Read Part 1 – The Basics

Read Part 2 – How To Set Profit Targets and Stop Losses

Read Part 3 – How To Successfully Leg Into A Butterfly

Read Part 4 – Trading Rules

Read Part 5 – Using Low Risk Directional Butterflies

Read Part 6 – The Greeks

Read Part 7 – Broken Wing Butterflies – One-Size Fits All

Read Part 8 – The Reverse Butterfly

Today we’re going to be looking at using Butterflies as part of a combination and using them to hedge other income trades.

Using Butterflies as Part of a Combination Strategy

So far we have looked mostly at using butterflies as a stand-alone trade, as both neutral and directional trades. Another skillful way to use butterflies is as part of a combination strategy or as a hedge for other trades.

Iron Condors are a popular income trade and adding at-the-money butterflies can increase your Theta decay, potentially allowing you to exit the trade earlier for the same amount of profit. Let’s take a look at an example:

Date: July 31st 2013,

Current Price: $1052

Trade Details: Iron Condor

Long 10 RUT Aug 15th $980 puts @ $1.45

Short 10 RUT Aug 15th $1000 puts @ $2.45

Short 10 RUT Aug 15th $1090 calls @ $1.25

Long 10 RUT Aug 15th $1110 calls @ $0.35

Premium: $1,900 Net Credit

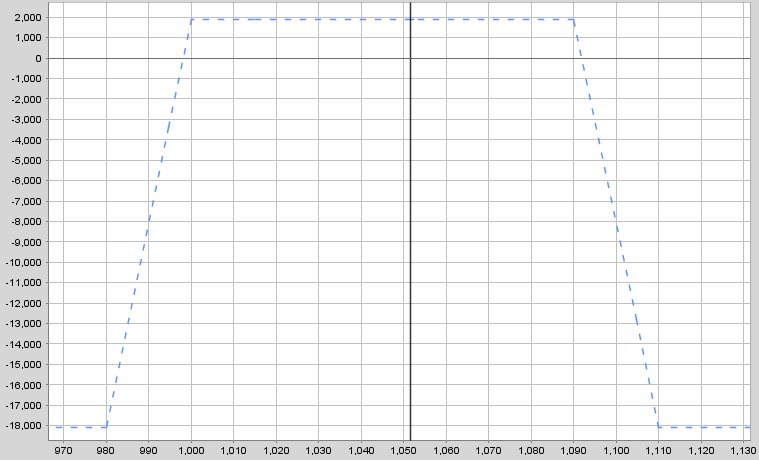

The payoff diagram is shown below. You can see we are risking $18,100 for a profit potential of $1,900.

Now if we want to increase our Theta and Vega exposure we can add a couple of at-the-money butterflies. A ratio of 2 butterflies for every 10 condor spreads is reasonable, but you can increase or decrease this depending on your opinion on volatility.

