Read Part 1 – The Basics

Read Part 2 – How To Set Profit Targets and Stop Losses

Read Part 3 – How To Successfully Leg Into A Butterfly

Read Part 4 – Trading Rules

Read Part 5 – Using Low Risk Directional Butterflies

Read Part 6 – The Greeks

Read Part 7 – Broken Wing Butterflies – One-Size Fits All

Read Part 8 – The Reverse Butterfly

Read Part 9 – Using Butterflies In A Combination Or As A Hedge

Read Part 10 – How To Protect Against Fast Moves

INTRODUCTION

The Bearish Butterfly is an advanced rules based strategy developed by a friend of mine called John Locke (no, not the guy off Lost).

The basic premise is that you enter a butterfly below the current stock price and then use reference points to add to, or adjust the trade.

You start with one-third of your total position size and then add the rest if the market rallies.

Keep in mind the bearish butterfly trade outlined here is a high risk, high reward trade so it’s not for everyone.

BEARISH BUTTERFLY SETUP

Below is the original Bearish Butterfly rules:

The trade is always entered with 56 days until expiry. RUT is the favored instrument and the initial butterfly is centered 20 points below the current RUT price. Your reference point is the centre of the butterfly and the adjustment points are then calculated as follows:

Reference point +40 – add second 1/3

Reference point +60 – add last 1/3

Reference point + 70 – roll lowest butterfly +60

Reference point + 80 – roll lowest butterfly +60

Reference point + 90 – roll lowest butterfly +60

So assuming at initiation of the trade RUT is at 1050, you enter a butterfly with 1/3 of your position size, centred at 1030. If RUT then rises to 1070 (i.e. 40 points above your butterfly centre), you add the second butterfly centred at 1050.

If RUT then breaks 1090, add the last butterfly at 1070.

If RUT continues to rally and breaks above 1100, close the 1030 butterfly and move it to 1090.

NEW BEARISH BUTTERFLY SETUP

The rules above were developed when RUT was trading around 600-800. Once RUT got up above 1200, I found that the rules weren’t really working very well and I was having to scale in to the trade too early.

Given the RUT Index value was basically double what it was when the rules were created, I decided to double all the parameters:

So instead of centering the butterfly 20 points below, I now put it 40 points below.

That makes sense if you think about it because a 20 point move on an Index at 600 is the same in percentage terms as a 40 point move on an Index at 1200.

The reference points are now as follows:

Reference point +80 – add second 1/3

Reference point +120 – add last 1/3

Reference point + 140 – roll lowest butterfly +120

Reference point + 160 – roll lowest butterfly +120

Reference point + 180 – roll lowest butterfly +120

BEARISH BUTTERFLY RISK MANAGEMENT

In terms of risk management rules and profit target the guidelines are set out as such:

Start with 20 contracts (10 butterflies) for the short strikes and scale to 60 contracts if fully scaled into. Of course you can reduce these numbers if you have a smaller account size.

Wing Span – Anything from 20 to 50 is ok. The wider the spread, the more expensive the trade, but the larger the profit zone

Planned Capital – $50,000

Minimum Capital Suggested in Account – $100,000

Profit Target – $15,000

Reduced Profit Target – $5,000… 21 DTE or closer

Max Loss – $15,000

Some people like the rules based approach of the bearish butterfly, but it’s not for everyone.

The strategy relies on the fact that at some point the market will provide a pullback into the developing profit zone that you are creating with the bearish butterfly.

Markets that grind higher without much of a pullback such as we have seen a few times in 2013 can be a disaster for this trade.

When this trade loses, it can lose big.

