Stocks ended mixed last week as traders digested a slew of earnings data. Overall earnings have been positive but we have seen some profit taking in market darlings AAPL and AMZN. Stocks moving higher included FB and NFLX while TWTR was another that was crushed.

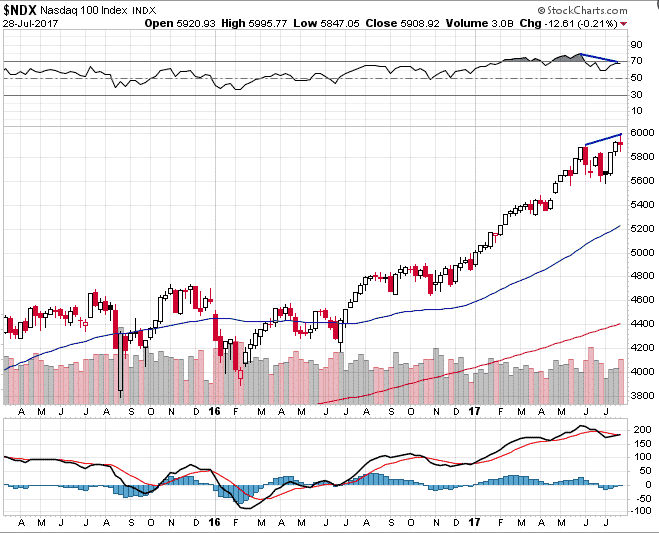

We can see below on the all important Nasdaq chart, that there is some indecision at these record high levels. The doji candle on the weekly chart, while also displaying negative divergence would be a concern for the bulls.

Here are some interesting comments that I read over the weekend regarding earnings:

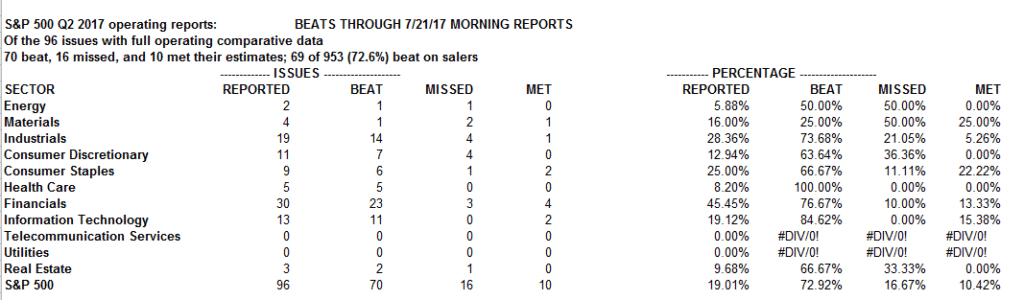

“Despite positive quarterly reports, an analysis of earnings calls suggests optimism may have peaked, the analysts said in a note, observing ‘a drop-off in mentions of ‘better’ relative to ‘worse’ or ‘weaker’ words.’

Moreover, the cut to third-quarter consensus earnings-per-share estimates is so far the largest since the fourth quarter of 2015, when profit growth was still declining and recession fears were percolating.”

And from the same article, Dan Suzuki, a Bank of America Merrill Lynch analyst was quoted as saying:

“And we are seeing the most rapid cuts to outlook. Even though it’s still early, the pace of downward revisions for the third quarter is the fastest we’ve seen in a few years. If this trend continues, it has a potential to weigh on markets.”

So, overall companies are beating expectations, but being cautious with their forward guidance as you can see below:

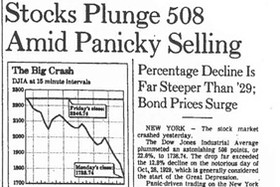

For now, the bulls remain in control, but with markets at these lofty levels, many people are concerned that we are on the verge of a 1987 style crash.

