As an option trader, you need to be following the VIX every day. If you’re not, you need to start now.

Gaining an understanding of the VIX will make a significant difference to your trading. Luckily for you, I’ve put together the ultimate resource for understanding and trading the VIX and its related derivative products.

In this post, I’ll explain in detail what the VIX is, what instruments are available to trade volatility and some pros and cons of using VIX derivatives to hedge your portfolio from fat tail or black swan events.

What is the VIX?

The VIX is a market volatility index created by the Chicago Board Options Exchange (CBOE) that reflects the markets expectations for volatility over the next 30 days. It is calculated by looking at the implied volatilities of numerous SPX puts and calls. In order to calculate the 30 day volatility, the CBOE has to use options from 2 expiry months and blend them.

You have probably heard the VIX referred to as the Fear Index due its characteristic of gauging future price volatility (high volatility often signals financial crisis). If you’re a bit of a nerd like me, you can check out the CBOE’s white paper for full details of how the VIX is calculated.

Why Should You Care?

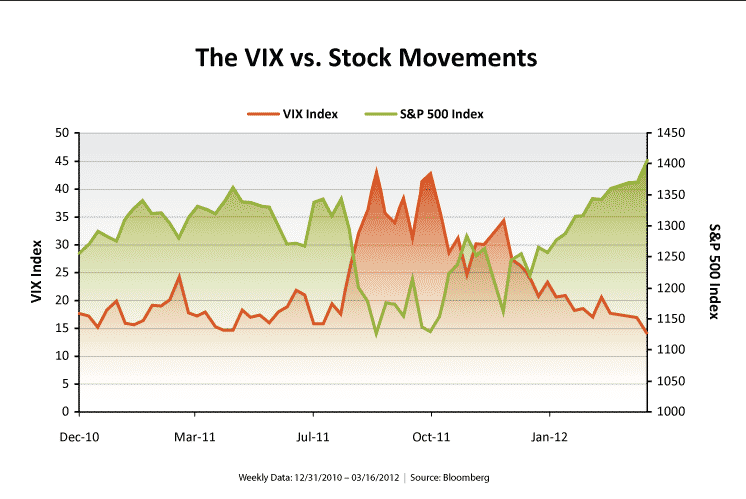

As the saying goes, “When the VIX is low it’s time to go, when the VIX is high it’s time to buy“. This saying reflects the fact that some of the best times to buy shares is during financial panics (when the VIX is high). In other words, buy when people are fearful (VIX is high) and sell when they are greedy or complacent (VIX is low).

History of the VIX

The CBOE introduced the VIX in 1993 based on a formula suggested by Professor Robert Whaley in The Journal of Derivatives. This VIX index was slightly different to the one we know and love today. The calculation of the index was different in that it focused only on at-the-money options rather than the wide range of options used in today’s calculation. Also, the original VIX was based on the S&P 100 rather than the S&P 500. The current VIX index was introduced on September 22, 2003, at which time the “old” VIX was assigned the ticker symbol VXO, which is still tracked today. You cannot trade the VIX index, but there are a number of products such as futures, options and exchange traded notes that are based on the VIX which can be traded.

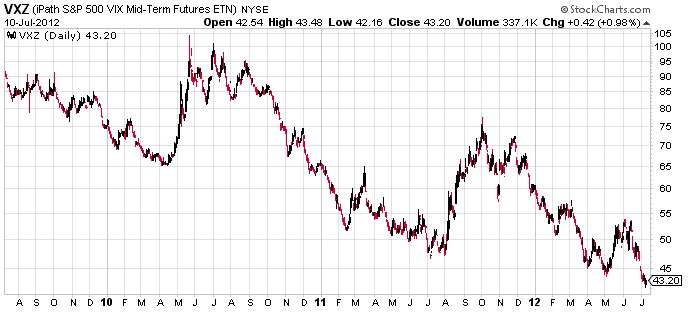

VIX futures were the first derivatives introduced on March 26, 2004. VIX options followed a few years later on February 24, 2006. Two exchange traded notes (VXX – iPath S&P 500 VIX Short Term Futures ETN and VXZ – iPath S&P 500 VIX Mid-Term Futures ETN) were added into the mix on January 30, 2009. So while we cannot actually trade the VIX index, there are plenty of choices available to traders which I will discuss below.

