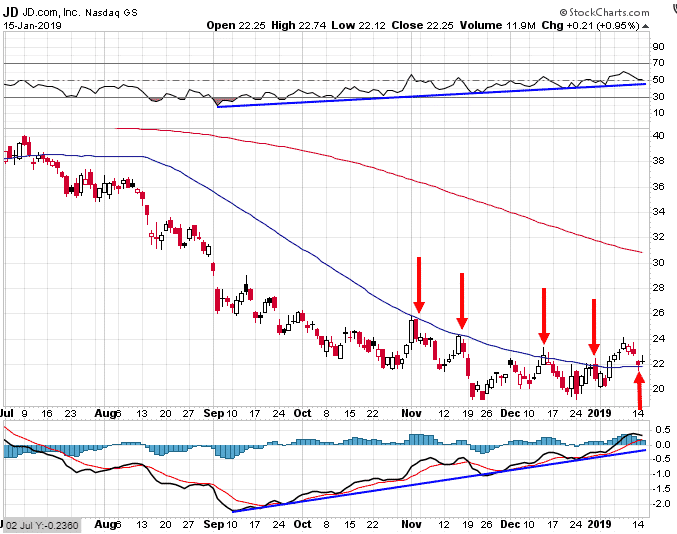

JD is one stock that has caught my eye recently as mentioned last week. It has been in a brutal downtrend since the start of 2018, dropping from just above $50 to its current price of $22.25.

Recently it looks as though it has been trying to form a bottom. After four failed attempts at breaking above the 50-day moving average, it has finally broken above and is now retracing back to the moving average to test the breakout.

I like that setup.

One trading opportunity for those traders with a bullish bias is a Bull Put Spread using the $22 strike as the short put and the $20 strike as the long put.

As of January 15th, this trade offered a 48% return on risk over the next 31 calendar days when using the February 15th expiry.

The 50-day moving average is currently around $22, and this could provide support and represents a good risk / reward for those betting that JD will stay above this line in the sand.

The maximum profit on the trade would be $65 per contract with a maximum risk of $135. The spread would achieve the maximum 48% profit if JD closes above $22 on February 15th in which case the entire spread would expire worthless allowing the premium seller to keep the $65 option premium.

The maximum loss would occur if JD closes below $20 on February 15th which would see the premium seller lose $135 on the trade.

The breakeven point for the Bull Put Spread is $21.35 which is calculated as $22 less the $0.65 option premium per contract. Keep in mind that due to the bid-ask spread, you may not be able to get filled at these prices, although the spreads do look pretty tight on this one.

Stop losses are always important, particularly with highly volatile stocks like this. A close below the 50-day moving average would make me re-evaluate and potentially pull the pin on this trade.

Earnings for JD are around Mar 1st-4th so the results will not impact this trade.

JD is sometimes referred to as “the Amazon of China” which sounds pretty good to me.

Gross profit for Q3 came in a $8.3 billion, slightly higher than the quarter before.

See chart below:

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.