Roku, INC. is a company based in Los Gatos, California that provides TV streaming services to more than 30.5 million active users located in different countries. The company is led by its CEO Anthony Wood and it generates revenues from different sources including subscription fees, the direct or indirect sale of consumer electronic devices (Roku TVs) and advertising services provided to businesses who use the Roku streaming service to deliver content to its user base.

During the first six months of 2019, its streaming service has delivered over 18.3 billion hours of video content. This represents a 73% growth compared to the same period for 2018.

Roku measures its revenue generation capacity through a metric known as Average Revenue per User (ARPU). Its ARPU by June 30, 2019, was $21.06, a 27% increase compared to the same period for last year.

Its total revenues for the first six months of 2019 were $301 million and the company lost $19.65 million during that same period, with its Losses per Share ending up at -$0.17.

Roku has never distributed dividends to its shareholders. The company’s business model is yet to be proven as profitable as competition continues to heat up in a market with big players such as Netflix, Apple and Amazon, and with a growing interest coming from other massive tech and telecommunication companies who have been developing their own services to tackle the $36 billion streaming service industry.

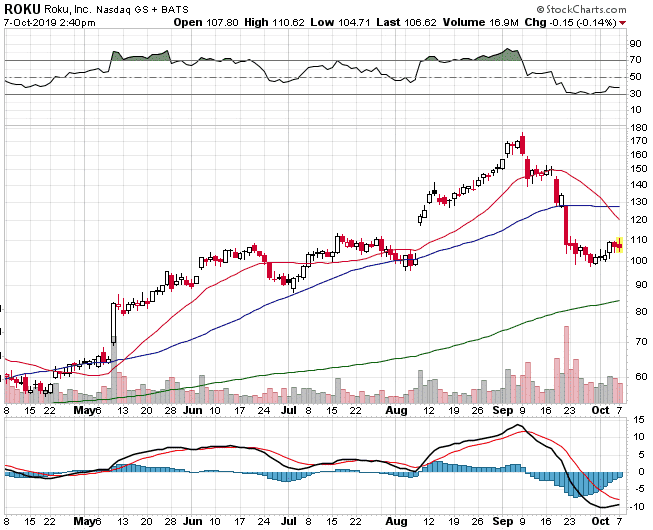

Roku’s stock price reached its all-time high by September 2018 when it traded close to $180 to, later on, take a nosedive to a price level close to $100 per share.

The stock is currently below the 20 and 50-day moving averages, but above the 200-day moving average which sits at 84.40.

RSI is at 37.41 which is close to the lowest level seen in 2019.

MACD is close to showing a bullish cross.

For bullish traders, a bull put spread can provide a high return due with a large margin for error due to the high implied volatility on the stock.

The spread I’m looking at is the January $75-$70 bull put spread which is trading around $1.00.

That represents a 25% return on risk over the next 3 months with an 30% margin for error.

The maximum profit on the trade would be $100 per contract with a maximum risk of $400. The spread would achieve the maximum 25% profit if ROKU closes above $75 on January 17th in which case the entire spread would expire worthless allowing the premium seller to keep the $100 option premium.

The maximum loss would occur if ROKU closes below $70 on January 17th which would see the premium seller lose $400 on the trade. However, it would be best to cut losses long before then.

The breakeven point for the bull put spread is $74 which is calculated as $75 less the $1.00 option premium per contract. Keep in mind that due to the bid-ask spread, you may not be able to get filled at these prices.

One way to get the best price on the spread is to leave a resting order just above the mid-point, say at $1.10 or $1.20.

There is pretty clear support on the ROKU chart around $98. If this level was broken I would close the trade straight away.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.