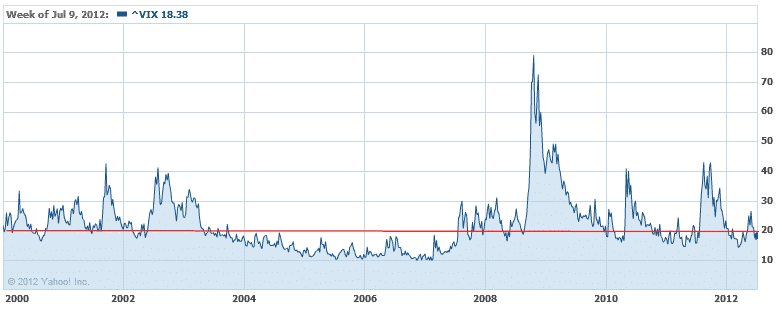

While the VIX was only introduced in 1993, the CBOE have used the calculation to reverse engineer the VXO index back to 1986 in order to see what level the volatility index was during the 1987 Black Monday crash. The figure they came up with was 172! Can you imagine the VIX at 172? The scariest thing is that this theoretical index was trading at 28 only 2 days before the crash.

Download the full VXO data here.

The VIX is a Statistic That Reverts to the Mean

The first thing investors need to understand about the VIX is that it does not behave like a stock. This is because it is a statistic, whereas stocks are based on a business with revenues and expenses. I think Jared Woodard explained it best in his recent article on Condor Options:

The VIX is a mean reverting, range bound index. This means that it cannot go to zero (the lowest level recorded was 9.39% on December 15th, 2006), and following sharp spikes during market corrections, it will slowly drift back down towards its mean. The mean for the VIX index dating back to 1990 is 20.12 according to Bill Luby of VIX and More. When we get a spike up to the 30 or 40 level, market participants know that eventually the VIX will return down to around 20.

VIX Derivatives

We cannot trade the VIX directly, but there are a number of derivatives available to investors, some better than others. One of the issues with VIX derivatives is that none of them can track the VIX index exactly. They can’t track the exact performance of the VIX because they only allow investors to bet on the future value of the VIX rather than its current value. Here is a list of some of the major VIX related products that are now available for trading:

VXX – iPath S&P 500 VIX Short Term Futures TM ETN

VXZ – iPath S&P 500 VIX Mid-Term Futures ETN

TVIX – VelocityShares Daily 2x VIX Short Term ETN

XIV – VelocityShares Daily Inverse VIX Short Term ETN

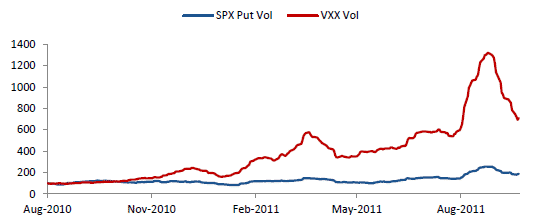

Some of these VIX related products have been incredibly popular, with trading volumes going through the roof. However, despite the increase in volume, the general public’s understanding of these VIX derivatives seems to be minor at best at non-existent at worst. To paraphrase a popular Warren Buffet quote, “only invest in things you understand”.

So while ETN’s such as VXX, VXZ and TVIX are increasing in popularity, they are not designed to be buy and hold investments. Anyone considering doing so should have their head examined. The reason for this the cost of rolling the futures to maintain a constant maturity date. To understand this, we first need to understand a little about contango and backwardation.

Contango

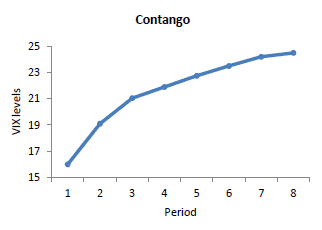

Contango is a term stemming from the futures market, which reflects the most common condition of the market. Contango is when long dated futures are higher than short dated futures. In the futures market this reflects the cost of carry, which would represent the costs of holding and paying for storage of a commodity. The further out in time you go, the higher the storage costs will be, hence the higher the price for the commodity future. Cost of carry on financial instruments would be the cost of financing the position, e.g. interest rate expense rather than storage expense.

