Resting orders is a term I came up with to describe orders that you put into the market and leave as good till cancelled (GTC) in the hopes that the stock might rally (or fall) enough for the order to get filled.

By doing this, I’m always getting in at a price I’m happy with rather than having to take what the market is offering.

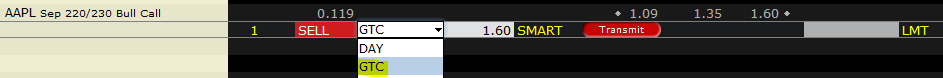

If I decide I want to trade a $220-$230 Bear Call Spread in AAPL, and the September spread is trading at $1.35, then I might put in a GTC order to sell that spread for $1.60.

Depending on how keen I am on getting in to the trade will effect how close to the market I put my resting order.

If I was really keen to get into the trade and didn’t want to miss it, I might put the order in much closer to the current price, say $1.40.

By doing this, I give myself a bit of a margin for error and make sure I only get filled at the best possible prices.

Sure, sometimes I’m going to miss out on trades, but I feel like by using this risk management technique I’m giving myself the best possible change for success.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.