A couple of stocks showed up on my scans last night – WMT, EXPE and OXY so let’s take a look and discuss some potential trade ideas.

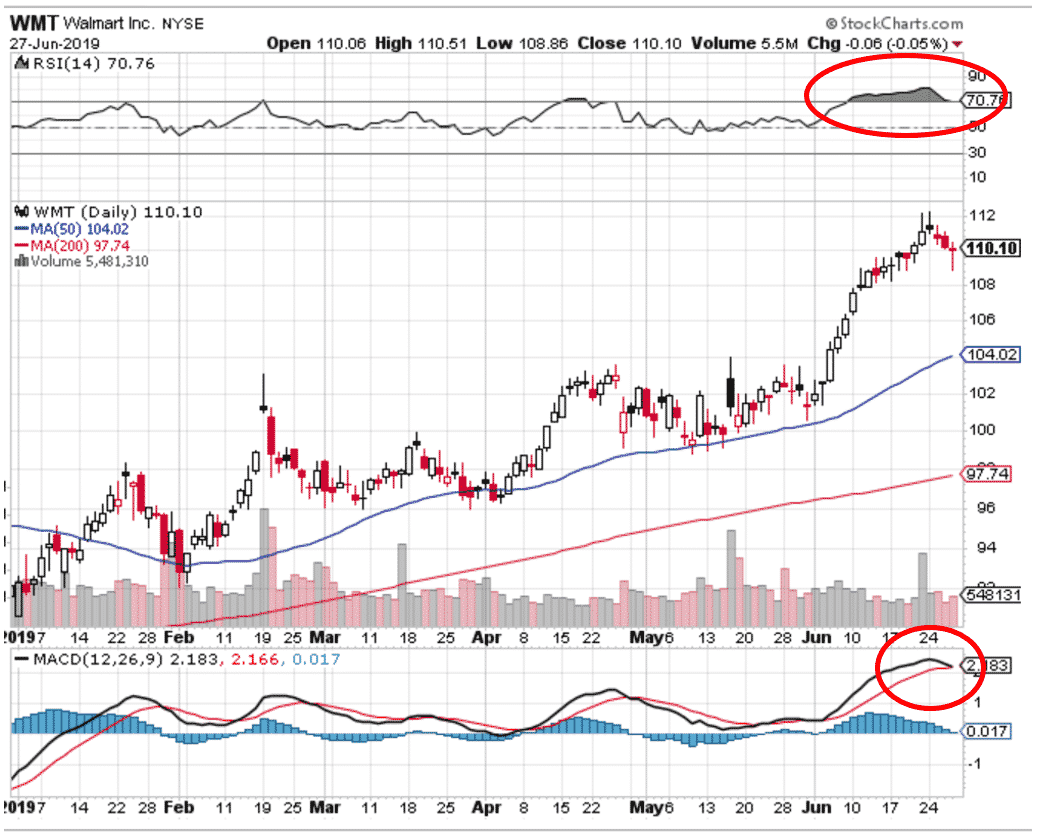

Firstly WMT. It’s currently the most overbought stock in the Dow Jones Industrial Average. That strength is a good thing, and I don’t necessarily want to bet against the stock, but I feel like momentum might carry it a bit higher before it starts to stall out.

On the chart below, you can see the stock is very extended and we’re getting a bearish MACD cross. It’s also quite a long way from the 50 and 200 day moving averages.

To me this says further upside is probably fairly limited. The August 120-125 bear call spread is currently only trading around $0.23. That’s not enough of a return for me, but if WMT can rally up a bit higher and that spread starts to trade around $0.55 – $0.60, I’ll be interested. That would represent a 13.6% return on capital in a month and a half if the trade expired worthless.

