One of the first things people ask when they learn about Iron Condors (and I had the same question when I first learned about them), is “what happens during a market crash?”

Another good one is “what if there is another Flash Crash?”

Some might argue that the Flash Crash was a once in a lifetime occurrence, but the fact of the matter is, these types of events happen a lot more regularly than people want to admit.

Contents

- Introduction

- Stop Losses

- VIX Call Options

- Use Further Out-of-the-Money Puts As A Hedge

- Method One

- Method Two

- Method Three

- Conclusion

Introduction

This is one of the risks we face as Iron Condor traders, but there are a few things we can do to protect ourselves.

However, keep in mind you will not be able to hedge away all your risk. After all, if you did that, you would have no return!

Your views on hedging will also depend on the total amount of capital you have at risk.

If you have $1,000,000 allocated to Iron Condors, do you think hedging will be more, or less important than for someone with only $10,000 allocated to Iron Condors?

Of course, hedging will be much more important for the person with $1,000,000 at risk. A 10% loss for him will be $100,000 whereas a 10% loss for the $10,000 trader will only be $1,000.

3 Ways to Manage Risk

Stop Losses

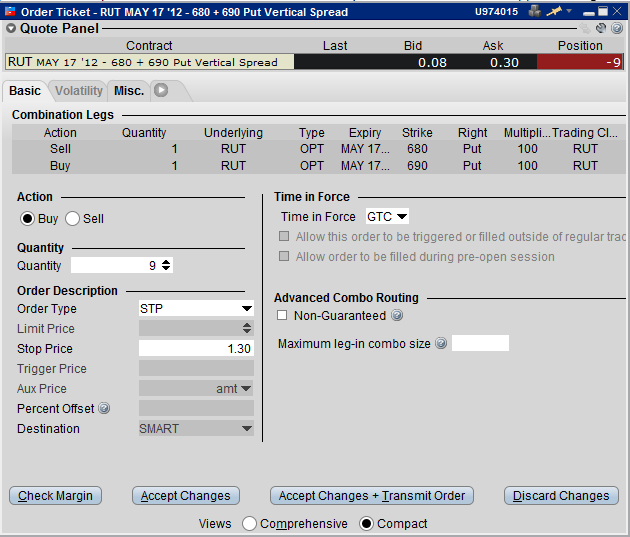

Using stop losses is the first and most important method for controlling risk that you need to master.

Where you place your stop loss is a matter of personal preference, but the mechanics will be the same no matter what. I like to set my initial stop loss at 3 times the original credit received.

So if I receive 0.50 for my bull put spreads, I will set my stop loss at 1.50 which results in a 1.00 loss (on the puts only, there would be some gains from the calls that would offset some of this).

Stop losses are your first line of defense as an iron condor trader and these should be entered straight after your entry trade is executed.

Your GTC (Good Till Cancelled) stop loss order should look something like this:

VIX Call Options

VIX Call options are another good way to hedge your downside risk, but beware, it’s not an exact science given the nature of VIX options.

The first thing that you will notice about VIX call options, is they do not behave like normal options.

The longer dated calls in particular do not move in tandem with the underlying index.

The problem stems from the fact that VIX options are European settled and also the tendency for the VIX to snap back to prior levels after a spike.

The VIX index is calculated by looking at the implied volatility of SPX options.

The process looks at out-of-the-money puts and calls from two different months, and blends them to generate an overall implied volatility for 30 days from now.

So, it does not track the actual volatility of the S&P 500, but rather the implied volatility of the corresponding options.

Kopin Tan from Barron’s explains the dilemma quite well:

The way I like to use VIX calls as a hedge is to match the expiration with the condor I am trading, so if I’m opening a May Iron Condor, I will buy May VIX calls.

I usually look at the option chain that is out-of-the-money and trading around $0.50. You can set up your hedge however you like and it’s not an exact science so is something you will need to test out a bit.

I like to think of it as an insurance cost that I am willing to write off each month, and I am willing to spend around 10% of the monthly income I am generating from the Condor.

So if I am bringing in $2,000 from my RUT Iron Condor, I will spend $200 on VIX call options. With the chain trading at $0.50 that means I buy 4 contracts. Simple as that.

In summary, VIX call options are not perfect, but they will give you some protection from a Flash Crash or severe market decline.

Use Further Out-of-the-Money Puts As A Hedge

The third method of protecting the downside risk of Iron Condors is by buying further out-of-the-money puts. You can do this in one of three ways:

Method One

Match the out-of-the-money puts to the period in which you are trading – This is nice and easy and stress free.

