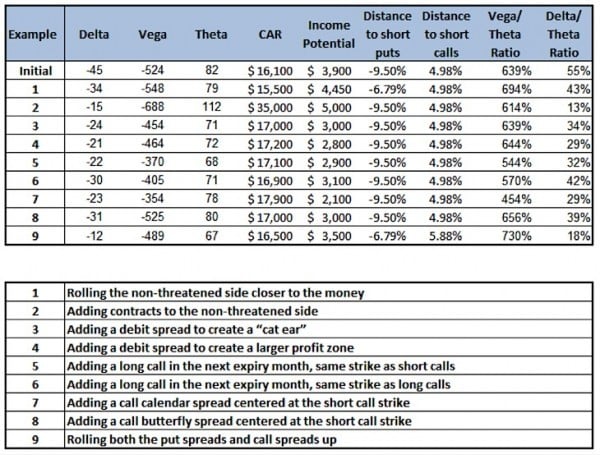

Summary

Below is a summary of all the different adjustment techniques presented above.

Don’t forget, you can also use these exact same tactics to hedge the put side if that is the side that’s under pressure.

While this list of adjustment techniques is not exhaustive, I hope it has opened your eyes to some new methods of adjusting an iron condor.

Some other techniques you can also consider include reducing the number of contracts on the threatened side and rolling the threatened credit spread out to the following month.

We hope you enjoyed this article on adjusting iron condors. If you have any questions, please send and email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great education . Liked it very much.

Can you help me in understanding volatility and profit and loss behavior wrt underlying price movement as applied to the following trade:

Sell (lets say) out of the money calls (approx. 10% out of the money) of near month and buy double the number of 20% out of the money calls of the far month. The volatility of the near month call is higher by about 1% than the volatility of the far month option. The net delta is negligible (<3). Vega and gamma are also nearly negligible. The trade is put 45 days before the expiry date of the near month. I want to understand how this strategy shall perform over the next 30-35 days and what should be the adjustment point (ie when to adjust such positions). For eg. with a dummy index (say DTX at 100 on 15 Mar12) i would like to sell 1 contract of 110 Aprl'12 (expiry say 25 April 12 call for (say) $1 and buy 2 contracts of 120 May12 (expiry say around 28 May) call for $0.45 with a net credit of $0.1 . The volatility of the 110 call is 0.24 and that of 120 call is 0.23. The net delta is -2 and net gamma is -.01 and net vega is -5. All values per contract.

This is good stuf, thank you for sharing it free of charge! I am just starting out trading Iron Condors. And yes, I did buy one of those video-courses for about a 100 bucks. In fact, I believe there is only one major seller of these “trade with confidence” courses, and he is selling the course via a very large network of resellers. Each time in a different disguise. But, to be fair to him: the course is actually pretty good. I am happy I bought it.

Kudos to you for publishing this blog on adjusting Iron Condors.

Would you mind sharing the IC spread sheet?

Thank you!

Lorie*

I trade with ThinkOrSwim and usually do one side at a time. For taking them off remember that with ThinkOrSwim you pay no commission when you buy to close and the option price is .05 or less. If you take off your postion in any kind of spread then this does not apply and you will pay commission on the trade.

Thanks for that Craig, very helpful

Thanks for this information! I have indeed already paid several hundred dollars elsewhere for the information you gave above and I have found with real-life experience that what you are saying is true. Thanks so much for the helpful info.

In the “quick example” above (before the choices available), wouldn’t the strike prices for the Bull Put spread be 770 and 760 (instead of the 670 and 660 you have listed)?

670 and 660 are the correct strikes that I traded. This was back in 2011.

The material on OptionTradingIQ is very helpful. I enjoyed the videos. They made clear to me that it is more important adjusting and exiting the trade rather than enetering it. Gavin gave me very good reading recommendations.

Thank you very much

Markus

hi, may i know for ic do you always use a fix delta for entering your positions or depending on the market conditions, for example delta of 0.10?

Hi chris, it depends on the market conditions, but delta is a good guide and 0.10 is a good area to be placing your short strikes.

what about “hedging” your losing side by selling another credit spread on the other side to cover your potential losses? For example, I am in an AAPL condor that has breached to short leg of the call spread w/AAPLs recent rally. Stock trading around 556, and the call spread is 555/560.

I am considering selling closing the (profitable) put spread from the original condor, and selling a new put spread w/same expiration date at strikes of 550/555 with enough contracts such that if AAPL moves completely above 560 by expiration, the credit from the new sold put spread covers this loss. I’m also considering selling a 545/550 put spread, thus allowing for the possibility to “win” both spreads.

Of course, the possibility is that, once I do that, AAPL moves down and then I have to repeat the process on the other end, magnifying my potential losses several-fold. But the expiration is only a week away.

What do you think of this strategy? Seems like a potential way to almost guarantee a win with a condor (one spread wins and the other turns into a break-even). Thanks,

Kumud Jindal

Yes, that is a strategy I use from time to time, especially once the spread becomes close to worthless as it no longer provides much protection if the market keeps trending.

