I use directional butterflies all the time as a way to gain short-term exposure to a directional opinion or to hedge a portfolio.

I’ve used them on the upside when stocks are grinding higher and also on the downside as a cheaper way of buying put protection.

Today, we’ll look at a RUT directional butterfly on the downside given that markets are looking a little shaky right now.

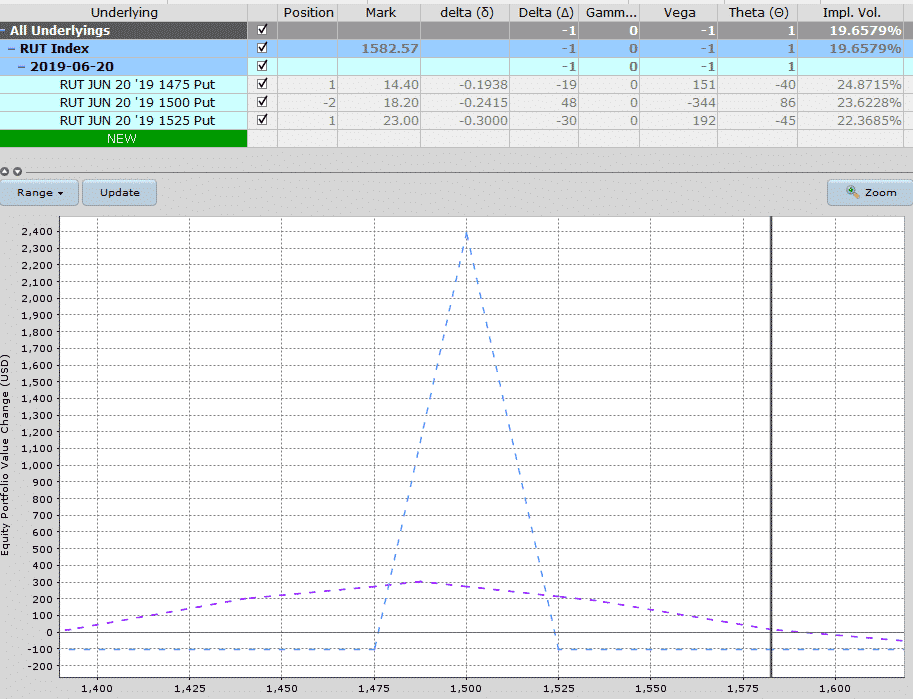

A June Butterfly on RUT with strikes at 1475 – 1500 – 1525 can be bought for $100 with a maximum potential gain of $2,400.

You would have to get very lucky to get the full gain and its unlikely RUT will close right at 1500, although I have had this happen before on a trade like this.

The more likely scenario is that we lose the entire $100.

A trade like this might be used when markets are looking vulnerable and we have some long deltas elsewhere that would get hurt by a 4-6% down move in RUT.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.