Thanks for visiting Options Trading IQ. I hope you’re enjoying my book. Below you will find some examples of positive and negative divergence, these are great trading indicators that you should keep an eye out for.

Don’t forget to download my free eBook, Volatility Made Easy – Effective Strategies For Surviving Severe Market Swings by clicking the box below.

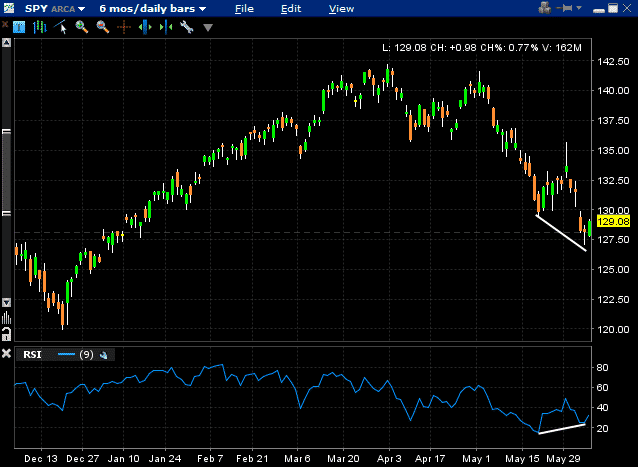

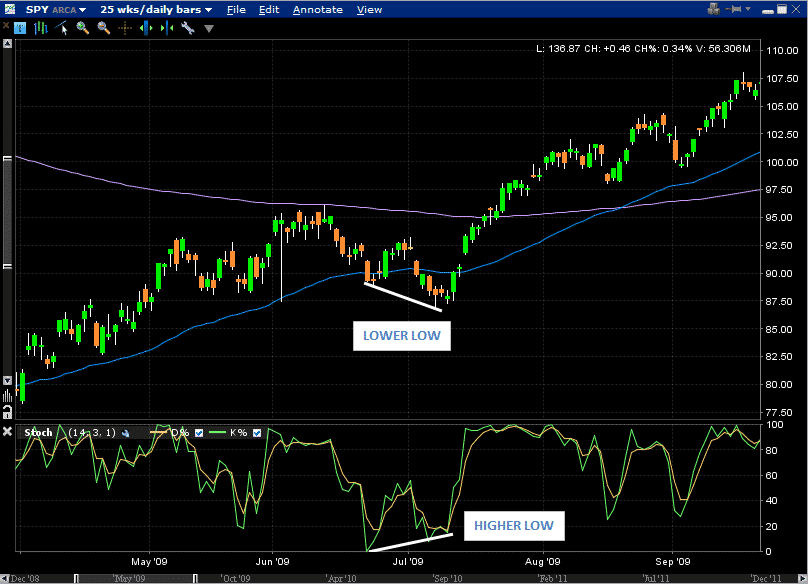

SPY BULLISH DIVERGENCE

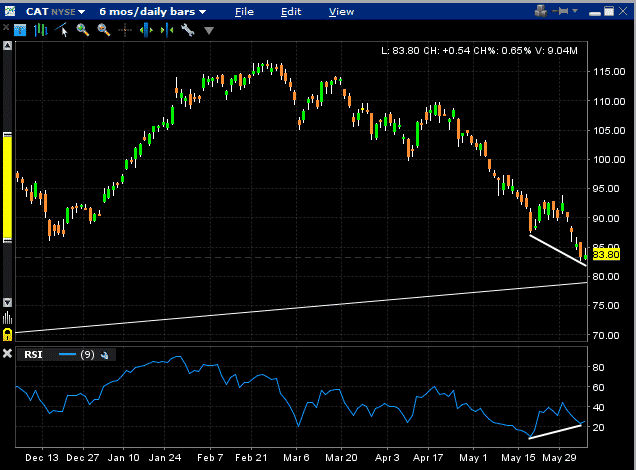

CAT BULLISH DIVERGENCE

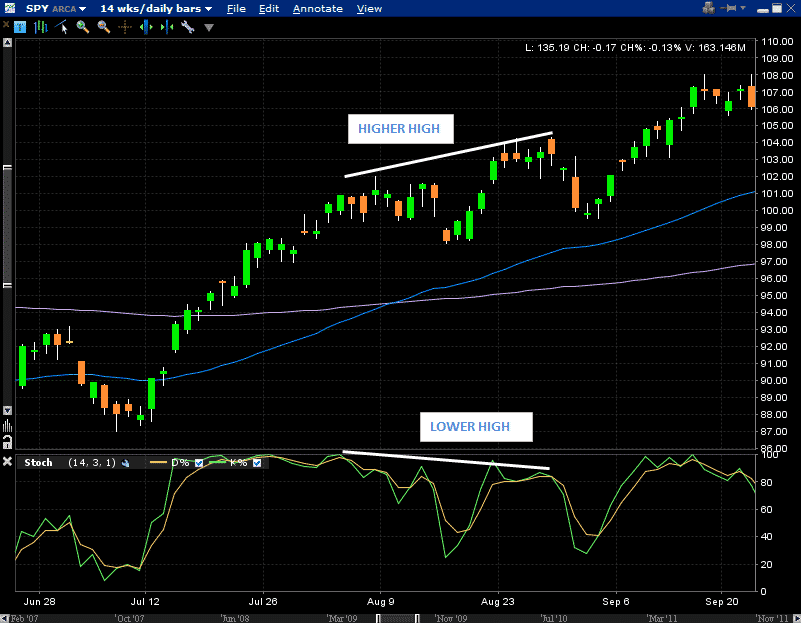

SPY BEARISH DIVERGENCE

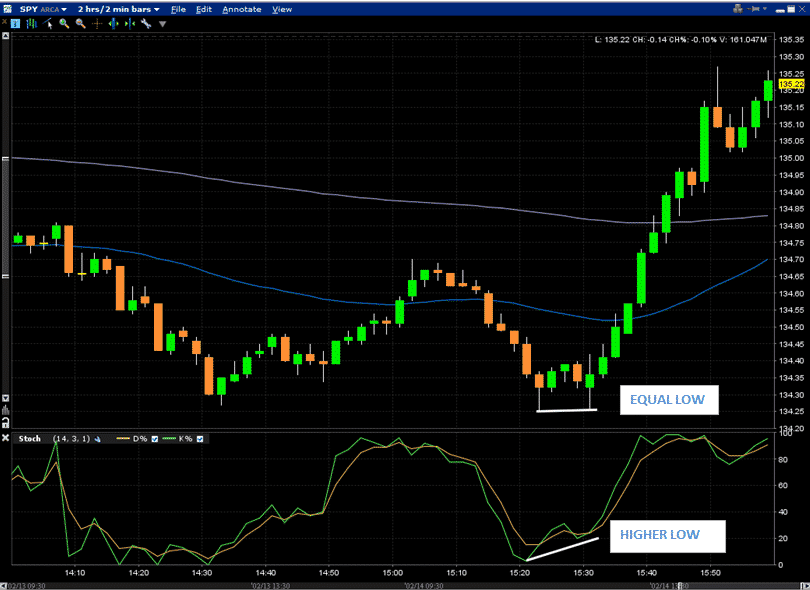

SPY BULLISH DIVERGENCE

SPY BULLISH DIVERGENCE