You put on your Iron Condor and then straight away you buy some further OTM puts. Usually if I am trading 10 lot spreads, I will by 1 or 2 further OTM puts. Let’s look at an example:

Date: May 1, 2012

RUT: 828.92

Sell 10 May 17th 770 Puts @1.85

Buy 10 May 17th 760 Puts @1.30

Sell 10 May 17th 870 Calls @ 1.05

Buy 10 May 17th 880 Calls @ 0.55

NET Credit = $1,050

This is a fairly standard Iron Condor trade and has a payoff diagram as shown below.

Now we’ll add in our hedge:

Buy 2 May 17th 730 Puts @ 0.55

HEDGE COST = $110

TOTAL NET CREDIT RECEIVED = $940

This changes the payoff diagram to look like this:

The thing to keep in mind here, is that this assumes zero change in volatility, whereas if we have another Flash Crash, volatility will go through the roof.

During the Flash Crash in 2010, the VIX reached 50, so let’s be conservative and assume a 20% spike in volatility, now our payoff diagram looks like this:

A couple of things to note here are that the green line, which represents the position at expiration, stays exactly the same.

This is to be expected, as the total gains and losses at expiry are predetermined based on where you place your strikes.

The second thing to note is the difference in the pink and orange lines.

You will notice that these are much higher with the hedge than without, and that the hedge is much more effective for the pink line (i.e. today).

This means that if a Flash Crash were to occur today, right after you place your trade, this would actually work out really well for you and might actually mean a profit on the total position.

However, if the Flash Crash occurs very close to expiry, the hedge provides much less protection.

Also, you need to be aware that this is all pretty subjective in terms of using a +20% increase in implied volatility, but hopefully these payoff diagrams have helped to illustrate the idea a little.

You will notice that I am also spending roughly 10% of my monthly income on my insurance costs, similar to the rationale for the VIX Calls.

Let’s move on to the second choice of hedging using longer dated out-of-the-money puts.

Method Two

Buy long dated puts as a constant hedge – This is a good idea if you know you are going to be placing Iron Condors each month and in more or less the same number of contracts.

The advantages are that you only have to enter your hedge once (less transaction fees) and you suffer less from time decay than if you were buying your hedge each month.

You could look to buy 12 months out and then roll it once there is only 3-4 months left until expiry. This way the full effects of time decay are not suffered.

The disadvantages are that if the index has a huge rally, your puts can lose a lot very quickly as they are now even further out-of-the-money.

Once they move further OTM, they will not provide much protection and you may be required to roll them up higher which will involve more costs.

The other disadvantage is that it will cost a lot of capital to buy long dated puts on the indexes.

As an example, when I put this data together it was May 1st, 2012 and RUT wass trading at 828. To buy 1 Mar 14th, 2013 (May 2013 options were not available yet) 575 put cost around $1,650 and the bid / ask spread is very wide (15.10 – 17.90).

Let’s look at the same Iron Condor above, but using 1 Mar 14th, 2013 put as a hedge:

Date: May 1, 2012

RUT: 828.92

Sell 10 May 17th 770 Puts @1.85

Buy 10 May 17th 760 Puts @1.30

Sell 10 May 17th 870 Calls @ 1.05

Buy 10 May 17th 880 Calls @ 0.55

NET Credit = $1,050

Now we’ll add in our hedge:

Buy 1 Mar 14th, 2013 575 Puts @ 16.50

HEDGE COST = $1,650

TOTAL NET DEBIT = -$600. Notice that we are actually PAYING for the total trade. The idea is that you will amortize the hedge cost over 10 months, so you should have paid for the hedge after approximately 1.5 months of selling Iron Condors. Let’s have a look at the payoff diagram for this one and note the differences between long dated and monthly options to hedge:

Firstly, the payoff diagram is tilted to the left, and you actually have a pretty good result if RUT finishes at 770 at expiry.

The other difference is that the second breakeven on the downside is much lower, instead of being around $680 (in the Method One example), it is now at $550.

Now let’s take a look at this payoff diagram assuming a 20% rise in implied volatility:

Very interesting here what a 20% rise in implied volatility does in the case. The long put is very long in Vega, so a rise in volatility will have a huge impact on the total position.

Method Three

Use weekly options when you feel protection is needed – Some people may prefer to leave their Iron Condors unhedged unless a specific circumstance calls for it.

In this case, using weekly options can also work. Reasons for adding a very short term hedge could include:

a. There is an important economic announcement

b. Market volatility is picking up, but you want to leave your position open for a few more days to see how it plays out

c. You’re close to expiry and also getting close to your stop loss level

Here’s how you could set it up:

Date: May 1, 2012

RUT: 828.92

Sell 10 May 17th 770 Puts @1.85

Buy 10 May 17th 760 Puts @1.30

Sell 10 May 17th 870 Calls @ 1.05

Buy 10 May 17th 880 Calls @ 0.55

NET Credit = $1,050

Now we’ll add in our hedge:

Buy 1 May 3rd 800 Puts @ 0.50

HEDGE COST = $50

TOTAL NET CREDIT = $1,000

This type of hedge is a little more advanced, but might be something worth looking at in certain situations.