Trade Details: Adding 2 at-the-money butterflies

Buy 2 RUT Aug 15th $1030 calls @ $28.30

Sell 4 RUT Aug 15th $1050 calls @ $14.30

Buy 2 RUT Aug 15th $1070 calls @ $5.10

Premium: $960 Net Debit

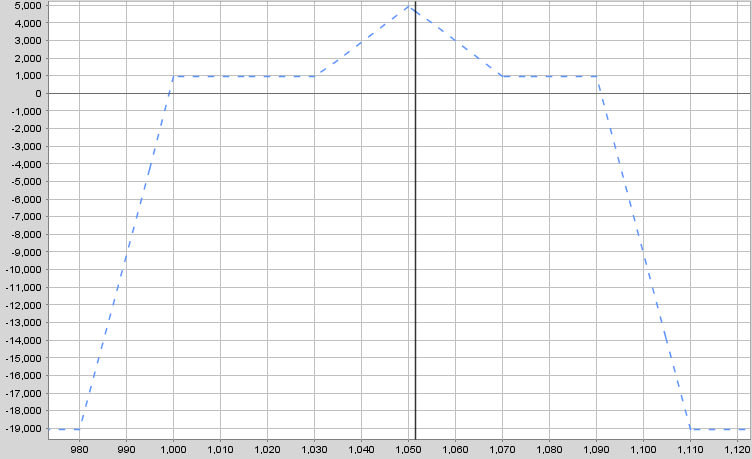

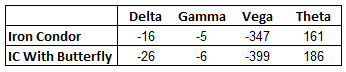

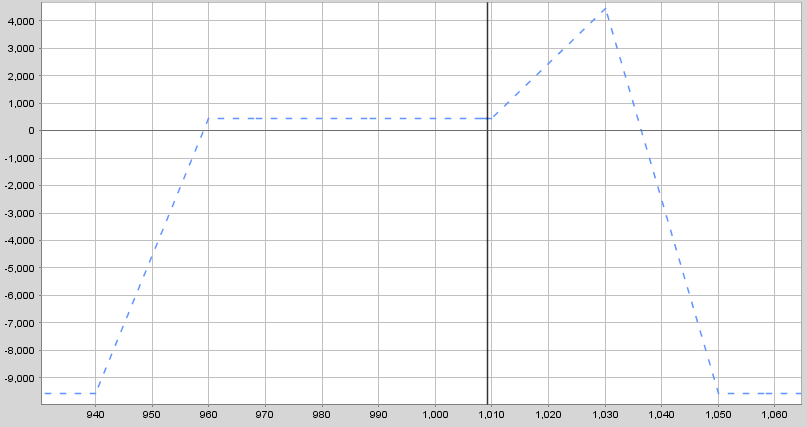

This gives us a profit diagram that looks like this. Notice that the capital at risk has increased by the cost of the butterfly and that we now have a large profit tent in the middle of the graph. The profit potential outside of the butterfly wings has dropped from $1,900 down to $940.

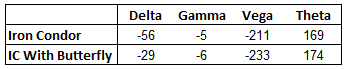

This type of trade would be perfect after a volatility spike where you are expecting the stock to trade sideways for 1-2 weeks. Let’s compare the greeks of the iron condor and the combination position. The key points here are that your Vega and Theta have both increased.

Using Butterflies As A Hedge

My preferred method for using butterflies as a hedge is when another income trade such as an iron condor is moving against me and threatening my short strikes. If you have ever traded iron condors, you will know that a stock aggressively moving towards your short strikes puts your position under significant pressure. Sometimes you will be forced to take losses for fear that the stock might continue trending, resulting in rapidly increasing losses.

When this occurs, some traders will take losses and close the trade and some will adjust and wait for the market to move back the other way before expiry. Butterflies are a great way to hedge under pressure iron condors as I will show you.

While keeping in mind there is no perfect hedge, incorporating a butterfly as a hedge for an under pressure iron condor can achieve the following things:

– Reduce your delta exposure allowing you to contain losses

– Allow you to stay in the trade longer and delay taking losses

– Potentially achieve larger gains

– Ride the trend rather than fight it

Let’s look at an example of how this might play out. The following is a RUT iron condor on July 8th where the short calls were under pressure. RUT had risen from a low of $942 on June 24th to $1009 on July 8th.

Date: July 8th 2013,

Current Price: $1008.93

Trade Details:

Long 5 RUT July 18th $940 puts

Short 5 RUT July 18th $960 puts

Short 5 RUT July 18th $1030 calls

Long 5 RUT July18th $1050 calls

At this point, the short calls were starting to get a little too close for comfort and the delta was getting to a point where it needed to be adjusted. Rather than the traditional methods of rolling iron condors which increase capital at risk, I could use a butterfly. Here’s how it could be done by adding the following trade:

