Theta, baby. That’s what it’s all about right? Sell options with the highest Theta and watch the money roll in. For many, that means selling weekly credit spreads and iron condors.

What’s great about these weekly trades, is that the money rolls in really quickly and you don’t have to wait for long to pick up your time decay. That’s all well and good when the markets are quiet, but what happens when stocks start to move around a bit?

Typically, I avoid weekly options unless I am using them as a hedge. A lot of people I talk to don’t understand my aversion to them. The reason is gamma risk.

They don’t call the last week of an options life gamma week for nothing! Most professional traders do not want to be short gamma during the final week of an options life.

However, many retail traders become obsessed with trying to trade weekly iron condors for income.

As a side note, for every person who asks me why I don’t trade weekly options, there are probably 4 who tell me the same story along the lines of – “everything was going great, I was making loads of money with my weekly condors, and then WHAM, I lost 6 months’ worth of gains in 1 week”.

Don’t get me wrong, weekly condors can be great, provided you know what you are getting yourself in for. Let’s take a look at a weekly and monthly iron condor and talk about the differences.

Using short deltas of 10, you can see that the risk/return profile of a weekly and monthly iron condor are fairly similar.

Net delta is also pretty similar.

The main differences are the Theta and Gamma. Weekly iron condors demonstrate much greater price risk, but receive much greater time decay in compensation.

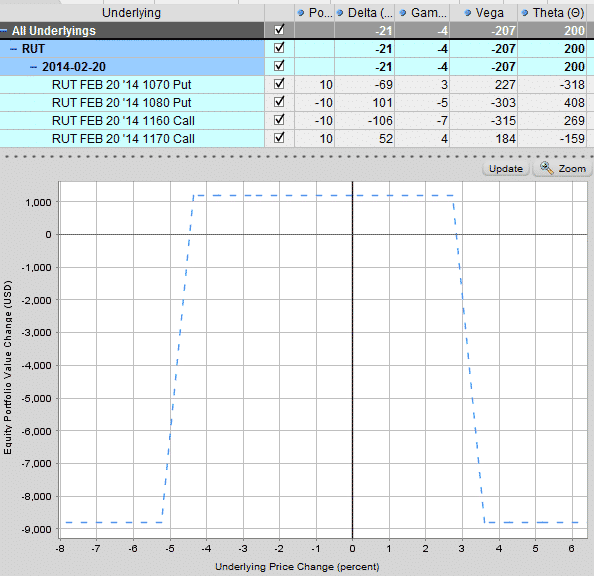

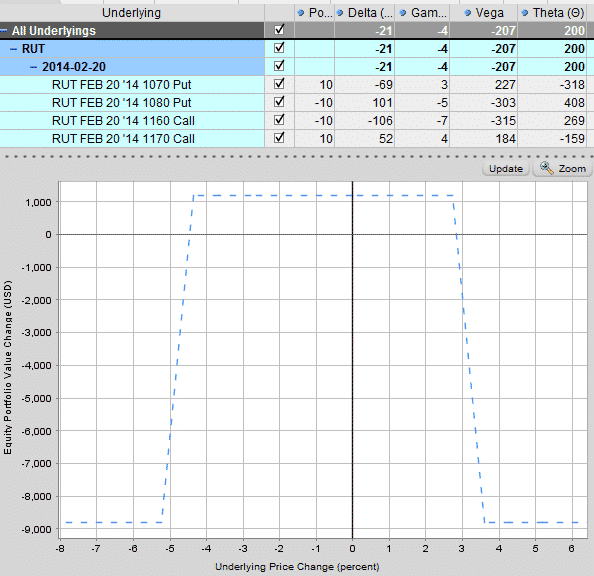

The weekly iron condor below has a Gamma of -4, Vega of -207 and Theta of 200

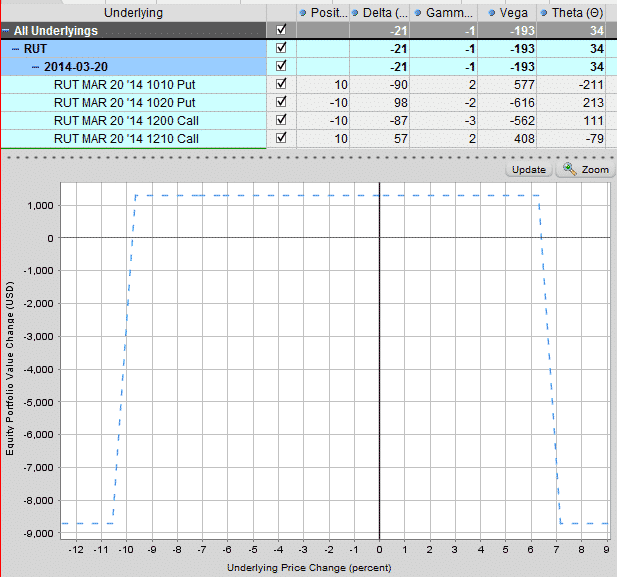

The monthly iron condor has a Gamma of -1 (or 75% less price risk), Vega of -193 and Theta of 34.

The ratio of Vega to Theta is much higher for the monthly condor at 5.68 times, compared to a ratio of closer to 1 to 1 for the weekly condor.

So, what do you think? Which would you rather trade?

< Free 10 Part Iron Condor Course >

WEEKLY IRON CONDOR

MONTHLY IRON CONDOR

I’m trading weekly index calendars. It’s works for me.

Hi Yaroslav,

That’s a good trade in this low vol environment.

Can you share your trading rules with the readers here?

Sure. Dan talked a lot about weekly calendars on webinars.

Short leg is 7-8 day ATM option.

Long leg is 21-22 day ATM option.

Position is delta neutral or slightly delta negative for vega hedging.

I like to open this trades Wednesday or Thursday morning.

Take profit – 8-10%.

Possible adjustments to double calendar or vertical spread.

Take profit after double calendar adjustment – 5%.

This strategy works good for RUT and SPX.

The main problem is the SPX and RUS spreads.

I like those rules, makes sense. The spreads are a bit of a pain as you said, especially if you need to make adjustments.

Thanks for sharing.

Hi Yaroslav,

Can you please be more specific regarding your adjustments rule?

Thanks,

Josefico

I’m trading credit spreads

I trade SPX weekly iron condors. I do 90+ probability trades. I start by computing a standard deviation from VXST and backtest the past 40 weeks for all expiration combinations adjusting until I get only 4 stop-outs in 40 weeks. I then do the trade with the smallest adjustment to achieve 90%. The stop loss points are $10 away from the short strikes. This is important. If SPX gets past the $10 point the cost to exit gets bad fast. I get anywhere from 25 to 35 cents per week. The distance between short strikes varies from 90 to 150 points wide depending on how high VXST is that week. Lately the best trade is opened Thursday at 10 AM Eastern for the following Friday expiration – a 7 trading day hold. Exits costs depend on the day the trade is stopped out. If the stop out is hit after noon on Friday I will babysit the trade and usually it is a winner. A trade exited on a Wednesday, for example, usually costs about 75 cents. I only exit 1 side of the trade allowing the other side to expire worthless.

Hi Bob,

I have only recently started trading Iron Condors.

Your method resonates with my. How is VXST useful? How do you backtest the past 40 weeks for all expiration combinations?

Thanks for the tips on stop loss points. I agree, SPX spreads can get out of hand real fast when it is moving against you.

So you use spx points for stop loss — not twice the amount collected on the spread — like some suggest?

Thanks for your time!!