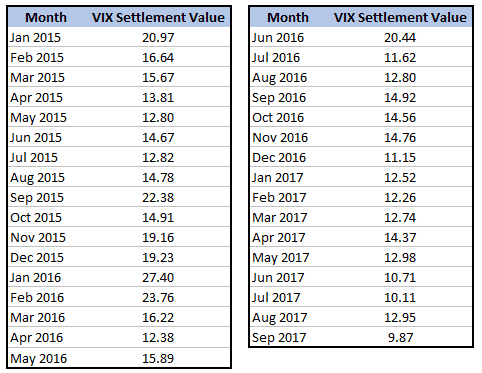

The short volatility trade has performed incredibly well so far this year with VIX down 21% since the start of the year.

Many traders have been wondering how long this will last. So far this year, the monthly VIX settlement value has been above 14 only once. It’s been below 11 twice and for September settled at a record low of 9.87.

Compare that with 2016 which saw three settlements above 20 and eight above 14.

Stock market volatility has been non-existent all year and has been hovering near record lows for nearly three months.

Sample Iron Condor Trading Plan

Once big trader thinks that’s all about to change and has made a whopping big bet for December expiry that stands to make as much as $263 million.

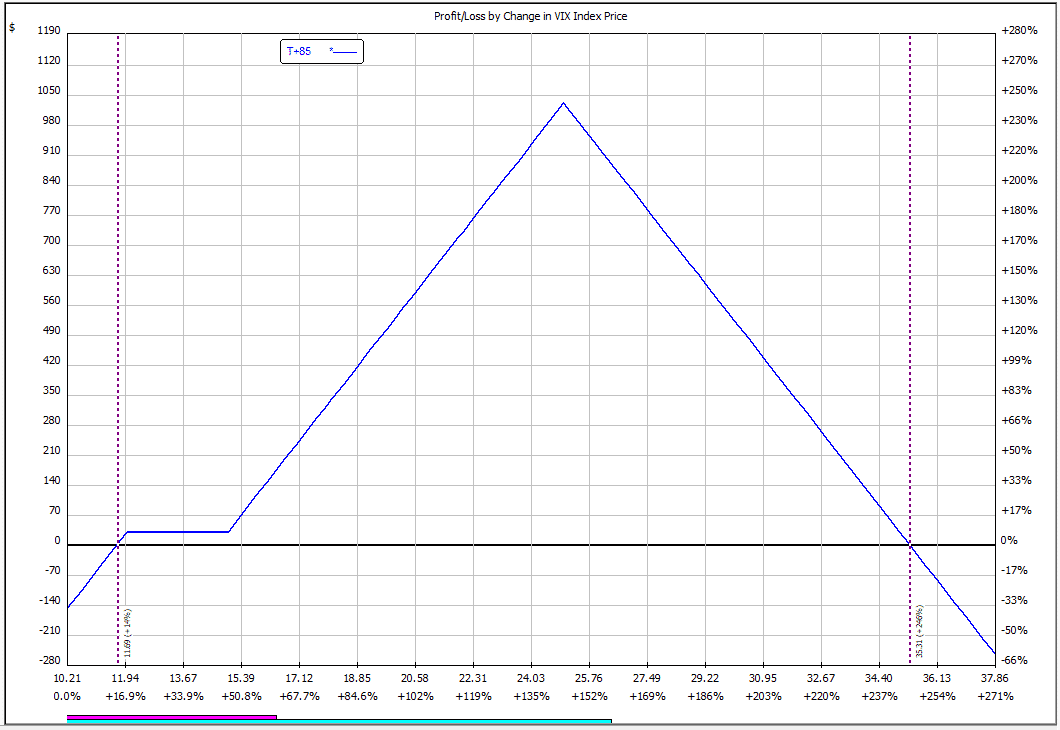

Here are the details of the trade. The trader entered 263,000 of these spreads, but I’ll just use a one lot to keep it simple:

Sell 1 VIX Dec 19th $12 Put @ $0.80

Buy 1 VIX Dec 19th $15 Call @ $1.80

Sell 2 VIX Dec 19th $25 Calls @ $0.65

Net Credit: $30

The trade loses if VIX settles below 11.70 or above 35.30. Anything in between is in the profit zone.

The ideal scenario is if VIX closes right at 25 on the December expiry.

Download the Implied Volatility Calculator

If VIX spikes too far, the trader would start to lose money if VIX settles above 35.30. Unlikely considering VIX hasn’t settled above 27.40 in the last three years, but certainly not impossible.

It’s unknown what the trader’s motivation is for the trade. Perhaps it is a stand-alone bet that the days of low volatility can’t last. Or perhaps it is a hedge against a portfolio of stocks and options that be adversely impacted by a rise in volatility.

One issue that could arise with this trade is if the volatility spike comes too early, the profits may not be as high as anticipated. Ideally the trader would want the rise in volatility to occur as close to the December expiration as possible.

Time will tell if this trade pays off. But it’s certainly an interesting way to hedge against a rise in volatility over the next few months.

Trade Safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I think it’s the same trader who entered the exact same trade 2 months ago. I’ve heard s/he has lost some $5 mil, still a fraction of the potential max profit. Looks like the trade is rolling the trade here.

The big risk is low volatility just before Christmas. Could easily lose 2k per spread.

Yes, the trade will lose if vol stays low in December and settles below 11.70. Not sure I agree with the potential 2K loss per spread though. To lose that much, VIX would need to settle under 2.5. No chance that happens.

If it settles at a low of 9 which I assume would just about be a record low, the trade would lose around $500 per spread.