BEARISH BUTTERFLY EXAMPLES

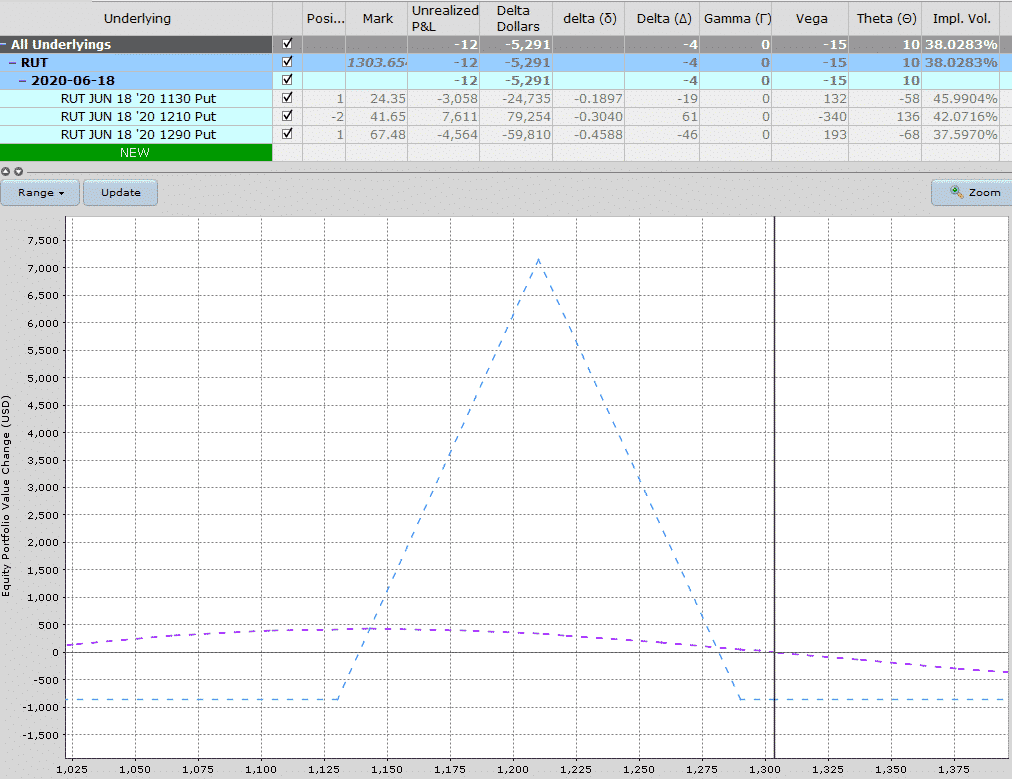

Here is an example of the standard set up for a Bearish Butterfly.

Scale in points for this example would be if RUT hits either 1130 or 1290.

