Covered calls are fantastic at generating additional income for investors, however they are not especially good at protecting investors from downside risk. Covered call traders have a similar downside exposure to stock holders, the only difference being the small cushion provided by the call option premium.

One way to deal with this dilemma is to trade a collar rather than just a pure covered call. A collar strategy involves adding an out-of-the-money put to a standard covered call trade. The put is typically added in the same expiry month as the sold call.

An option collar, gives the investor much better downside protection that purely trading covered calls.

Think about investors who had traded covered calls over Bears Sterns and Lehman Brothers in 2007-2008. The call option premium received for selling covered calls would have provided little comfort to those investors left holding on to their shares as the companies went bankrupt. Investors who had purchased an out-of-the-money put in addition to these covered calls, would still have suffered losses, but the losses would be much, much less than if that had not bought a protective put.

Let’s look at a theoretical example.

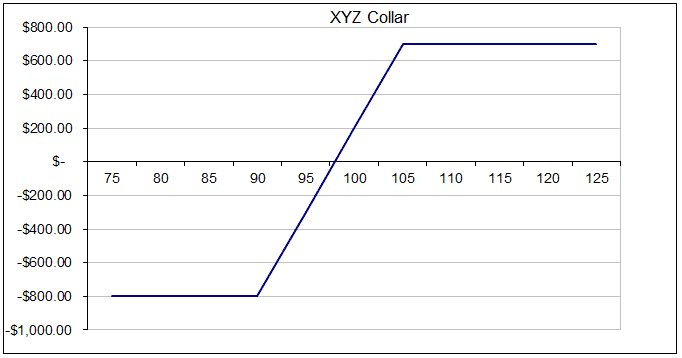

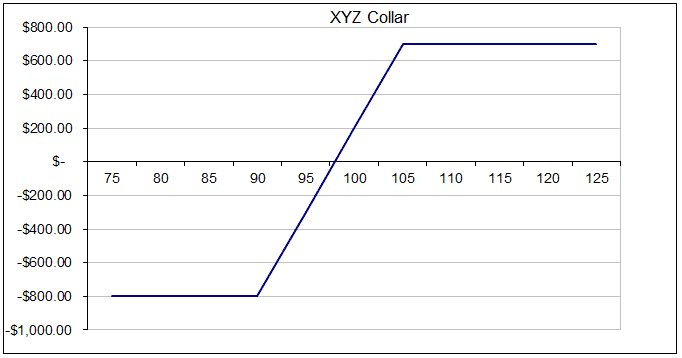

XYZ stock is trading at $100. An investor purchases 100 shares totaling $10,000 and simultaneously sells a $105 call for $3 and buys a $90 put for $1. The payoff diagram for the trade is shown below.

The total cost for the trade is the $10,000 for the purchase of shares, plus the $100 for the put purchase, less $300 for selling the call for a net cost of $9,800.

At expiration is the stock is above $105, the shares will be called away and the investor would have made a $700 profit. That represents a $500 capital gain from the shares plus a net income portion of $200 ($300 for the call sale less $100 for the put purchase).

In the worst case scenario that the company goes bankrupt, the most the collar trader will lose is $800. Losses are capped below the put strike price of $90. So even if the stock falls to $0, the most the investor will lose is $9,800 less $9,000 or $800 in total.