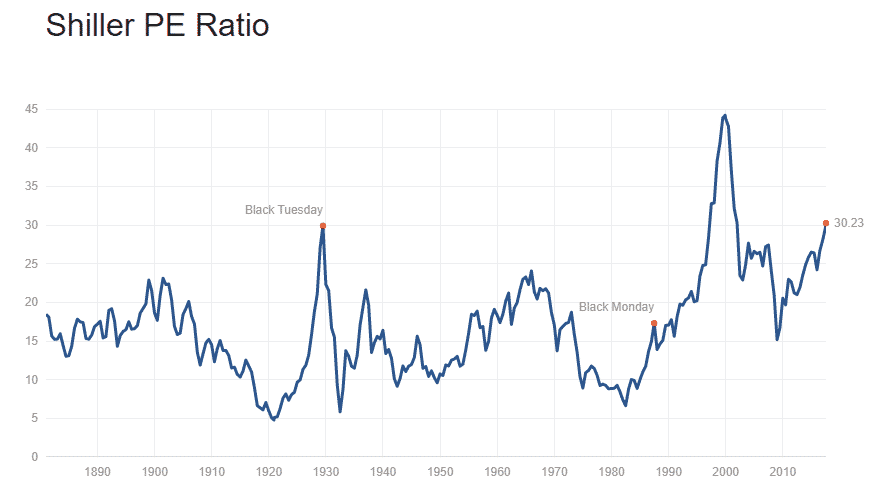

One particularly scary chart is the Shiller PE Ratio. The index is currently right at Black Tuesday levels and the only time it was higher was during the Tech Bubble?

This chart has had a lot of press lately, and while scary, it doesn’t mean we are going to crash tomorrow. In fact, in stage 3 of a bull market, stocks can accelerate very quickly.

The best thing we can do as traders is to be conservative and not take on too much risk in this environment. As I discussed on last weeks webinar, we can also scale into trades to reduce risk. I’ll be discussing that in more detail on Tuesday night if you want to join me.

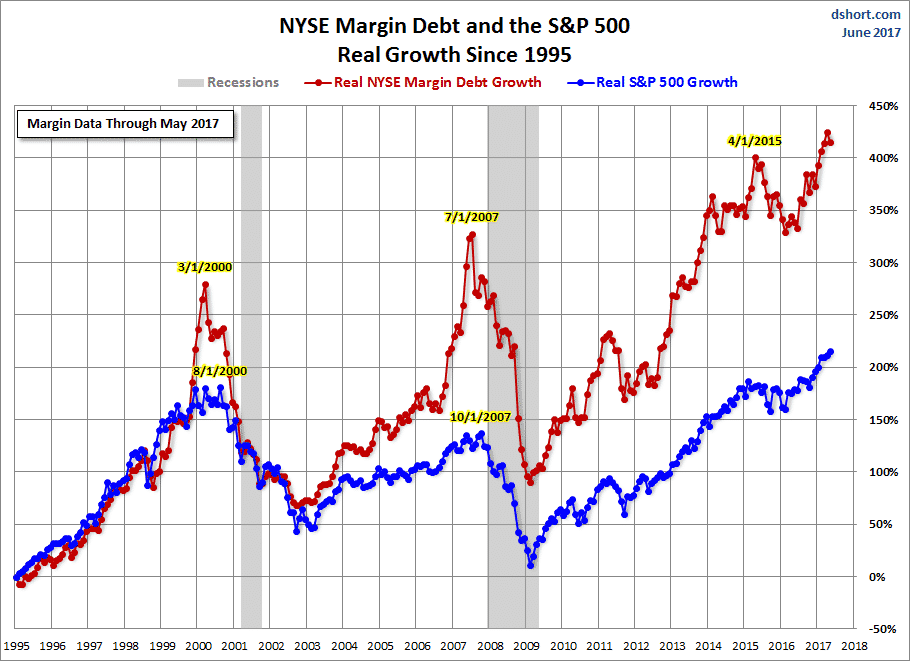

Most market bubbles are preceeded by an unwinding in margin debt. The last two bubble saw a sharp rise in margin debt before the crash. Notice that margin debt started to fall as stocks remained near the highs, then once stocks started selling off, forced liquidations caused the fall in stocks to rapidly accelerate.

For now, a small pullback is probably in order, but long term stocks probably have a bit further to run as we haven’t yet reached that “irrational exuberance” level. Stay safe out there and remember that now is not a time to be taking on too much risk.

Trade safe!