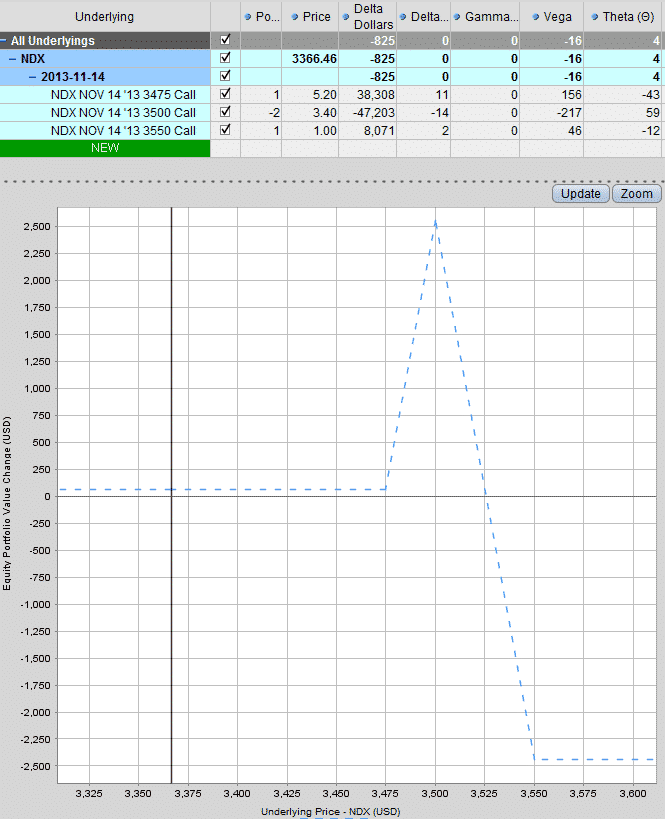

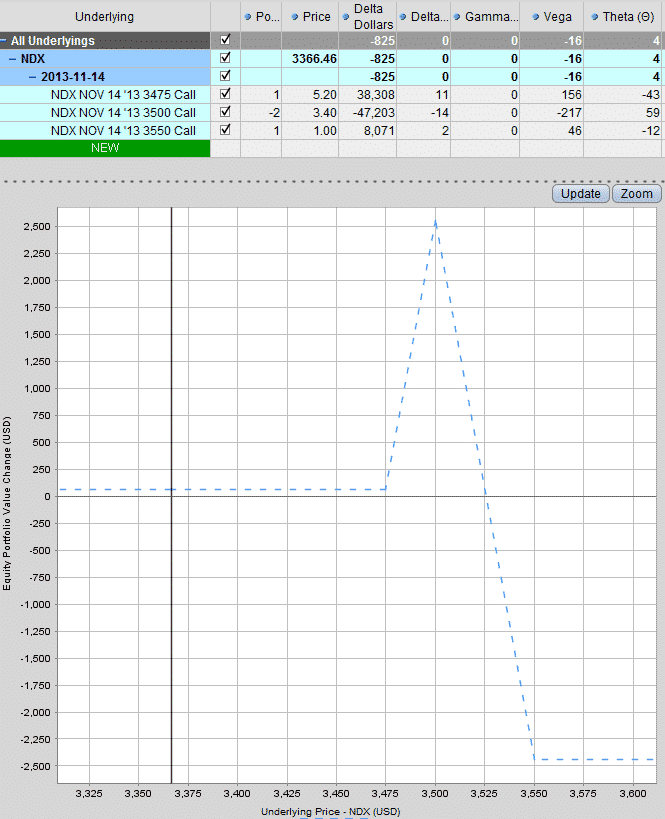

NDX has been on a huge run lately, here is one way to profit if NDX continues to slowly drift higher. Let’s take a look at a Broken Wing Butterfly using calls.

This setup has no risk to the downside. If the market rallies you have the potential of landing in the profit tent. The problem is, you don’t want NDX to rally and reach the tent too early. Around 4-5 days to expiry would be good.

Here’s the setup:

Date: October 23rd 2013,

Current Price: $3365

Trade Details: NDX Broken Wing Butterfly

Buy 1 NDX Nov 14th $3475 call

Sell 2 NDX Nov 14th $3500 calls

Buy 1 NDX Nov 14th $3550 call

Premium: roughly $40 Net Credit

Max Loss: $2,440

Max Gain: $2,560

Breakeven Points: 3525

Profit Target: 20% or roughly $500

Stop Loss: 10% or roughly $250

To learn more about butterfly spreads, click the link below to register for a FREE 13 part Butterfly Course.

Nice trade. I’m wondering what the strikes would be just using the QQQ?

Hi Scott, A rough equivalent using QQQ would be 85, 86, 88