Contango occurs with VIX futures as well. When the VIX is very low, the expectation is that it will rise again at some point in the future, back up towards the mean. In this case, long dated VIX futures will be more expensive than short dated futures. This is what contango looks like on VIX futures:

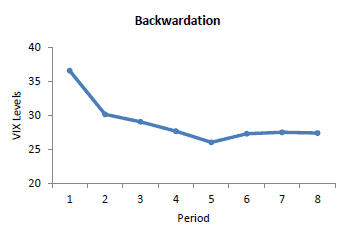

Backwardation

So if we have contango when the VIX is low, what do we have when the VIX is high? Basically the opposite scenario whereby the short dated futures are more expensive than the long dated futures. This is known as backwardation. Here is what backwardation looks like on VIX futures:

RDA Capital put together an excellent paper in September 2011 entitled “Is Volatility as an Asset Class the Missing Link?” You can download the report here, it’s a fantastic read, but you may need to read it a few times before it sinks in. Here is an extract from the paper that explains the concepts of contango and backwardation very well:

You can check out the current state of the VIX term structure at the CBOE website. This is what it looked like as of July 10th, 2012. Notice the nice contango effect and also that the curve is much steeper on the left of the chart. This means the contango effect is at its greatest with short term futures.

You can see from the chart above that in order to roll the futures contract, the ETN’s would have to sell August (lower) and buy September (higher).

Current VIX Futures

August: 18.76

September: 20.14

October: 21.07

November: 22.07

Using VIX Derivatives to Hedge a Portfolio

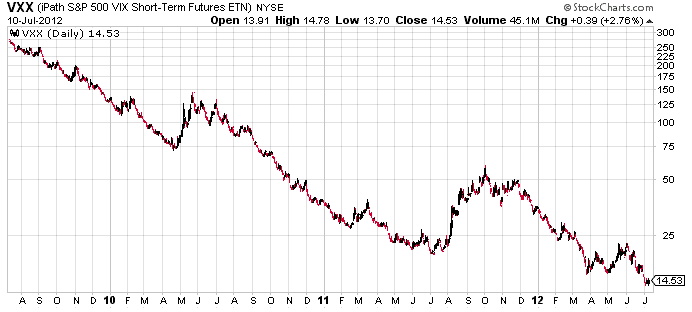

Buying volatility in order to hedge a portfolio from fat tails, or black swan events is a popular strategy due to the high negative correlation between the VIX and market indexes such as the S&P 500. However, most investors probably have not given too much thought on exactly how to do this, and too many are blindly holding on to VXX, VXZ and TVIX assuming they are protected from volatility spikes. While that strategy may perform well whenever there is a significant correction and subsequent rise in volatility, holding these ETN’s over the long term may be hazardous to your portfolio’s health.

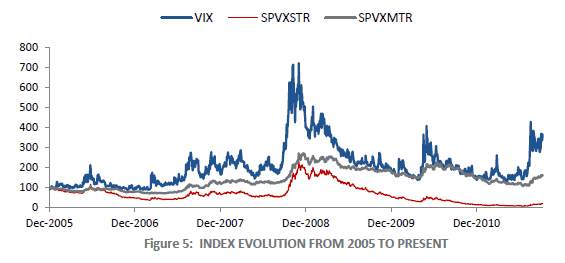

You can see below the performance of SPVXSTR (the index on which VXX is based) and SPVXMTR (the index on which VXZ is based). SPVXSTR made an almost 300% gain during the crash of 2008, however since 2005 it has lost over 90% of its value.

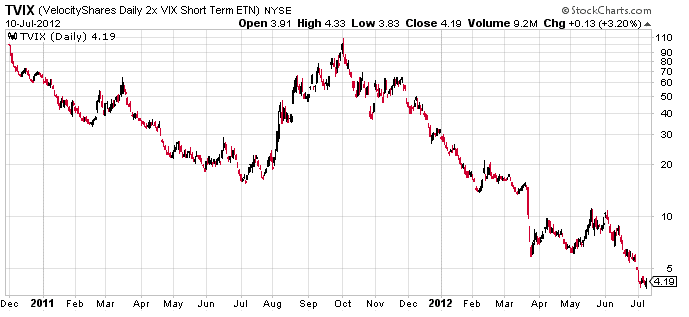

Leveraging Up With TVIX

Some traders looking for even greater protection (or to profit) from volatility are trading TVIX – the 2x Leveraged VIX Short Term ETN. This ETN will produce higher returns when the VIX moves up. However, the same roll forward cost applies resulting in significant losses if held for the long term. Even the term sheet for the product says, “If you hold your ETN as a long-term investment, it is likely that you will lose all or a substantial portion of your investment.” Wow, sounds great, where do I sign up!!