In this hedging scenario, if RUT has a big fall in the next 2 days, you will have a little bit of a profit on your hedge to offset the losses on the monthly condor.

The downside of this method is that it has cost you 5% of your monthly income and you have only had protection for 2 days.

Conclusion

In summary, if you’re trading Iron Condors, you need to have a plan for how you will protect against a violent selloff and there are a few different ideas to choose from.

Those who are trading large account sizes have a much greater need to hedge than those with small accounts.

Also, there can be a time to hedge and a time not to hedge, during strong bull markets, the need for hedging is lower than in times of market uncertainly or strong bear markets.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Great article. Great summary. I buy ‘units’ in the time period of the trade (ie. your Method 1), although have tried all methods. One of the problems I have always had is actually using the insurance when it becomes a fat profit during a sell-off. Obviously selling your insurance leaves the condor exposed again, so you either need to take a punt on a market bounce, change your insurance, or unwind the whole trade.

Thanks Graham, I am in favour of either unwinding the trade and repositioning.

Thank you. Very helpful.

Great articles!

Glad you found them useful Alex

Thank you very much for this excellent explanation. Clear and succinct. Best explanation I have seen on the net!

Excellent summary. Thanks for the post. I’ve used units with my condors for years, but haven’t yet experienced a situation where they have increased in value by more than 50%…a $1.00 put going to $1.50, but they do help me sleep better at night!

i like the idea of buying 1-2 OTM puts for every 10 lot. actually i would also add the same protection on the upside. if i am trading 10 lots or more i will always want to be hedged and not for fear of just a flash crash either. capital preservation is a must and like Dave said, he can sleep easier knowing the protection is there. i’m not sure about this but with hedging there comes hedge management so i will need to learn this skill as well but my initial instincts say that w/a hedge one doesn’t only have to trade low delta ICs. so maybe 15-20 deltas become possible thus reducing the margin requirement. any way i love this idea it helps me a lot and will give me more confidence in trading larger lot sizes. i greatly appreciate these ideas.

Glad it helped you Brian. Great comments.

Dear Sir,

Many many thanks for your trading ideas I really enjoying

Manohar

Good article. I am starting a program like this and used a stop loss order a few weeks ago on an SPX weekly IC and I got executed out early and erroneously. The spread widened abnormally they said on both put and call sides and I was out and SPX did not move much at all. So I don’t know if a stop order is the best method. Someone could manipulate the bid ask and trigger your stop. Ever see this? I guess that’s why you offer other approaches. Thanks.

Awesome Article about adjustment possibilities as almost nobody teaches it. I have never seen such short and useful information. Thanks Gavin :). Before reading that mthods I only have read that you can break down the leg number of calls or puts such called back-ratio process.

Useful information– simply explained….

for quick react during a flash crash

protect the portfolio by buying the SPOT (using Emini contract $50 per point)

Yes good call. Just need to be careful not to get burnt on the hedge if the market rallies back, but that’s the case with any hedge strategy.

Very thanks for this useful article from Italy!

Antonio

Thanks Antonio, glad you liked it.

An excellent article. Is Method 1 sometimes known as the Batman?? From Australia!

You can call it that it you like. 🙂

thank you great

Great Article Gavin. From the sounds of it I like the idea of Method 2 (to reduce extrinsic decay costs), but ideally more on sleepy / neutral underlying’s (to avoid losing too much the other way) and to lower the cost, would think to pay for it by selling Weekly Puts (Put Diagonal), and/or Collar it with writing near / same term Calls.

Regarding the upside risk of delta-neutral short strategies (Short IC, Strangles, double diagonals/calendars), I saw somewhere about delta hedging as the underlying moves, using long call options, and possibly cheapest buying / selling stock.

What’s the pro/con of using long call option vs buying/selling stock vs selling naked puts to adjust the delta?

When would you do this? (when your short option walls are challenged and/or DTE is less with high gamma risk?)

Hi Felix, thanks. I like using stock to delta hedge as there are no other greeks to worry about, but it can get expensive if you end up needing to buy/sell lots of stock.

I tend to do this when my delta gets to a certain level, but I don’t want to move my option strikes.

I wonder if this method works. Always reserve some cash. In the event of fast and furious market crashes such as 03/2020, use the cash to buy 3x ETFs such as TQQQ. When the market bounces back quickly, that will cover your losses or even be profitable. Of course, you may not want to hold it forever.