In previous lessons on covered calls, we’ve learned about compounding and volatility. Today we’re going to talk about open interest and how it is important to keep it in mind when trading covered calls.

Higher open interest is good for covered call sellers as it means there is more liquidity which results in tighter bid/ask spread.

This means it is easier and cheaper for investors to get in and out of positions.

When an option strike is first created there is zero open interest. If someone then sells to open 5 contracts as part of a covered call trade, another trader takes the opposite side and buys to open 5 contracts. There are now 5 contracts open.

If another trade comes along and also sells 5 contracts, then there are now 10 contracts open.

Assume a few days later the first trader comes in and decides to buy back his calls, he would initiate a buy to close order and open interest would be reduced.

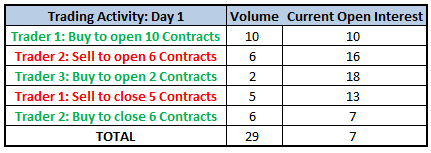

Some traders may be confused by volume and open interest.

They are separate and volume can be higher than the open interest if a large trader closes a big position. You can see this in the table below, total volume for the day is 29, but open interest is only 7.

An opening transaction will increase both volume and open interest. That could be a buy to open OR a sell to open (such as in a covered call trade).

A closing transaction (Sell to close, or buy to close) will reduce open interest, but increase volume.

That way you will ensure that the bid/ask spread is reasonably tight. Otherwise a bid/ask spread of less than $0.10 is also good. Keep in mind that during times of market volatility, spreads will widen and that will be more pronounced for option chains with low open interest.

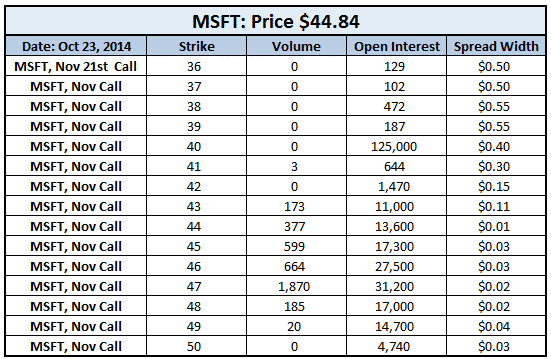

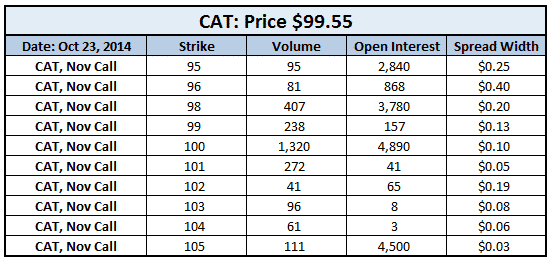

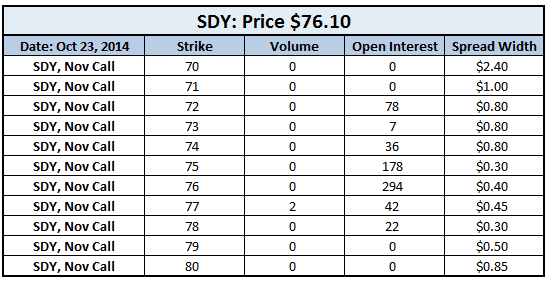

Let’s take a look at 3 live examples and see how things compare. We’ll compare a stock with high volume and open interest (MSFT) with stocks that have medium (CAT) and low (SDY) volume and open interest.

Firstly, MSFT; you can see that there is massive open interest in the options of this stock with the highest being the $40 calls with 125,000 open interest.

Note also that the spreads for the at-the-money options are very narrow with the spreads being only 1 or 2 cents wide in some cases.

This is a stock that you would feel very comfortable writing a covered call over given the high liquidity and open interest. Opening and closing your position would be a breeze.

CAT is a stock with a medium level of volume and open interest. Spreads are reasonably narrow around the at-the-money strikes, but not quite as good as MSFT.

There may be a small amount of slippage incurred when opening and closing covered call trades on CAT.

SDY is a great ETF based on high dividend stocks in the S&P 500.

High dividends are part of what we are looking for as covered call traders, so this is fantastic!

However, on second glance, when we look at the volume, open interest and spread data on this ETF, we might have second thoughts.

On this day, SDY has traded a grand total of 2 contracts across all the strikes shown. That is a definite warning sign, as is the fact that open interest is very low. Spreads on the at-the-money strikes are 30 to 40 cents which is not nearly as attractive as MSFT or even CAT.

The spread on the at-the-money strike of $76 is $0.80 to $1.20. Given the lack of volume, it is very unlikely that you would get filled at the mid-point of $1.00.

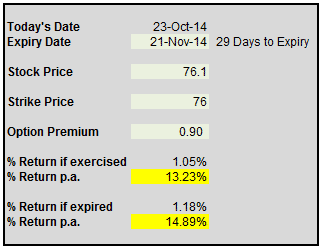

Assuming you can only get filled at $0.90, let’s compare the impact on your potential returns.

If you sell the option for $0.90 and it expires worthless, your return is 1.18% or 14.89% annualized.

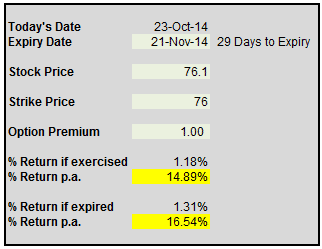

If you sell the option for $1.00 and it expires worthless, your return is 1.31% of 16.54% annualized. That’s nearly a 2% annualized difference!

Keep in mind that if you need to buy back the call at any point, your return will be further diminished if you can’t close it at the mid-point.

As you can see, being aware of the open interest and structuring your covered calls accordingly can have a significant impact on your overall performance.