You just have to be careful that the market doesn’t reverse and put your new spread under pressure.

HI Gavin, I’m really enjoying ITIQ and have been reading my copy of the Iron Condor trading course. I did have one question about adjusting as you describe it here.

When is the best time to roll up (or down) the IC? Before or as price reaches the short strike?

Hi Tailgun, you should definitely adjust before price hits your short strike. Keep an eye on the delta of your short strike, I like to adjust when it hits 30 at the latest. Hope that helps!

It does, thanks!

This may seem like an elementary question but if your underlying security was not at the strike price you had bought (with strike prices of 670 and 660. At the time, RUT was trading at around 799. Then, in early August, we had the mini market meltdown and on August 4th, RUT had dropped to 727.) Why would you have to close the trade at a loss? If the option were to expire at 727 why wouldn’t you still be winning the trade?

How was this the (This was a worst case scenario for me, with the underlying index making a sharp move only a few days after I placed the trade)

Wouldn’t worst case scenario be it moving below the leg of the condor?

Hi Smoko,

When the market drops like that the volatility shoots up and you are sitting on a big unrealized loss. Yes, you could continue to hold in the hope that the market does not fall below your short strikes, but remember hope is a dangerous word in the stock market.

Also, assuming you are down, say 15% on the trade, how much more pain are you willing to take if the index continues to fall? You have to cut your losses (or adjust) at some point, otherwise the chances of you blowing up your account are very high.

Think about 2008. As the stock market fell, would you continue to hold an iron condor just because your short strike was at 670 and the market was at 727. What happens if the market gaps down 10% the next day?

Where most people get in to trouble with condors is that they don’t cut their losses soon enough and continue to hold until there account is wiped out.

Hello, I recently started selling Iron Condors and I’m interested in these adjustment strategies. I have a question regarding Choice 4 above. Often it does seem to be a good idea to adjust BOTH sides of the condor – one to stay in the profitable range and the other to collect some money to offset your loss of adjusting the other side.

Here is my question: isn’t “rolling” (adjusting) both sides of an iron condor essentially the same as buying back your iron condor (closing out the position) and selling a new one? There is an important difference though: I think you’ll save money on commissions (using ThinkOrSwim) and save time/effort because closing out one and selling another is easier (at least on TOS) than rolling one side at a time. Please correct me if I’m wrong.

thanks,

andrew

Hi Andrew,

Yes you are basically closing the initial condor and opening a new one. If you can do that cheaper than rolling the sides via TOS then go for it.

Hope that helps.

Hi,

I have been trying our Iron Condor for a few months, I am testing option 4 too but I find that everytime I buy back and sell again, my ROI for that month dropped a lot. Is this expected or am I doing something wrong?

Good article. There are many way to adjust an iron condor, how you will adjust depends on a lot of factors, an important one is the underlying title of the iron condor. If volatility picks up a lot and the underlying is going down or up a lot the strategy might be different for the Dow30 index, or for a junior gold miner. One is very likely to bounce back, maybe even before the end of the day, the other might take a couple of decades or not bounce back at all. Of course you have done your homework and know exactly what your portfolio’s worst case loss would be.

Let us talk about Standard Deviation in addition to or rather than Delta.

2 Standard Deviation away from the Under Stock price offers a 95% success with the Under Stock Price remaining between the Short Put Strike and the Short Call Strike.

It is not easy to find the Standard Deviation value for Stocks or Indexes.

However Bollinger Bands are supposed to be 2 Standard Deviations away from the Under Stock.

However the Bollinger Bands are moving up or down and in size every day.

Looking at the Bollinger Bands before selecting the Put and Call Options Legs may be helpful.

Hi Dr. Who, yes standard deviation is used regularly by option traders. I have a calculator that I will send you.

Hey guys I have a question on if yourIron Condor needs to be adjusted and let’s say the the price of the underlying is moving up close to your call spread could you not just buy back the call spread side and leave the remainder as a bull put spread?

Hi Cliff, yes you can do that. Just depends how far the calls have gone against you. The loss on the calls might outweigh the profit you make on the puts.

excellent stuff

Thanks!

I just hadda say as an avid options newbie (but one who’s learning fast) I have read a lot of articles about adjustments, trade repair, etc. This is the most complete and clear rundown of the possibilities I’ve seen – thanks!

My pleasure, glad you enjoyed it.

Excellent strategies and I plan on employing some of them. On occasion if my trade goes the wrong way and I assess that the price action will continue I simply close out the short side of the trade and take the hit, and hold on to the long side. I have had this work out so as to turn what looked to be like a sure loss into a win or near break even. But I would only use this strategy if my technical analysis strongly indicates that the current direction will continue.

Yes, it’s good to adapt if things change. I like to say “It’s ok to be wrong, it’s not ok to stay wrong”.