Trade Details: Butterfly Hedge For In Trouble Iron Condor

Buy 2 RUT July 18th $1010 calls @ $10.30

Sell 4 RUT July 18th $1030 calls @ $2.65

Buy 2 RUT July 18th $1050 calls @ $0.45

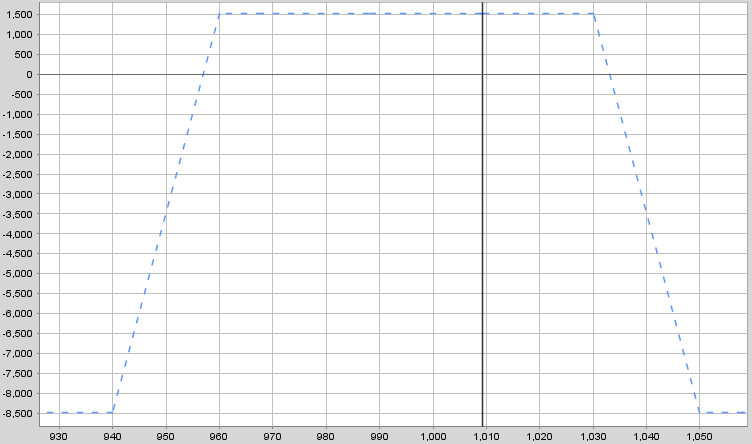

Doing this changes the profit graph to look like the following. Notice that there is now a significant profit zone centered around the short call strike of $1030.

Making this adjustment has increased capital at risk by about $1000, but that isn’t too bad considering the alternatives. Keep in mind that potential profits on the upside has also increased. The income portion of the trade has dropped from $1500 to $750 but that’s ok as this hedge is more concerned with defending the short strike of 1030. The delta exposure has been cut in half, so losses from any further upside in RUT will be lower than if the condor was left as it was.

If in a couple of days, RUT declines, you can then remove the butterfly at a small loss and then you have your existing condor back.

You can do the same move in the puts if the market is attacking your short puts.

Unfortunately in this case, RUT continued to move higher and the position had to be closed for a loss. However, the butterfly hedge helped to keep losses lower than the would have been from just holding the condor.

I hope you enjoyed today’s lesson. Let me know if you have any questions!

Regarding the Butterfly hedge to protect a condor short, is there a rule for the number of contracts used in the hedge compared to the number of contracts used in the condor?

Condor – 5, 5, 5, 5

Butterfly Hedge – 2,4,2

No set rule, just keep an eye on your greeks. I usually do 2-3 per 10 condors.

In the example for “Using butterflies as a hedge”, even after adding the butterfly, the breakeven is still at 1035 isnt it?

I agree that at 1030, the max profit potential significantly rises, but the whole point of hedge in the above example was to provide protection on the upside. Wouldnt it have made more sense to get out at 1030 and get $1500, rather than put a butterfly?

Hi Ro. In the example, the trade was never in profit of $1500. That was the income potential in the trade. The trade was actually under water at that point. You would only make this type of adjustment when you think the move to the upside is totally exhausted but you want to stay in the trade. Yes, there is a risk that if the market get above 1035, you could start to see some big losses so it’s a risk you would have to be prepared to take.

Gavin, you recommend closing just short calls if price gets to 1035?

I prefer not to do that. Leaves you exposed with a lot of positive delta

Hi, I was wondering about using an iron butterfly to hedge an iron condor that is in trouble. For example, let’s say you have an IC with ODTE. Short strikes at 11000 and 11200 and price at 11000 (for ndx). Max profit ~10k. Price starts drifting to 11180 with half a day of trading left. My idea was to sell an IB close to the breakeven price on the top side. I estimate a cost of only ~1-2k for 22k max profit.

Nevermind. I think id be better off using one or two additional condors (fairly narrow ones) near the upper long strike at the start of the day, or preferably, the night before to capture more decay. Or I could simply purchase more calls at the upper strike when I hit the breakeven…

It’s quite hard to hedge such short dated trades because of the high gamma, but let us know how you go with this.