Just take a look at the chart of TVIX below, is this something you want in your long term portfolio?? VXX has performed about the same. VXZ is the one that has performed the best losing only 50%. This proves the fact that longer term futures suffer less from roll cost.

The Optimal Hedge Strategy Using VIX Derivatives

During a contango market, roll forward costs affect short dated futures more than longer dated futures. Therefore, it makes more sense to buy mid-term VIX futures (VXZ) during contango. Here is some more advice from RDA:

Interesting advice, and I would be keen to hear from anyone who has attempted this strategy of buying VXZ and shorting VXX as a means of protecting their portfolio from black swan events. If anyone has attempted such a strategy, please let me know in the comments section below.

Conclusion

We know that volatility and black swan events are something that most investors and traders fear. Volatility, as measured by the VIX can provide a great hedge due to the high inverse correlation with stocks, however we cannot trade the VIX directly and must rely on VIX derivatives which are becoming increasingly more popular. In the endless search for the perfect portfolio protection, have we found the answer with VXX, VXZ and TVIX? The jury is still out. They do serve a purpose, but cannot be used as a buy and hold strategy due to the roll cost. One idea presented by RDA Capital suggests buying VXZ and selling VXX as the optimal strategy to protect from volatility.

$VXX is not designed for Buy and Hold

Related Posts

How To Trade Volatility – Chuck Norris Style!

Why It Pays To Learn How To Trade Volatility

How To Trade Volatility Using the VIX Index

I know that Jeff Augen in his book “the volatility edge of options trading” recommends selling vix puts as a way to hedge against a large move. I agree that short term vxx funds are very expensive. Even writing calls against the vxx index is not sufficient to cover the fund cost. And such a strategy would then cap any gains.

I hadn’t thought about selling VIX puts, I might look in to that.

Excellent info, thank you for taking the time out to explain.

you’re welcome Scott. Glad you enjoyed it.

Hi Brian,

Thanks for your comment, glad you enjoyed the post. Yes, iron condors for monthly income are certainly a good way to go. I had been buying VIX calls as a means of hedging my volatility exposure, but I have gone off that lately as it doesn’t seem to work that well to be honest. After researching VXX, VXZ and TVIX, I am staying away from them, they are just to risky / unpredictable.

Hi, great piece.

I was wondering if you could recommend any good intro text books on futures for a beginner?

I was also wondering if you could provided any materials that more thoroughly explain the construction of vix derivatives? Most specifically svxy, xiv, tvix, and uvxy

Thanks a lot

hmm, sorry I’m more of an options guy than a futures guy, so wouldn’t know who to recommend in that area.

Also, I wanted to get your opinion on the nature of VIX being mean reverting. I was reading an article on indexology that argues the VIX is actually mode reverting.

I was wondering how you’d respond to the article?

Here is the link http://www.indexologyblog.com/2014/05/23/vix-reverting-to-the-mode/

Very good article, thanks for sending that through. Mode reverting seems to make more sense.

I like to keep trading as simple as possible. Look at a five year chart of the $VIX. Is there a six month period where it has failed to go above 15? You can go out up to six months on CBOE VIX option contracts. I wait for the VIX to drop to 15 or below and then do a bull put spread five to six months out with the short leg slightly OTM. Sit back and wait for those inevitable spikes to close the position and your patience will be rewarded. You can also do far out bear call spreads when the VIX spikes, a bit more tricky with the timing though.

Tom

Gavin, After my previous post I found your tutorial on How to Trade the VIX. A wonderful tutorial and I think it is a good trade for beginners as well as advanced trading. Trading the VIX removes the concerns about earnings announcements, dividends, etc. and with a short VIX position, bad news is a good thing as horrible as that may sound.

Tom

Great comments Tom, I like your style. Might have to try out your trading strategy.

Gavin, I recently discovered your website. Bless you for your efforts and dedication to pass along your experience, knowledge and clarity in a subject that is so often clouded in mystery. I have already benefited from your tutorials.

Tom

Thanks for the kinds words Tom. I’m humbled.

What would be considered holding a VIX derivative long term? Should it be held only daily, weekly etc.?

I would consider anything more than a few weeks long term for VIX derivatives.