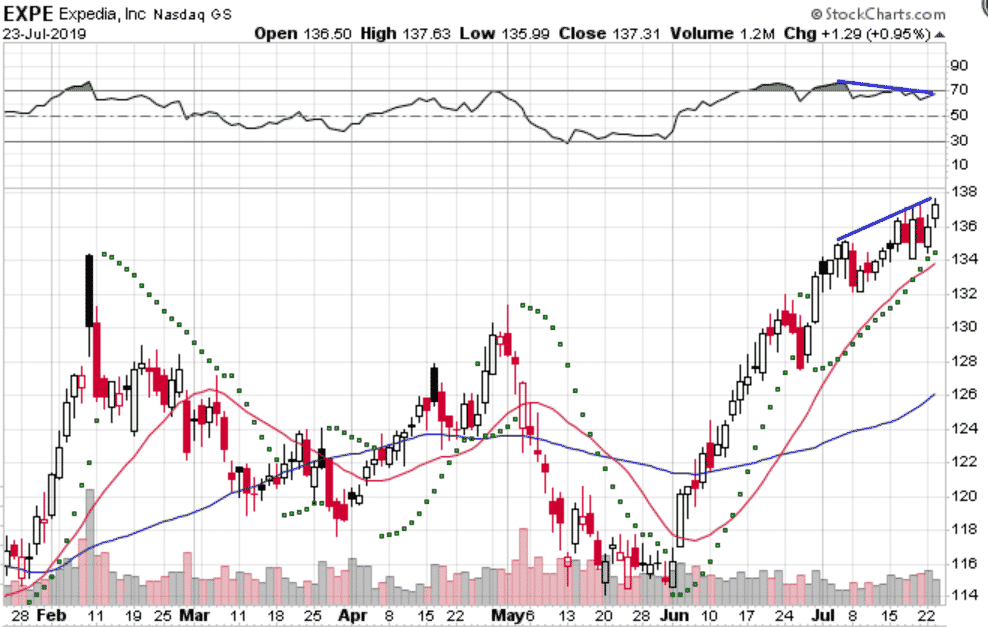

EXPE and NEM are two stocks I’ve been watching with interest over the last few weeks.

Both have had a really good run recently with EXPE being up over 20% in the last month or so. NEM is up around 30% in the last two months.

Both are now starting to show slight negative divergence suggesting further upside might be limited.

On the chart below, you can see the stock is very extended and we’re getting a slight bearish divergence. The stock is also a long way above the 50-day moving average.

I’m looking at the November 160-165 bear call spread which is currently trading at $0.68. I’ve got an order in to sell that spread for $0.80 and am hoping the stock rallies just a bit more to allow the trade to be filled.

If it doesn’t get filled, no problem. I’ll just move on to the next opportunity. There’s no point forcing things.

If the spread gets filled and expires worthless, that represents a 19% return on capital at risk in just under 4 months.

While the time decay is a lot slower on these longer terms trades, they are less impacted by adverse moves giving me more time to adjust. And a 19% return in 4 months is still pretty darn good, assuming of course things work out as planned which they don’t always.

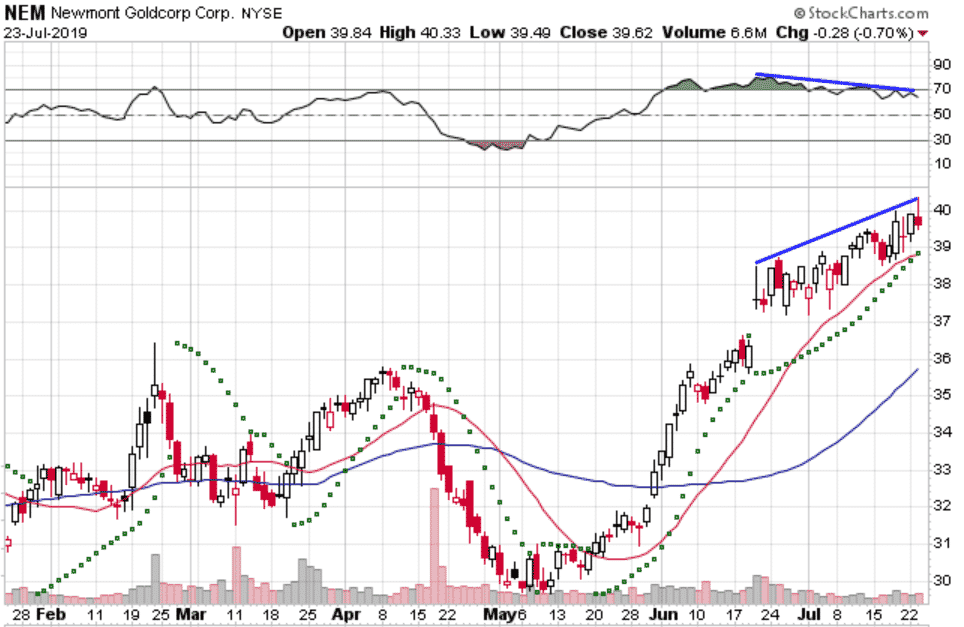

NEM is in a pretty similar situation having experienced a very strong rally on the back of stronger gold prices. The stock is also showing negative divergence and is quite far from its 50-day moving average.

I’m currently short the September $43.12 – 48.12 call spread which is trading around $0.47.

If that spread expires worthless, it will achieve an almost 10% return on capital in 2 months.

Conservative traders may prefer to sell the spread at $0.60 if it gets there. This trade is a bit shorter-term, so the P&L will move a bit quicker. Also, keep in mind that earnings are tomorrow, so might be best to wait until after that.

Access the Top 5 Tools for Option Traders

I share quite a few trade ideas like this in a free Facebook Group for option traders.

Enjoy your Wednesday and trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.