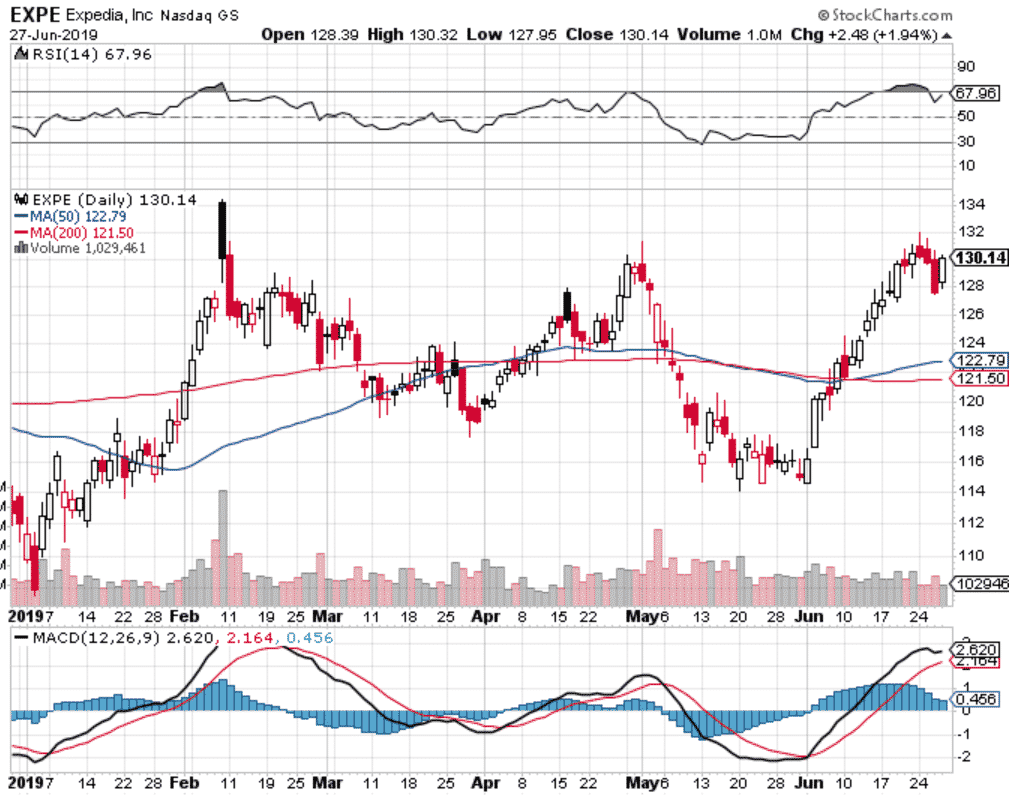

EXPE is another stock in a similar situation where it has had a nice rally, is starting to get overbought and upside above $135 is probably fairly limited.

The August $145 – $150 bear call spread is trading around $0.50 currently. I’ll be watching to see if that gets up to around $0.80 which would represent a 19% return on capital.

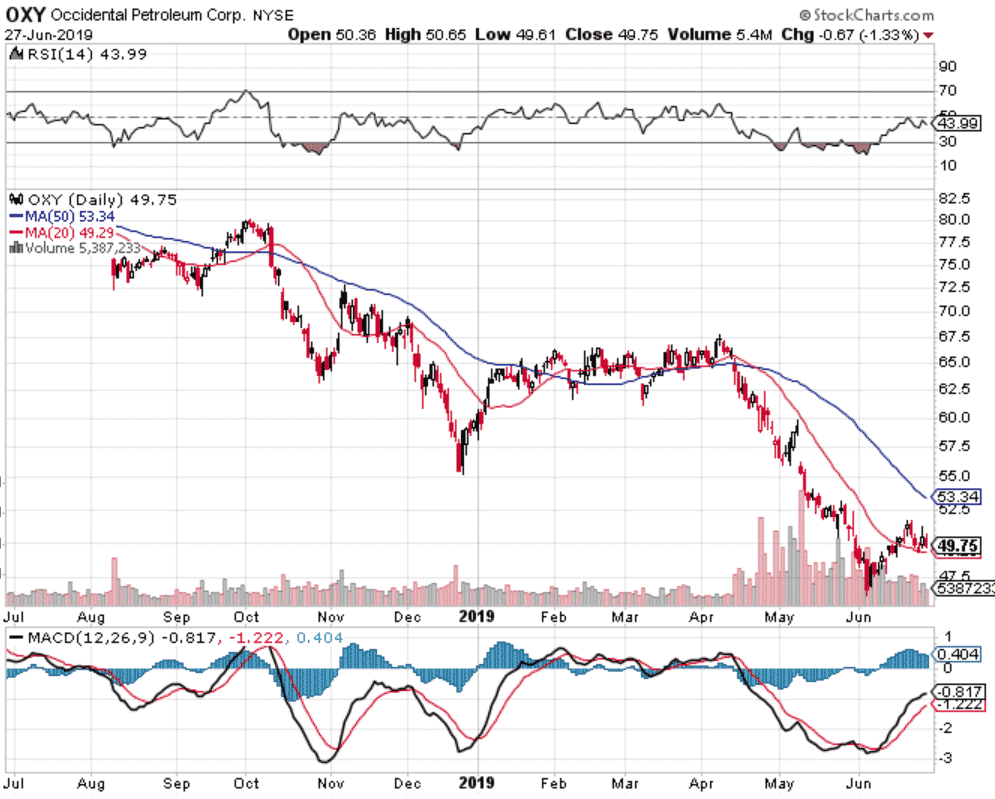

OXY has had a pretty terrible 8 months dropping 38% from $80 to $49.75.The last 2 months in particular have been terrible with the stock moving pretty much straight down from $67.50 to as low as $47.30.

Access the Top 5 Tools for Option Traders

The stock is now back above the 20 day moving average and that average is starting to flatten out. If it continues to hold, OXY may be able to put in a short-term bottom.

OXY has a forward dividend yield of 6.27% which should start to attract buyers.

Volatility is on the high side compared to the last 12 months.

The August $47.50 – $42.50 bull put spread is currently trading for around $0.90. With a short strike at $47.50 it doesn’t give a huge margin for error. The $45 – $40 spread is trading at $0.45, which is a little low, but could be worth selling around $0.60 if it gets there.

I share quite a few trade ideas like this in a free Facebook Group for option traders.

Enjoy your Friday and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.