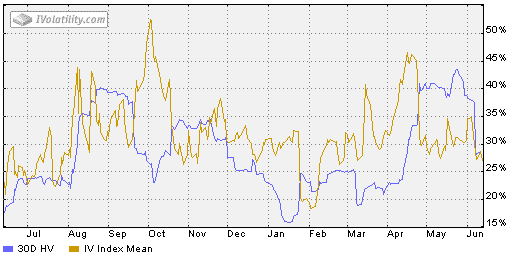

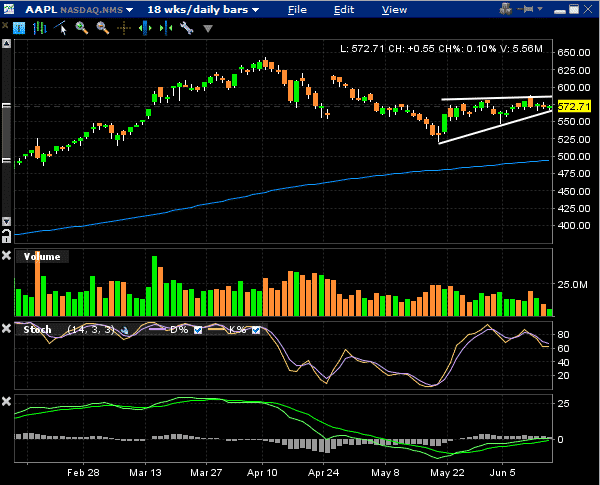

On June 14th, I posted the following 2 charts of AAPL stock and AAPL Implied Volatility. The charts showed that AAPL was consolidating in a narrow range or wedge pattern and was looking ready for a breakout. At the time I present two different trade ideas for AAPL that would benefit from a breakout, but were not dependent on correctly picking the direction of the breakout.

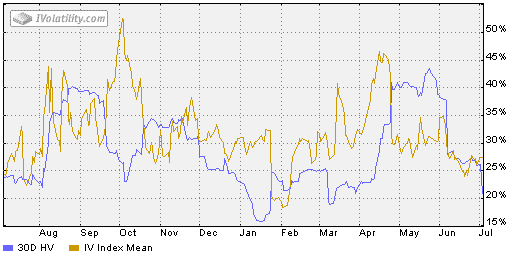

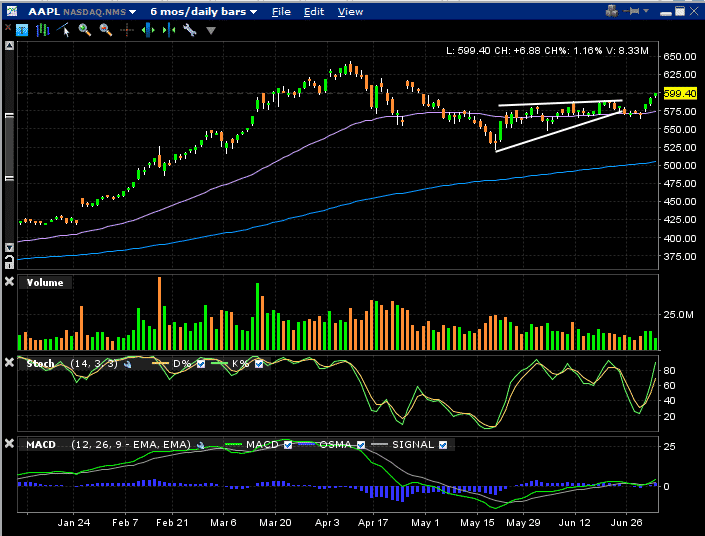

So here we are almost 3 weeks later. The current implied volatility chart and stock chart of AAPL are shown below. You can see that implied volatility is roughly at the same level around 27, and the stock has risen $27, from $572 to $599. The big breakout and / or rise in implied volatility that I was expecting never eventuated. So, let’s review the two trades and take a look at how each is performing thus far.

Trade Idea 1 – Long Strangle

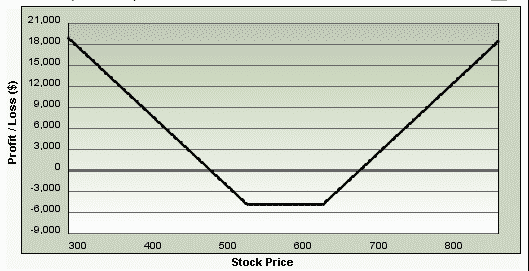

The first trade was a long strangle set up by buying and out-of-the-money call and an out-of-the-money put. This was the trade:

Buy 1 October $625 call @ $23.00

Buy 1 October $525 put @ $26.00

Total Debit: $4,900

Delta: 8.67

Gamma: 0.64

Theta: -31.77

Vega: 244.67

So, let’s see how this trade is doing as of today:

Long 1 October $625 call @ $26.30

Long 1 October $525 put @ $12.95

Total Value: $3,925

Initial Debit: $4,900

Total Loss: -$975

Loss Percentage: -19.90%

Delta: 25.82

Gamma: 0.69

Theta: -30.35

Vega: 220.88

Trade Idea 2 – Double Calendar Spread

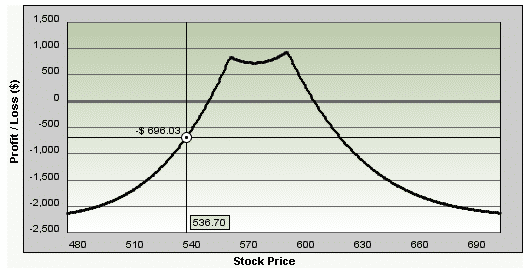

The other trade was a double calendar spread set up as follows:

Buy 1 August $590 Call @ $22.80

Sell 1 July $590 Call @ $11.95

Buy 1 August $560 Put @ $25.60

Sell 1 July $560 Put @ $14.20

Total Debit: $2,225

Delta: 2.18

Gamma: -0.54

Theta: 3.76

Vega: 50.13

So, let’s see how this trade is doing after two weeks:

Long 1 August $590 Call @ $29.60

Short 1 July $590 Call @ $17.05

Long 1 August $560 Put @ $10.20

Short 1 July $560 Put @ $1.74

Total Value: $2,101

Total Debit: $2,225

Total Loss: -$124

Loss Percentage: -5.57%

Delta: -18.36

Gamma:0.26

Theta: -13.48

Vega: 92.31

Analysis of the Long Strangle Trade

Clearly this trade has not worked so far. Volatility stayed more or less the same, and we have lost 3 weeks worth of time decay. The initial trade had a Theta value of -31.77, so the position has lost roughly $600 purely from Theta decay.

AAPL has started to rise significantly in the last few trading days which has seen the delta move up to over 25. This long straddle trade may yet work out if AAPL can continue it’s run higher over the next week.

Analysis of the Double Calendar Spread Trade

The Double Calendar Spread Strategy has performed better in that it has lost less so far. This is due to the positive Theta and lower Vega (50 as opposed to 244). Looking at the position today, it now has negative Theta due to the fact that the stock price is above the strikes of the higher calendar spread. Also note the fact that Delta is now negative and Vega has increased.

Owners of the Double Calendar Spread would be hoping for a fall in AAPL stock and a subsequent rise in implied volatility.

Conclusion

Based on the analysis and stock performance so far we can see that the Double Calendar Spread Strategy outperforms a Long Strangle trade when there is very little change in implied volatility and the stock does not make the large move that was anticipated. However, if AAPL had dropped 15% and had a huge implied volatility spike, it would definitely be a different story.

I will post another update in two weeks time when the July options expire.

Happy trading!