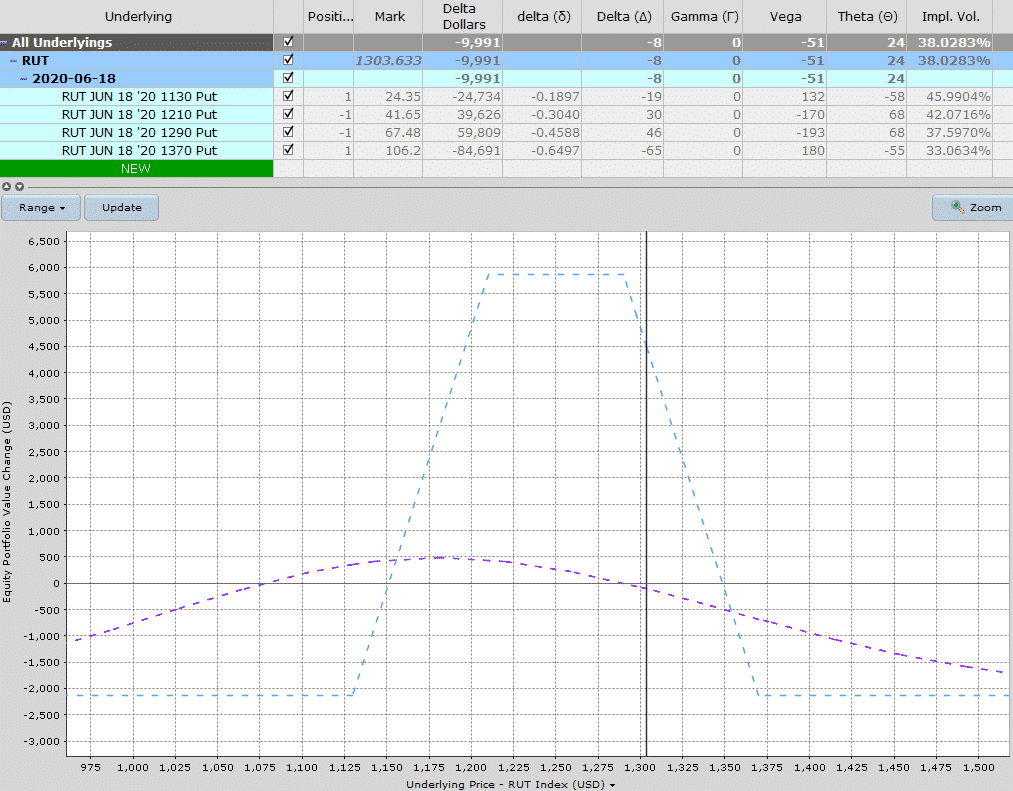

On April 28th, RUT below through the first scale point at 1290, so we added a second butterfly.

We actually went slightly off plan with this one.

The rules state to add the second butterfly 40 points below, which would have been 1250, but we went with the second butterfly at 1290 to limit the negative delta.

BEFORE ADJUSTMENT

AFTER ADJUSTMENT

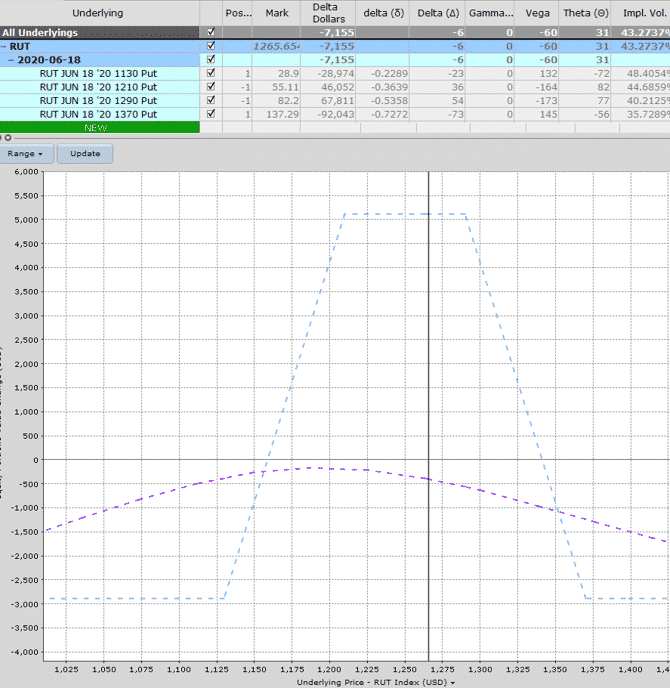

By May 6th, RUT had dropped back to 1265 and we were sitting with profits of $734 which was above the profit target of 30% capital at risk.

Enjoy your site. Where would the bearish butterfly be adjusted in the event of downward move? Are positions ever added on the way down?

Thanks.

Tom C

Hi Tom, yes you can add to it on the way down as well. I’ve done that successfully a couple of times.

It looks like starting 20 pts down from current price brings you to a DELTA. Of around 35%

Yep generally speaking that’s about right.

It’s true, you can get really hurt with this trade when in a grinding upmarket, or strong/quick upmarket. The environment we are in now (March 22) should be fine.

Would love to get the ebook, thank you

I’ve emailed it to you.

Thanks Gavin. I can see the benefits of using deltas instead of specific strike increments. That would seem to allow application to other indices as well (SPX?)

Thank you.

Would you list the full current rule structure?

It’s listed above under new bearish butterfly setup.