I had an email today from a reader asking about some AMZN calls that traded yesterday. I was a bit intrigued by the email so I thought I would look into it some more. Here is the email:

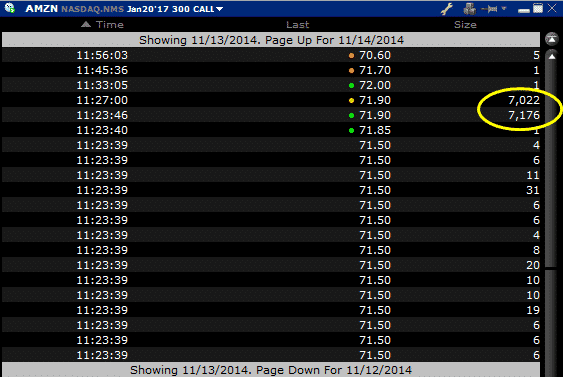

“Hello, I want to see what your thoughts are on this trade, what can I learn for it if anything? On 11/13 a trader bought 7000K $300 Strike calls that expire on January 2017 for $71.90 each. That totals $50,000,000 The break even price for this trade is $371.00. At that time AMZN would have to rally 18% to make money. Any thoughts would be appreciated. Thank You”

Bringing up the time and sales information, I can indeed see the 7,022 calls being traded on Thursday, but I also see another 7,176 being traded 4 minutes before then. In fact, the majority of the days trades in this strike occurred within a 4 minute window.

Just running the numbers here each options contract was worth $7,190 and multiplying that by the 14,198 contracts we get $102,086,620. Yes, that’s right $102 million. The actual notional value of the trade would be the number of contracts x the strike price x 100. That would be $425.9 million. Not a small sum by any stretch of the imagination

So a large trader placed a $425.9 million bet on Amazon between 11:23 and 11:27.

Guess what happens 15 minutes later?

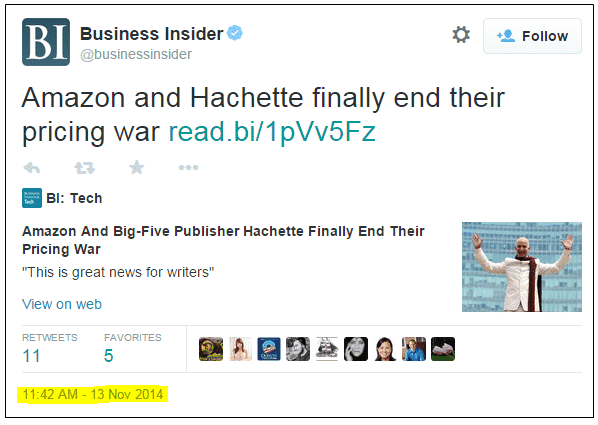

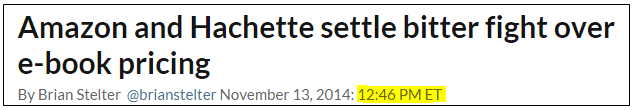

Surprise, surprise we have the news that Amazon has reached an agreement with Hachette.

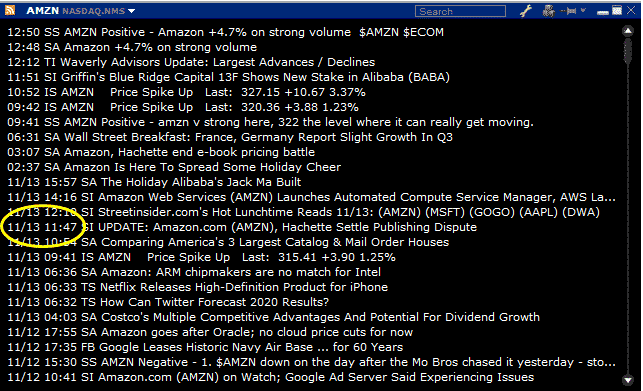

From what I can see Business Insider broke the news at 11:42. Interactive Brokers shows the news story at 11:47. I can’t find any evidence that the news was released anywhere else earlier than that. CNN Money “broke” the story at 12:46.

It’s interesting to note that the price of Amazon didn’t move much after the news release, but maybe it took a little while for the general public to catch on.

Today, AMZN was +3.50%.

Those Jan 2017 $300 calls, traded as high as $81.70 and finished the day around $78.50. Let’s do some math.

What’s 14,198 contracts x (78.50 – 71.90) x 100 ?

Just a cool $9.37 million in profits. Not bad for a days “work”.

Probably nothing will even come of this, but clearly something shady went on here yesterday. This industry is so crooked and corrupt that it makes me sick. Please share this if you agree.

Obviously someone got “lucky”.

This looks fishy to me, has to be a inside job. Jerry

Nice article IQ. I saw something on CNBC about this but nothing detailed like the work you did here. I wouldn’t say the market is rigged but there is plenty of big money players who know how to work the system.

Where is the SCC?????

Well, who’s going to report to the SEC? Whether anyone will be prosecuted is up for grabs, but at least maybe someone could draw their attention to the curious timing.

What I do not understand who would ever take the other side of that trade? Alarm bells would be going off all over the place……Okay….I am so naive!!!.

Hi Steve, most likely the person on the other side of this trade was a market maker who very quickly would have offset the risk in some way. It’s very easy to neutralize the delta by buying stock.

Yes I agree, but what can you do except take advantage if it? It’s hopeless to try to fight it, and if you do it’s like standing in front of a steamroller. I didn’t believe the tweet from wall st Jesus about it, that makes me dumb. I made the same mistake with a tesla news announcement a few weeks earlier. One of these days I will catch on.

There are some people who follow this type of thing very closely. Options Hawk is one that I know of and would recommend. I’ve never traded based on this type of information myself but I’m sure people can and do profit from it, but you probably need to be pretty quick.

This happens all the time. It happened in BHI 10 minutes before the news was released. Its not surprising at all. This a reason why some traders follow unusual call flow. I remember FURX had huge call buying of extremely expensive OTM options and the next day they opened 80 dollars higher. Many positions made millions over night.

Yes I’ve seen a few of these examples myself recently. I’m sure this happens much more often than people realize.

This is the kind of stuff I’ve heard people talk about when they are discussing “unusual options activity” as a way to make spec trades. There are a couple different services out there that provide services to chart such activity in real time (I just recently trialed one). What’s your opinion of this? Have you tried taking advantage of these moves?

Hi John, not personally. I know Options Hawk watches unusual option activity and I’m sure there are people that profit from this sort of information.

Gavin,

Company officers could have bought about 325,000 shares and made to same profit, but, that would be insider trading. Instead they buy calls, make the same profit and it’s ok with SEC. Don’t you love options?

Bob

Indeed Bob, although this seems like such a blatant case that surely the SEC would look into it anyway?

If they were trading a news item that broke 15minutes later. they wouldn’t be trading the 2017 strikes

Possibly teebs, maybe they were trying to argue that it was a long term strategy rather than trying to game the system. I agree that the shorter term options would have risen more in price, but maybe they would come under more scrutiny from the SEC.

I hope they look into this. People trading on insider information steal from all honest traders. Where are you FTC?

I agree Rick. I hope something is done about this.

Dontcha wonder what the counter party was thinking? What are your thoughts on this?

Hi Jark, yes you have to wonder, but I would assume they offset the risk elsewhere by delta hedging.

Yes, I agreed with you that someone had the inside information about the coming news. The trading world has not changed much since it was created.

If anyone doesn’t think this market is rigged than I have a bridge in Brooklyn that I could let you have at a great price.