Sometimes markets move really quickly as we’ve seen lately and it leaves us little time to adjust our positions.

Here’s a quick and easy strategy I use to cut my exposure and stem the bleeding while I figure out whether I want to adjust or close the main position.

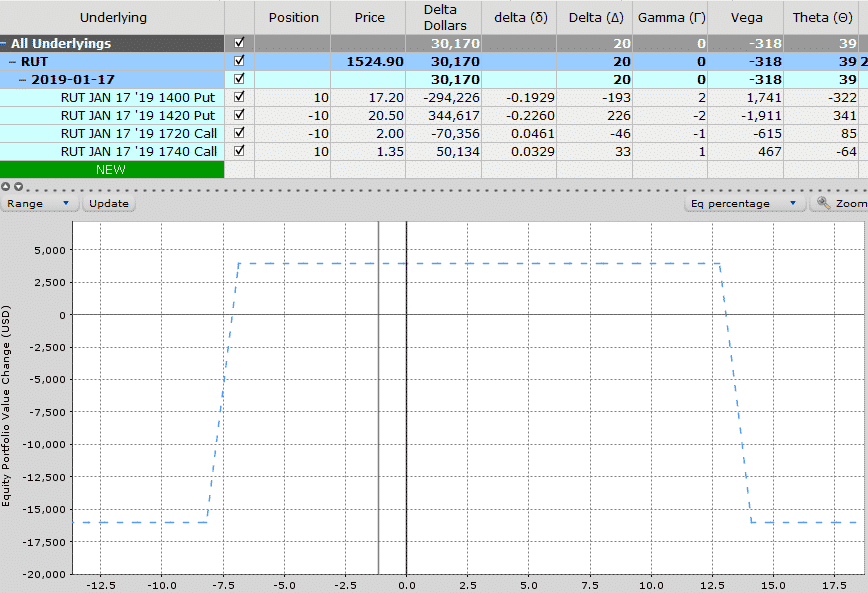

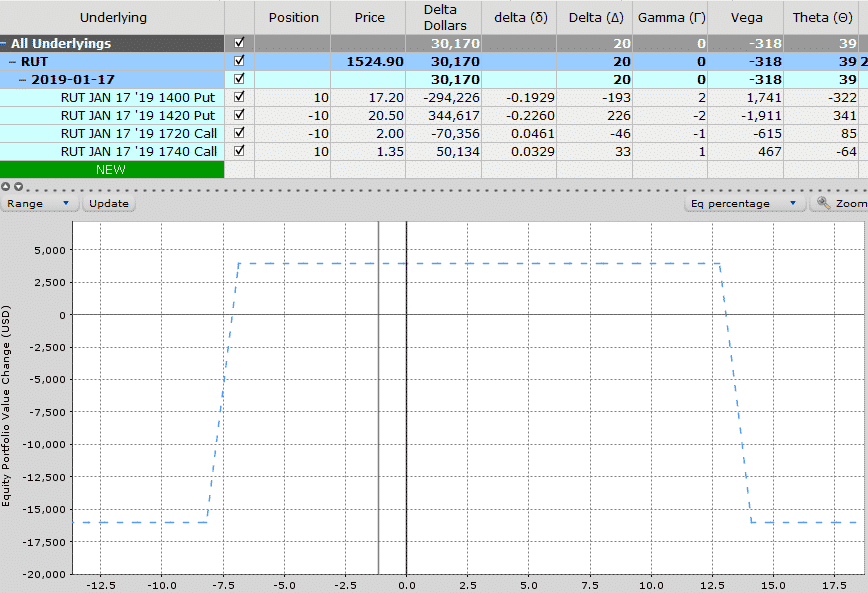

Let’s say we have the following Iron Condor that is showing too much positive Delta as the market is falling.

Assuming we decide we don’t want to adjust the Condor, and we want to give it a bit more time to see if the market will bounce. But, we are concerned that further downside will see our losses start to pile up pretty quickly.

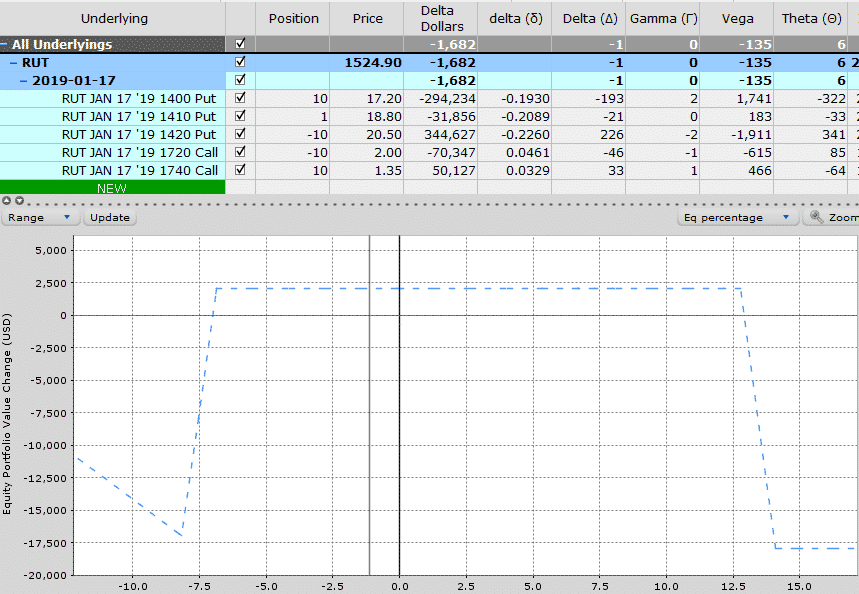

In that case, we can simply buy 1 put option to neutralize the Delta.

You can see above that the net position Delta is 20. So we simply buy a 20 Delta put and voila, we’re back to Delta neutral.

If the market continues to fall, the long put acts as a hedge and will reduce the losses on the Condor.

If the market rallies, we can sell the long put for a small loss, it’s done it’s job and it no longer needed.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.