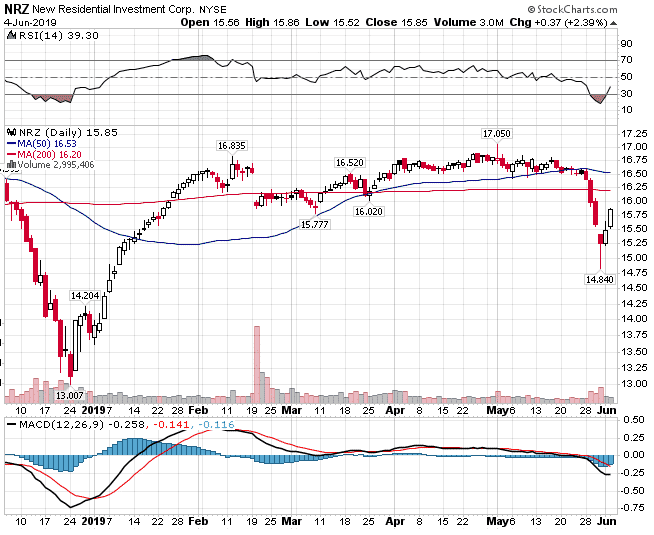

Back in December, 2018 I wrote that NRZ had copped a beating and asked what you thought I should do next.

At the time, the stock had dropped from $18.25 to $15.50 and it then continued to plummet down to $13.

From top to bottom the drop was 28.7%, not exactly what you want when selling cash secured puts…..

When May option expiration approached, I decided to roll the position out to November rather than take ownership of 200 shares. I also sold an extra 2 puts.

All up, I’ve received $644 in net premium with exposure to 400 shares which works out at $1.61 per share.

If I’m assigned at $17, my net purchase price would be $15.39.

The stock is once again being impacted by the changes in the yield curve which has once again gone inverted.

Remember that mortgage REITs borrow short-term and lend long-term, so if short-term borrowing costs are higher than long-term mortgage rates, that’s not a good thing.

While the stock recently recovered to around $17, it’s once again back below $16, but there is still plenty of time before expiration for it to recover.

Overall the position is -$136 which represents about -2% on capital at risk.

Since initiating the trade, the stock is down -8.75%.

I’ll keep you posted as the trade progresses.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.