Learning how to trade volatility is an extremely important aspect of options trading. Trading volatility can be very complex, but it is very easy to obtain a basic understanding and that is all most traders will ever need.

I put together a reference guide on how to trade volatility if you want to check it out. Today, I want to talk about how you can use volatility, and specifically the VIX index, as a trading tool to help you make decisions on position sizing as well as entry and exit rules.

Position sizing and money management are some of the hardest things for traders to handle.

Some people think that once you have your trading plan detailing you entry and exit rules you’re set, but that’s not the case. Money management is one of the most crucial aspects of successful trading. So, what does volatility have to do with money management?

1. Each option strategy will be either positive or negative Vega. Having a combination of positive and negative Vega trades can help lower your overall volatility risk.

2. You can set entry and exit rules based on volatility levels

3. You can create position sizing rules based on volatility levels

My primary trading strategies are Iron Condors, Bull Put Spreads and Bear Call Spreads which are all net short volatility trades.

In order to hedge some of my Vega risk, I like to use some long volatility trades such as Calendar Spreads and Diagonal Spreads.

You can also use volatility as a trading entry signal.

On my Iron Condor trading plan, I have 5 entry guidelines. One of these is to enter the positions on a down day (when volatility has spiked) as this will allow me to either a) bring in more premium or b) move my strikes further away from the market.

<< Click Here To Download a Copy of My Iron Condor Trading Plan >>

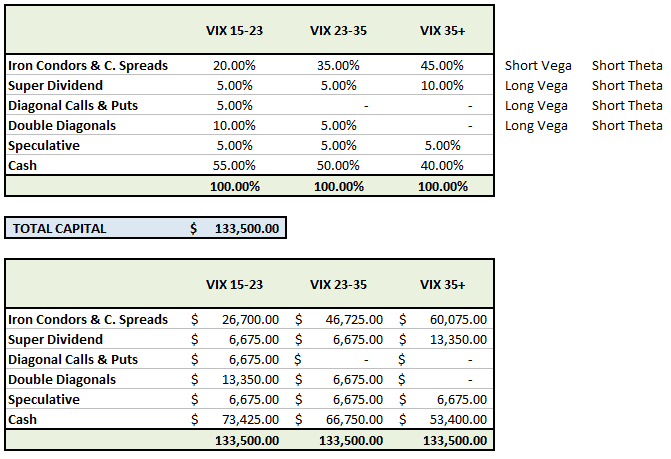

Also on my trading plan I include position sizing rules based on where volatility (as measured by the VIX Index) is trading. Below is an example of how you could structure your portfolio based on implied volatility levels.

You can see that when the VIX is high, you allocate more capital to short vega strategies. I also discuss this concept in the video below.

I hope you enjoyed this article, if you have any questions, please email me at [email protected].

Here’s to your ultimate success!

Gav.

Gavin

From what I understand, to buy call or put option, we prefer low VIX in order to make profit because it gives us a gradual incremental stock prices and not so volatile in prices. The stock indexes will go higher with lower VIX.

Normally the fear gauge when VIX is higher than 35 as you mentioned but in stock IV can be lower if that particular stock is still gradually moving up trend. Do you observed and have any strong co-relation between certain stocks option and VIX.

In a low VIX environment, it is quite difficult to scan stocks with high IV option to sell unless they have catalyst events like earning. I prefer to sell option spread if the IV for option is more than 40%.

However, if the stock IV is High, we prefer to short or sell spread option even though the VIX is Low.

I am a bit confused between the VIX and stock implied volatility and option chain with different strike price together with different Implied volatility. Can you explain and elaborate on the co-relationship between VIX, stock IV and option strike price IV in the option chain.

Thanks.

Hi Lawrence,

Yes, when buying calls or puts, you want a low VIX (because the options you are buying will be cheaper).

Stocks tend to follow a similar volatility pattern to the overall market (VIX) but not always. For example, in the lead up to earnings, implied volatility for a stock will rise, when the VIX might be flat.

You can try using your broker to scan for high volatility stocks, also check out http://www.ivolatility.com

Yes, you can still sell spreads on a stock with High IV even though VIX is low.

Hope that helps.

Hi Gav on minute 4 seconds 16 of your video you say that Long Calls are positive vega. I dont understand why long calls are positive vega and gain from a rise in IV: if I buy a call and IV goes up, market goes down so I should lose, not gain.

Where am I mistaking?

thanks for explaining

Danilo

Hi Danilo,

Long calls are indeed long volatility. Assuming all other things being equal (i.e. no change in stock price, time, interest rates etc.) if volatility goes up the value of the call goes up.

But yes, you are right, typically volatility rises as the market falls. Occasionally you will see vol rise when the market rises. This is not rare, but it’s not like it happens every time.